Binge read all things wealth building, debt reduction, & lifestyle.

Protecting the Asset That Helps Build Wealth

Your income drives every financial goal - paying down debt, owning a home, saving for retirement, and building financial freedom.

At Millionaires in Medicine, the focus is on building confidence and structure around budgeting, investing, and long-term planning. That progress depends on consistent income.

What happens if you can’t work?

Disability insurance exists to protect cash flow – the same way diversification protects a portfolio or insurance protects a property. During the accumulation phase of your career, income continuity is the foundation of every financial strategy. Without it, even disciplined savers and investors are forced into damage control.

A medical professional earning $100,000 at age 32 is on track to generate nearly $7 million over his or her career. Shouldn’t that multi-million dollar asset be insured?

Disability Risk is More Common Than People Realize

Many people assume disability only applies to catastrophic events, like paralysis from a car accident or a ...

The Epidemic of Politeness Costing PAs Tens of Thousands in Pay

Most physician assistants don’t earn less because they aren’t valuable.

They earn less because they’re too polite to ask.

I’ve seen it over and over again—smart, capable PAs leaving tens of thousands of dollars on the table simply because negotiation feels uncomfortable, intimidating, or “ungrateful.”

I’m Kristin Burton, PA-C, and I’ve been a PA for nearly a decade. I’ve negotiated primary jobs, per diem roles, investment deals, and business contracts. And I can tell you this with certainty:

Failing to negotiate doesn’t just affect your next paycheck—it compounds into decades of under-earning and lost wealth.

Why Negotiation Feels So Hard for PAs

I still remember my first PA job offer.

I was on rotation when the email hit my inbox. My heart was racing. I was thrilled. They could have offered me almost any number and I would’ve said yes.

I was just grateful to have a six-figure job as a new grad.

Negotiation wasn’t even on my radar.

And that mindset—“Where do I sign?”—follows ...

The Retirement Mistake Costing Medical Pros Millions

What if I told you that you might be leaving millions of dollars on the table for your future retirement?

And what if that loss came down to one small mistake most medical professionals make without realizing it?

I’m talking about a simple setting inside your employer retirement portal… a single button you likely clicked once, years ago… and never looked at again.

It’s one of the easiest financial pitfalls to fix, but the impact is massive. And with new IRS rules coming in 2026, ignoring it could cost you more than you think.

Today, I want to show you the exact retirement mistake 90% of PAs, NPs, CRNAs, and PharmDs are making — and how to correct it before 2025 ends.

The One Button Most Medical Pros Never Re-Check

A cardiothoracic surgery PA I’ll call Sarah came to us after investing for years. She had originally set her 401(k) contribution to the maximum back when she started her job five years earlier… and then never touched it again.

The problem?

IRS contribution limits chan...

Is Being a PA Worth It? The Financial Truth No One Told Me

Is being a PA actually worth it?

I asked myself this exact question when I graduated—bright-eyed, excited about finally making a six-figure income… and completely oblivious to how my student loan debt, training years, and missed investing opportunities would impact my long-term wealth.

I became a PA for all the same reasons most of you did:

I wanted to earn more, build a stable career, and make a difference in medicine.

But here’s the truth I wish someone had told me earlier:

Becoming a PA can put you $800,000 behind financially before you ever see your first paycheck.

Let me walk you through the real math—so you can understand how to make being a PA financially worth it.

PA Salary vs National Averages: The Part That Looks Great at First

Most new PAs graduate in their late 20s or early 30s.

According to Forbes:

- National average income for this age group: $58,500

- New PA salary according to MaritHealth: ~$131,500

When I first saw these numbers, I thought:

“Amazing. I’m u...

Why "I’ll Do It Later" Is Ruining Your Finances (and What to Do Instead)

You just wrapped a 12-hour shift. You’re exhausted. Your feet hurt. The only thing on your mind is crashing into bed or bingeing a comfort show—not logging into your Roth IRA.

We get it.

But here’s the truth no one tells you:

In the world of high-income medical professionals, “I’ll do it later” often turns into never.

And when “never” meets your finances? You miss out on hundreds of thousands—maybe even millions—over your lifetime.

So let’s change that.

Below are 5 quick, high-impact money moves you can set up in a single day that’ll skyrocket your financial independence by 2026.

Hack #1: Automate Your Wealth Machine

Money isn’t like fitness. You don’t need to grind daily to see results.

Set up automation once, and your money will keep working while you rest, chart, and live your life.

✅ Set up automatic transfers from checking → investment account

✅ Go beyond savings—set recurring ETF or index fund purchase orders

✅ Use workplace 401(k)/403(b) + open a Roth IRA and taxable broke...

Are You Underpaid? The 6-Step Salary Check Every PA, NP, and PharmD Needs

📉 You might be underpaid by $10,000—or more.

If you're a PA, NP, or pharmacist and you're relying on vibes and guesswork instead of real data to evaluate your compensation, you could be losing tens of thousands of dollars every year. That’s money that could be funding your investments, knocking out debt, or helping you reach financial independence faster.

So let’s fix that.

Below is the 6-step system to figure out what you should be earning—and what to do if you're falling short.

Step 1: Find the Median Salary for Your Subspecialty

First, you need a benchmark.

It’s shocking how many medical professionals skip this part. Before asking friends or Facebook groups if a salary is “good,” go to actual data sources.

📊 Try:

- MaritHealth’s Salary Explorer (most granular + updated for 2025)

- AAPA Salary Report

- Bureau of Labor Statistics

- Salary.com

- Glassdoor’s Know Your Worth tool

For example:

- 🩺 CT Surgery PA Median = $158,000

- 👶 Pediatric PA Median = $127,000

👉 Write this num...

Are You On Track for Retirement as a PA, NP, or PharmD?

You finally did it! You finished training, you’re earning six figures, and you’re doing the “right” things: tackling student loans, saving a bit, maybe even investing.

So why does it still feel like you’re behind?

Here’s the truth: as a high-income earner who started late (thanks to years of school and training), your path to financial freedom looks different. And if you're under 40, there’s really only one metric that matters right now:

👉 Your investing rate.

Let’s break down exactly what it takes to retire comfortably—without relying on guesses or generic advice built for people who started saving at 22.

Why High Earners Still Fall Short in Retirement

Let this stat sink in:

📉 Nearly 50% of households earning $200K+ are on track to retire with less than 60% of their current lifestyle.

That means half the Teslas in the hospital parking lot are headed for a lifestyle downgrade in retirement. Scary, right?

And the reason? It’s not their income—it’s that they started investing too ...

PA vs MD: Who Builds More Wealth by Age 50?

When you walk into a hospital room, who do you assume is swimming in cash?

The attending physician with years of training under their belt? The surgeon who drives a luxury car and racks up high six-figure paychecks?

What if the real millionaire in the room isn’t the MD—but the PA?

Today, we’re pulling back the curtain and looking at real investment projections, salary timelines, and wealth trajectories to answer the ultimate money question:

Who ends up richer by age 50… a PA or an MD?

Let’s find out. 👇

The Head Start Advantage: PA vs MD Timeline

On average, PAs enter the workforce by age 26, while physicians don’t reach full attending status until around age 32–35, depending on specialty.

That’s quite the investing head start for the PA. While a physician may earn an income in residency or fellowship, it’s often barely enough for them to get by and investing isn’t an option.

Even if physicians make 2–3x more than PAs in gross salary once they complete training, the compounding...

What $133K Really Means as a New Grad PA in 2025

So, you landed your first job as a PA and the contract says $133,000. Cue the confetti, right?

Not so fast.

That six-figure salary might look like you’ve made it—but once taxes, benefits, student loans, and cost of living enter the chat? Your paycheck starts looking eerily similar to... a seasoned second-grade teacher.

Let’s break down what $133K actually looks like in your bank account—and what you can do to stretch it farther.

Step 1: Understand Where Your Money’s Really Going

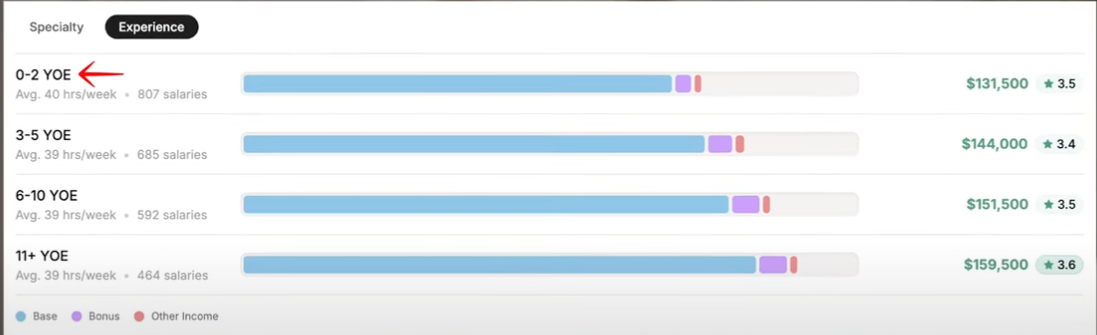

On paper, the median PA salary is about $133,000/year, according to the Bureau of Labor Statistics (2025). But new grads with 0–2 years of experience are earning just under that, around $131,500.

Source: Marit Health

Once we break it down:

- Federal income tax (24%): ~$31,500

- State tax (5%): ~$6,500

- FICA (7.65%): ~$10,000

- Medical, dental, vision insurance: ~$2,400/year

- 401(k) contribution (5%): ~$6,500

🎯 Take-home pay? Roughly $75,000

That’s about $6,250/month—and we haven’t touched student lo...

How to Save as a PA-C (or Any Medical Professional Earning $100K+)

If you're a PA, NP, or pharmacist earning over $100K a year but your savings account still looks like it belongs to your student days... you're not alone.

I became a millionaire by age 31, not by winning the lottery or flipping houses—but by mastering the basics: saving, investing, and being intentional with money. In this post, I’ll walk you through how to calculate your real savings rate, strategies to save more without sacrificing joy, and how to build wealth faster.

Step 1: Know Your Actual Savings Rate

Most medical professionals have no idea what their savings rate is. If that’s you? Let’s fix that.

To find your savings rate:

- Add up ALL dollars you put toward true savings and investments each month. That includes:

- Emergency fund deposits (your sinking funds for vacations don’t count)

- 401(k), 403(b), or other employer retirement plan contributions

- Roth IRA or brokerage account deposits

- HSA contributions

- Then divide that number by your gross monthly income (not your ...