How to Not Lose Money In The Stock Market

As a medical professional, you work tirelessly to care for your patients. Your income is hard-earned, and the last thing you want is to see it vanish into thin air due to stock market ups and downs. It's completely understandable to feel hesitant about investing, but let's break down the fear and explore how you can build wealth while navigating market volatility.

I've been in your shoes. As the founder of Strive Coaching, I've helped countless medical professionals turn their six-figure incomes into seven-figure net worths. I’ve also personally experienced the gut-wrenching feeling of losing over $25,000 in a single day in the stock market. Trust me, I understand the fear.

Zooming Out for the Big Picture

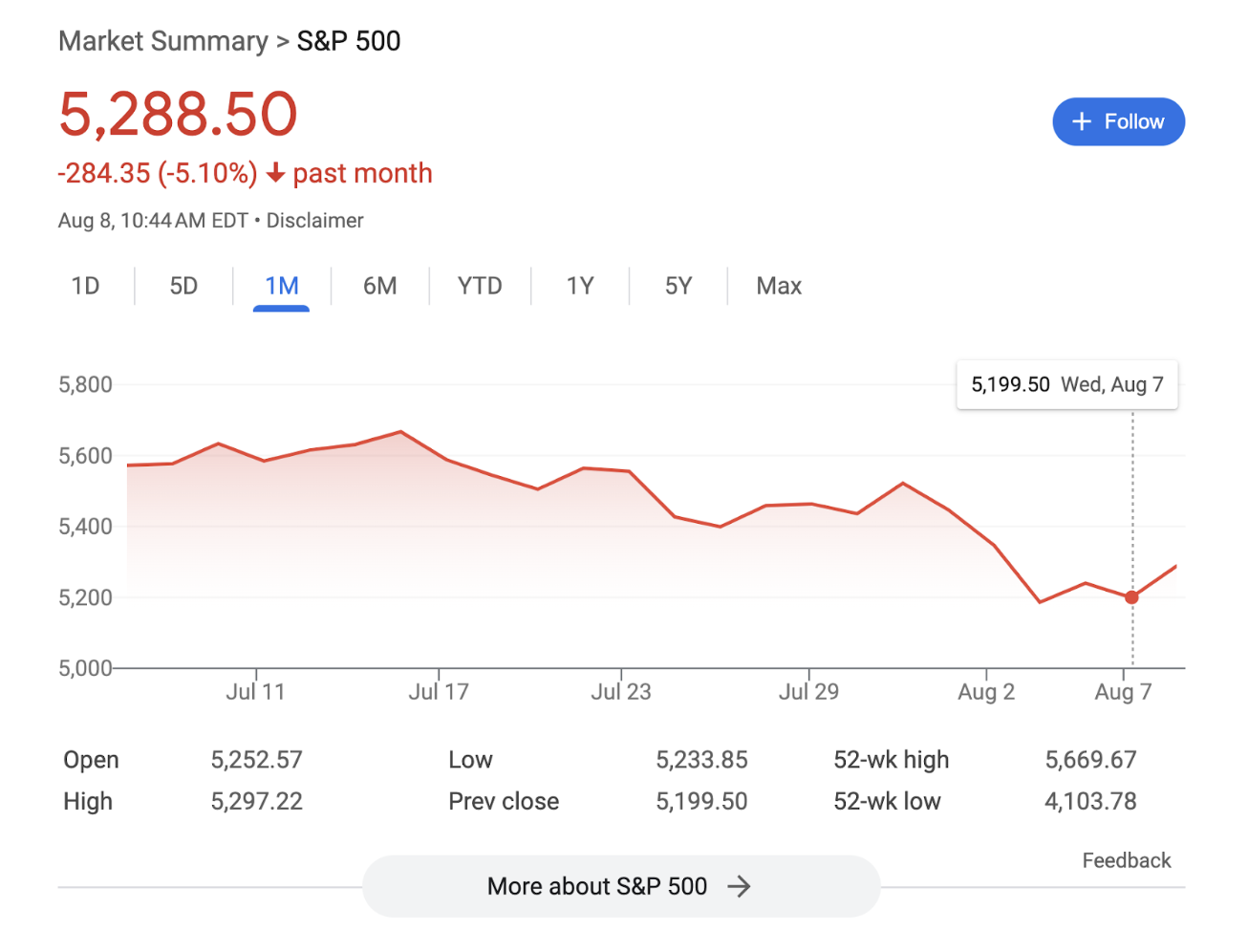

Right now, the market might be feeling a bit rocky. You might be wondering if it's even worth starting to invest or if you should pull out your money altogether. Let's take a step back.

While short-term market fluctuations can be scary, history tells a different story. Over the long haul, the stock market has consistently climbed.

Sure, there have been downturns (like the early days of the pandemic), but if you look at the bigger picture, these dips are just temporary bumps on a road leading upwards.

Three Keys to Weathering the Storm

So, how can you protect your investments and build wealth over time? Here are three key strategies:

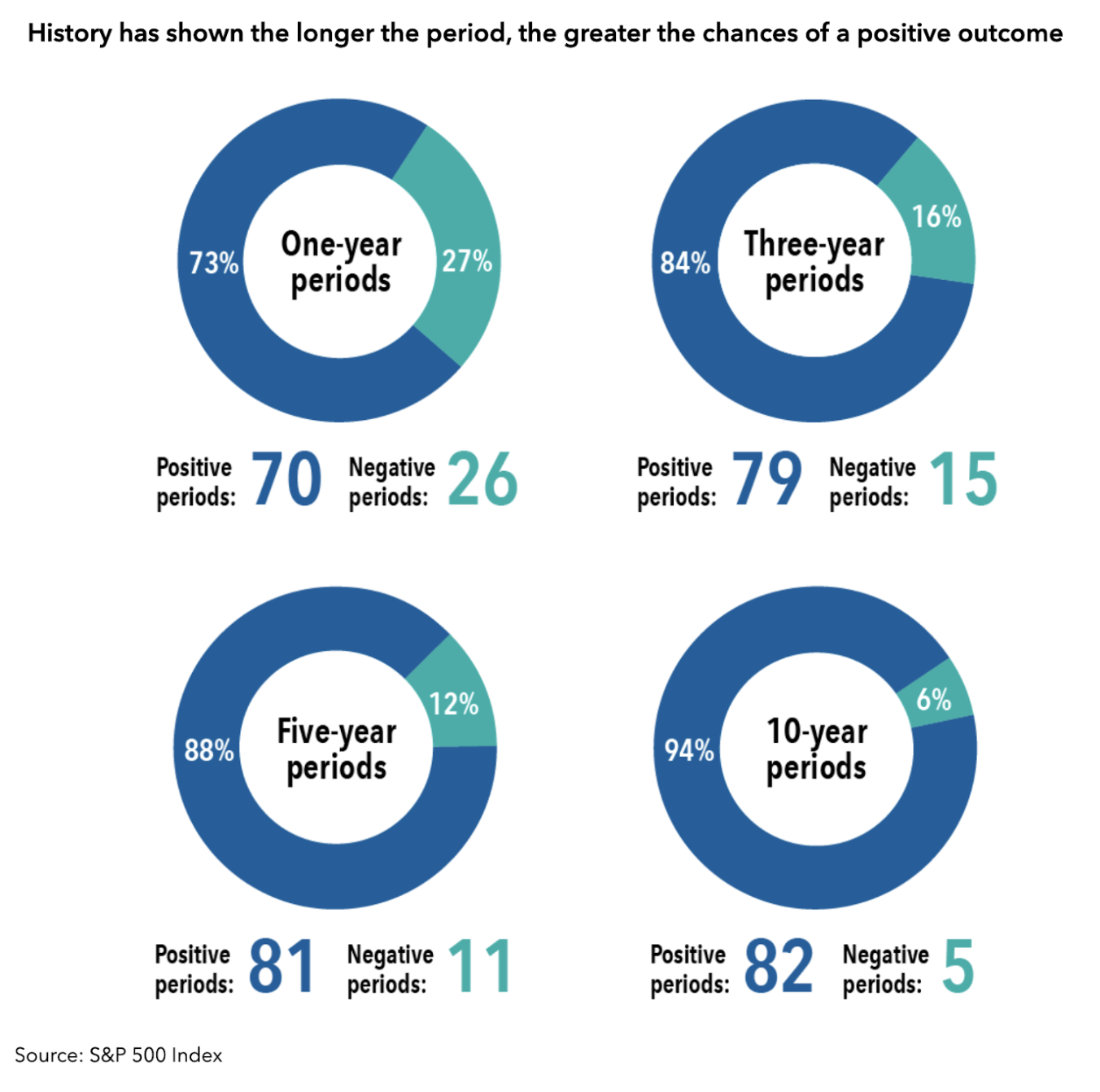

1. Hold Tight: The longer you hold your investments, the better your chances of earning a positive return. Studies show that the risk of loss decreases significantly as your investment horizon increases. If you're investing for retirement decades down the road, the odds are in your favor.

The table above shows the concept that longer holding periods are associated with a higher probability of positive returns.

Understanding Bull and Bear Markets

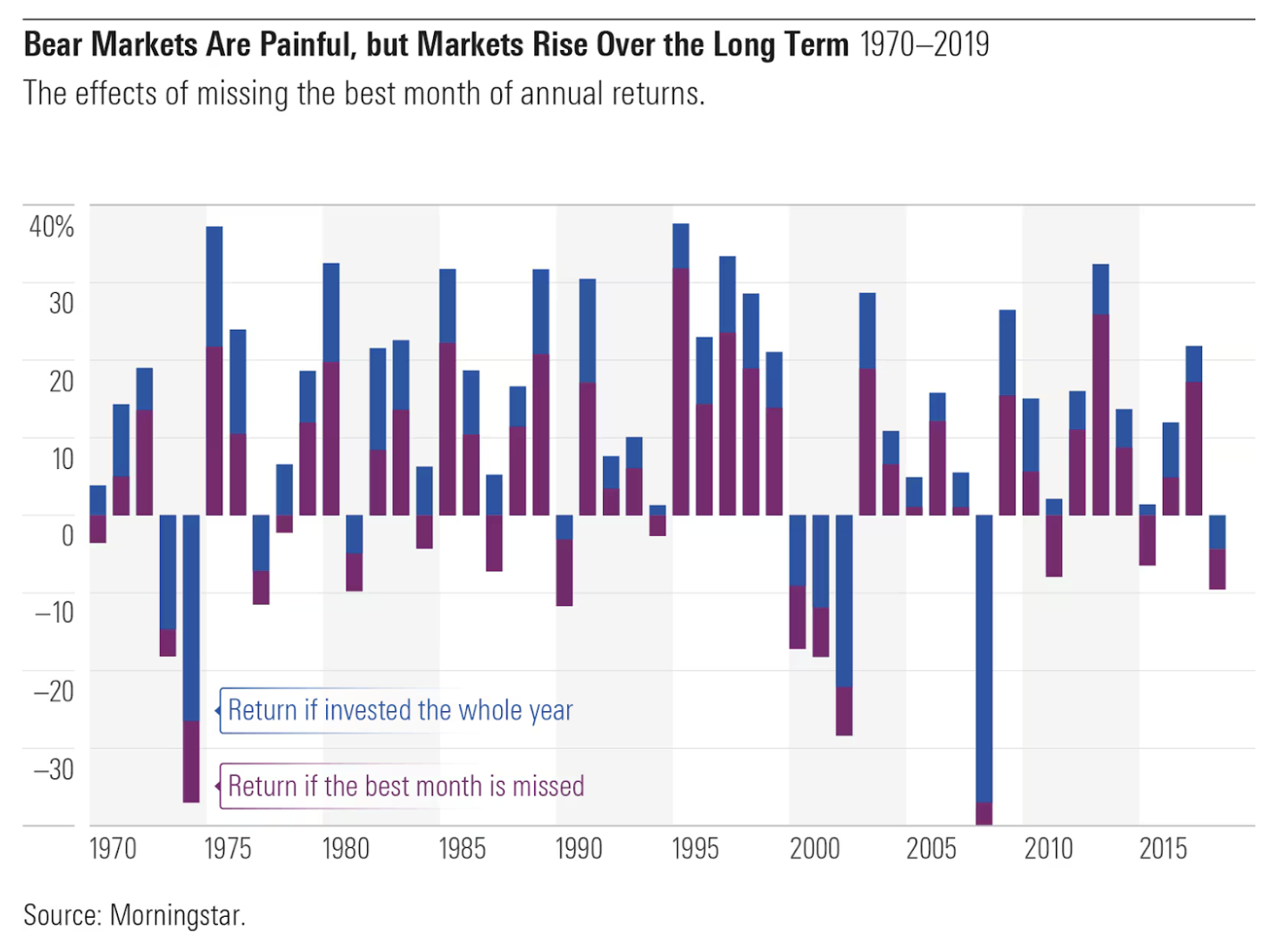

The image presents a bar chart comparing the returns of an investor who stays invested throughout the year versus one who misses the best month of the year. See how staying invested throughout the year is crucial for maximizing returns

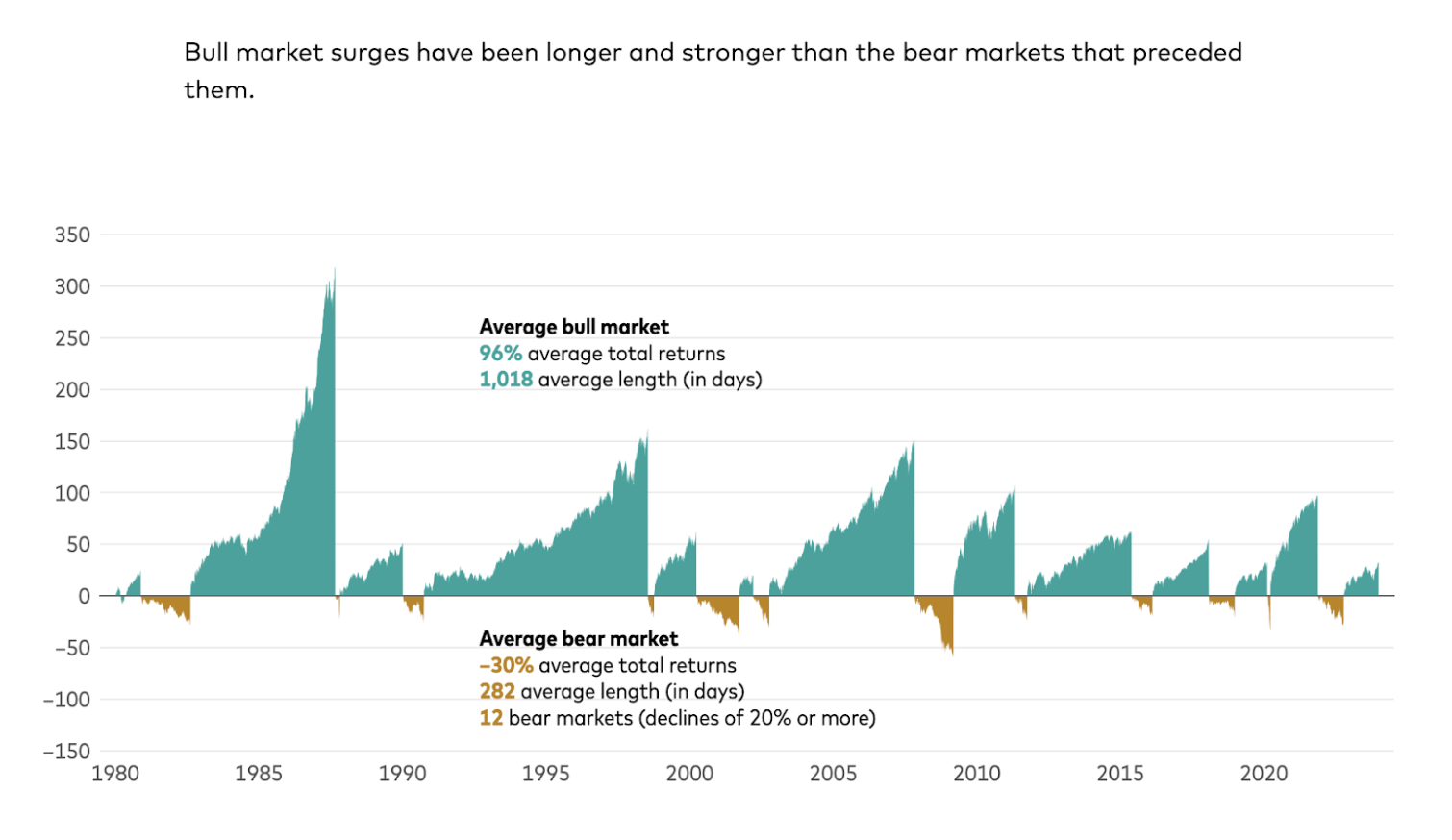

A bull market is characterized by rising prices and investor optimism, while a bear market is marked by falling prices and pessimism. Historically, bull markets have tended to be longer and stronger than bear markets.

Navigating these market cycles requires emotional intelligence as much as financial acumen. During bull markets, it's easy to get caught up in the excitement and take on more risk than you can handle. The fear of missing out (FOMO) can lead to impulsive decisions. On the other hand, bear markets can induce fear and uncertainty, leading to panic selling.

As shown above, we can see how bull market have historically been longer and stronger than the bear market that followed. So, if you can stay the course, through a bear market, the likelihood of you then being the recipient of the givings of a bull market on the backend are quite high and historically really outpaced those bear markets in terms of return.

By staying invested, you increase your chances of participating in the market's eventual recovery.

2. Dollar-Cost Averaging: This strategy involves investing a fixed amount of money regularly, regardless of market conditions. By doing this, you avoid the psychological traps that lead you to buy high and sell low - and ensures you’re maximizing your time in the market.

3. Automated Investment Systems: Setting up an automated investment system, where you invest a fixed amount regularly, can be a huge relief. It takes the stress out of constantly watching the market, as you're not trying to time the perfect moment to buy or sell. It also makes life simple and efficient, which I’m all about.

Overcoming Investment Fear

Investing can be emotionally charged, but it's important to remember that making impulsive decisions based on fear can harm your long-term goals. By focusing on the big picture, sticking to your plan, and diversifying your investments, you can increase your chances of success.

Remember, building wealth is a marathon, not a sprint. Stay patient, stay informed, and seek advice from financial professionals if needed. You've worked hard for your money. It's time to put it to work for you.