Breaking News: The Future of America’s PAs & NPs is in Jeopardy

Sweeping federal loan changes take effect July 1, 2026, under the One Big Beautiful Bill (OBBB). While the bill eliminates the Grad PLUS Loan program for all graduate students, the consequences will not be evenly distributed. In recently released guidance, the U.S. Department of Education classified Physician Assistant (PA) and Nurse Practitioner (NP) degrees as non-professional graduate programs—a categorization that will have profound and harmful impacts on the healthcare workforce.

While professional programs such as medicine (MD/DO), dentistry (DDS/DMD), pharmacy (PharmD), podiatry (DPM), optometry (OD), veterinary medicine (DVM), chiropractic (DC), law (JD/LLB), theology (M.Div.), and clinical psychology (PsyD) remain eligible for $50,000 in annual federal borrowing and $200,000 in aggregate federal loans, PA and NP students will be restricted to $20,500 per year and $100,000 lifetime—with no Grad PLUS option available after July 2026.

For PA and NP education, these limits are s...

From $0 to $1.2M in 7 Years: How PAs Can Become Millionaires Faster Than You Think

What if I told you that it’s possible to go from zero to over a million dollars invested in just 7 years on a PA salary?

No gimmicks. No crazy frugality. No lottery luck.

Just a clear, proven 3-step strategy any driven PA can follow.

Let’s break it all down.

Step 1: Cross the $200K Mark with Your Primary Job

This is where most PAs tap out, but it’s also where the biggest growth potential starts.

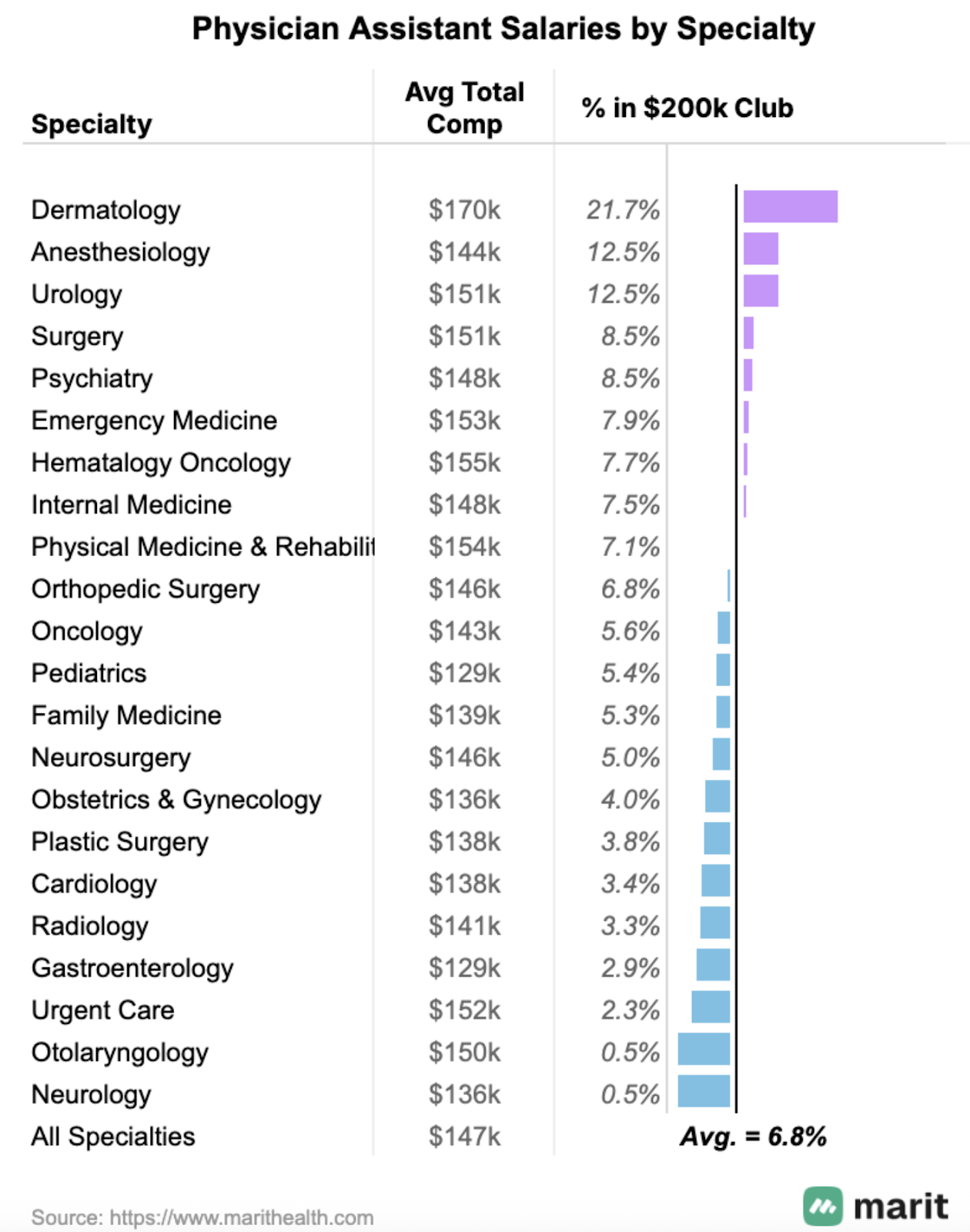

📊 According to data from Marit Health, 1 in 14 PAs already earn over $200K/year.

Here’s how to increase your odds of joining them:

✅ Choose a High-Earning Specialty:

Dermatology, critical care, cardiothoracic surgery, and PM&R consistently top the list. But it’s not just about the specialty—it’s about where you land within it.

💡 Specialties like dermatology, plastic surgery, and psychiatry have high intraspeciality variance in pay, meaning some PAs are crushing $200K+ while others are barely above average. Don’t just switch specialties… switch to a better-paying role within your speci...

How Following Common Money Advice Can Cost Medical Professionals Millions

Many PAs & NPs, especially those with significant student loan debt, follow the common financial advice to pay off all student loan debt as quickly as possible post-graduation. Some medical professionals feel shame surrounding their debt burdens, and desire to clear this balance as quickly as possible. Others are interested in the increased monthly cashflow they would have available without a student loan payment. Despite these benefits, there is significant cost associated this approach. In this article I will walk you through the math of following this common advice as a PA-C or NP, and why it might not be the best choice for you.

So... Debt Strategy: What Works and What Doesn’t

There are two commonly discussed methods utilized to clearing debt of any type. The first is the “debt snowball” strategy, which entails paying off all debt in order of current balance starting with the smallest balance. The benefit of this strategy is the psychological boost generated as you clear each...

Why Following Dave Ramsey’s Advice Cost Me Thousands as a Medical Professional

When I graduated from PA school back in 2016, I did what a lot of new grads do when they’re desperate for financial guidance:

I followed Dave Ramsey’s plan.

I was told:

❌ Don’t invest until you’re debt free.

❌ Pay off all your student loans as fast as you can.

❌ Use a financial advisor to pick actively managed mutual funds.

And honestly? It cost me a lot of money and years of delayed wealth-building.

If you’re a PA, NP, pharmacist, or physician with over six figures in student loan debt, this post is your warning. Dave Ramsey’s advice might be dangerous for you.

Why Dave Ramsey’s Advice Doesn’t Work for Medical Professionals

Let’s be clear: Dave Ramsey has helped millions of people get out of credit card debt, avoid car loans, and live below their means.

But that advice is great for the masses, not for medical professionals with $100K+ in federal student loan debt.

When your debt is extreme and your income is delayed due to years of training, you’re not on the financial bell cu...

The One Student Loan Metric Every New Grad PA-C & Medical Professional Needs to Know

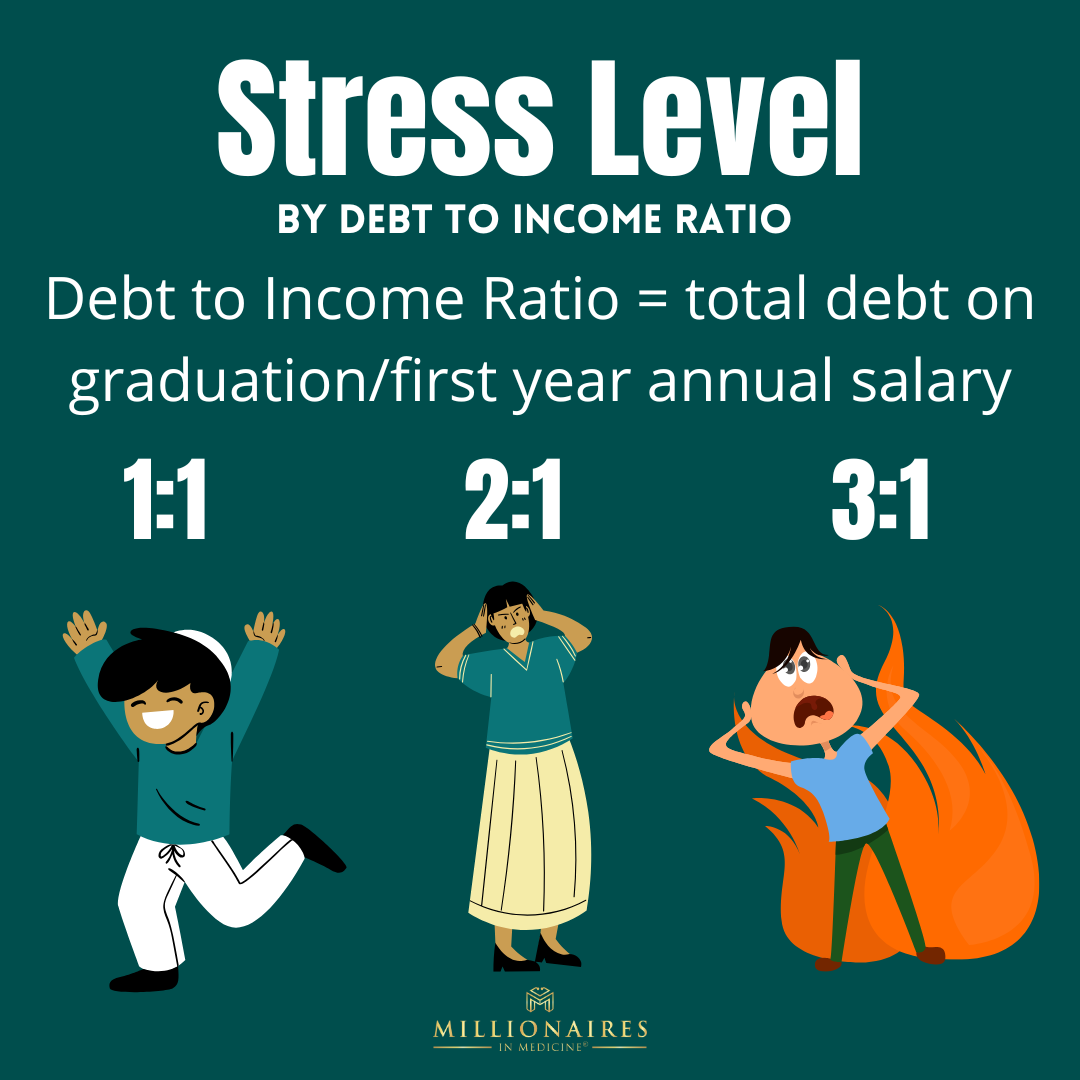

If you’re a new grad PA, NP, PharmD, or medical professional trying to figure out how the heck you’re supposed to manage your student loans… there’s one number that changes everything:

Your Debt-to-Income Ratio.

This simple calculation determines:

✅ Whether PSLF is worth it

✅ If private practice is even an option

✅ How painful your monthly payments will be

✅ And how much flexibility you’ll actually have in your career

Let’s break down why debt-to-income ratio (DTI) matters so much, especially if you're just starting out.

What Is Debt-to-Income Ratio (DTI) for Medical Professionals?

Your debt-to-income ratio is your total student loan debt divided by your anticipated annual income.

Example:

If you graduate with $100K in student loans and expect to earn $100K as a PA, your DTI is 1:1.

If you have $200K in loans, and still earn $100K, your DTI is 2:1.

🎯 Key tip: Use starting salary, not median salary, especially if you’re still in school or early in your career.

The Ideal DTI Rat...

DTI Ratios: The #1 Money Metric Stressing You Out

Navigating student loan debt as a new graduate in the medical field? Don’t worry, we got you.

For recent medical graduates, understanding and managing the “Debt-to-Income (DTI) ratio" is essential for effective student loan management. This ratio has significant implications not only on your immediate financial health but also on your long-term career flexibility and quality of life.

👉🏻 Want to see how DTI ratios affect financial decisions in action? Watch our DTI Ratios Explained video for clear visuals and examples.

What is Debt-to-Income (DTI) Ratio?

The DTI ratio is calculated by dividing your total student loan debt by your annual income. For newcomers or students, you should base this on your expected starting salary rather than the median for your field, providing a realistic outlook as you start your career.

For example, if you accumulate $200,000 in student loans and your starting salary is $100,000, your DTI ratio is 2:1.

Detailed Implications of DTI Ratio...

3 Student Loan Mistakes (That Cost Tens of Thousands)

Are you a medical professional struggling with student loan debt? You're not alone. In fact, many medical professionals are making costly mistakes that can significantly impact their financial future.

Let's look closely into the top three mistakes medical professionals are making with their student loan debt:

1. Accidentally Choosing Taxable Loan Forgiveness

One of the most common mistakes is choosing taxable loan forgiveness without realizing that you’re doing it. When you're on an income-driven repayment plan and your loans aren't paid off after 20-25 years, the remaining balance is typically forgiven. However, this forgiveness is taxable, meaning you'll have to pay taxes on the forgiven amount as though it was ordinary earned income.

Medical professionals often opt for income-driven repayment plans without realizing that the remaining loan balance after 20-25 years is forgiven but taxed as income. This mistake can lead to a substantial tax bill, and may end up being the hig...

How I Became A Millionaire At 31 As A PA-C

I became a millionaire at 31.

I didn't sell a business, get a six figure inheritance, or rob a bank. Rather, my husband and I accomplished this feat by being incredibly purposeful and deliberate with our finances over a period of many years.

When I graduated from physician assistant school at the age of 25, I was saddled with an overwhelming student loan debt of $161,000. My husband and I had little savings to speak of, no real knowledge about investing, and the added burden of a mortgage to contend with. The future looked daunting, and at times it felt like we were facing an insurmountable challenge.

At the time, I thought my primary money problem was my student loan debt. (Turns out, it wasn't. More on that later.) Nevertheless, I remained determined to tackle my student loans head-on and focused all my energy on paying them off as rapidly as possible, hoping to achieve financial stability sooner rather than later.

I worked full time as a PA-C, and then picked up 4-5 per diem (pa...

Should I pay off debt or invest?

I paid off $161,000 in student loan debt in 16 months. I made TREMENDOUS lifestyle sacrifices to achieve that goal, and didn't invest along the way.

Was that the correct approach? Not necessarily. The answer actually varies for each of us.

Most healthcare professionals are facing this age old question: How much of your income should be going to debt vs investments? Should it be all or nothing?

The answer depends on a variety of factors, one of which being personal preference. In general, investing should be prioritized above LOW interest debt, particularly if you are young. Here are some suggested cut offs:

- Invest first if your debt is less than 8-9% if in 20s

- Invest first if your debt is less than 6-7% if in 30s

- Invest first if your debt is less than 4-5% if in 40s

Above those cut offs, pay off the debt first!

Why does age matter? With age, your portfolio will have a higher bond allocation and generally low returns. In addition, you want the security that complete debt fr...

The PA StartUp Podcast with Chris Darst

This episode will definitely inspire you about what is possible for you on your student loan journey!