The Epidemic of Politeness Costing PAs Tens of Thousands in Pay

Most physician assistants don’t earn less because they aren’t valuable.

They earn less because they’re too polite to ask.

I’ve seen it over and over again—smart, capable PAs leaving tens of thousands of dollars on the table simply because negotiation feels uncomfortable, intimidating, or “ungrateful.”

I’m Kristin Burton, PA-C, and I’ve been a PA for nearly a decade. I’ve negotiated primary jobs, per diem roles, investment deals, and business contracts. And I can tell you this with certainty:

Failing to negotiate doesn’t just affect your next paycheck—it compounds into decades of under-earning and lost wealth.

Why Negotiation Feels So Hard for PAs

I still remember my first PA job offer.

I was on rotation when the email hit my inbox. My heart was racing. I was thrilled. They could have offered me almost any number and I would’ve said yes.

I was just grateful to have a six-figure job as a new grad.

Negotiation wasn’t even on my radar.

And that mindset—“Where do I sign?”—follows ...

Should Medical Professionals Consider a 50-Year Mortgage? The Truth No One’s Telling You

What if you could finally afford your actual dream home — not the starter home, not the condo, but the home with the extra space, the yard, and the room to breathe?

And what if the monthly payment felt like rent?

That’s the promise behind the new 50-year mortgage being proposed. On the surface, it sounds like a solution for medical professionals struggling with high home prices, rising interest rates, and student loan debt.

But is it actually a good idea?

Let’s walk through the real numbers.

Why Housing Feels Impossible for Medical Professionals

Home prices have jumped 30–50% since 2020.

Interest rates climbed.

Saving a six-figure down payment as a new grad PA, NP, CRNA, or PharmD feels unrealistic.

So the 50-year mortgage claims to “solve” affordability by lowering monthly payments.

But lowering payments always comes with a cost.

What a 50-Year Mortgage Really Means for a $400K Home

Assume:

- Home price: $400,000

- Loan: $320,000 (20% down)

- Interest rate: 6.5%

30-Year Mo...

Are You Underpaid? The 6-Step Salary Check Every PA, NP, and PharmD Needs

📉 You might be underpaid by $10,000—or more.

If you're a PA, NP, or pharmacist and you're relying on vibes and guesswork instead of real data to evaluate your compensation, you could be losing tens of thousands of dollars every year. That’s money that could be funding your investments, knocking out debt, or helping you reach financial independence faster.

So let’s fix that.

Below is the 6-step system to figure out what you should be earning—and what to do if you're falling short.

Step 1: Find the Median Salary for Your Subspecialty

First, you need a benchmark.

It’s shocking how many medical professionals skip this part. Before asking friends or Facebook groups if a salary is “good,” go to actual data sources.

📊 Try:

- MaritHealth’s Salary Explorer (most granular + updated for 2025)

- AAPA Salary Report

- Bureau of Labor Statistics

- Salary.com

- Glassdoor’s Know Your Worth tool

For example:

- 🩺 CT Surgery PA Median = $158,000

- 👶 Pediatric PA Median = $127,000

👉 Write this num...

The Debt Avalanche Strategy Every Medical Professional Needs to Know in 2025

If you're a PA, NP, or pharmacist with any debt that's causing you stress, this guide is for you.

Forget random payment orders or blind budgeting apps. It's time to get strategic about your debt and your future wealth. In this blog, you'll learn the smarter way to tackle debt (hint: it's not the snowball method), how to save thousands in interest, and when to start investing while still paying off loans.

Snowball vs. Avalanche: What Actually Saves You Money?

You've likely heard of the Debt Snowball, a method where you pay off the smallest debt first regardless of interest rate. It's emotionally satisfying, sure. But if you're carrying any high-interest debt (like credit cards or personal loans), it's costing you thousands more over time.

Instead, opt for the Debt Avalanche strategy:

- Step 1: List your debts from highest to lowest interest rate (not balance).

- Step 2: Make minimum payments on all debts.

- Step 3: Throw all extra payments at the highest-interest debt first.

💡 Exa...

How to Save as a PA-C (or Any Medical Professional Earning $100K+)

If you're a PA, NP, or pharmacist earning over $100K a year but your savings account still looks like it belongs to your student days... you're not alone.

I became a millionaire by age 31, not by winning the lottery or flipping houses—but by mastering the basics: saving, investing, and being intentional with money. In this post, I’ll walk you through how to calculate your real savings rate, strategies to save more without sacrificing joy, and how to build wealth faster.

Step 1: Know Your Actual Savings Rate

Most medical professionals have no idea what their savings rate is. If that’s you? Let’s fix that.

To find your savings rate:

- Add up ALL dollars you put toward true savings and investments each month. That includes:

- Emergency fund deposits (your sinking funds for vacations don’t count)

- 401(k), 403(b), or other employer retirement plan contributions

- Roth IRA or brokerage account deposits

- HSA contributions

- Then divide that number by your gross monthly income (not your ...

From $0 to $1.2M in 7 Years: How PAs Can Become Millionaires Faster Than You Think

What if I told you that it’s possible to go from zero to over a million dollars invested in just 7 years on a PA salary?

No gimmicks. No crazy frugality. No lottery luck.

Just a clear, proven 3-step strategy any driven PA can follow.

Let’s break it all down.

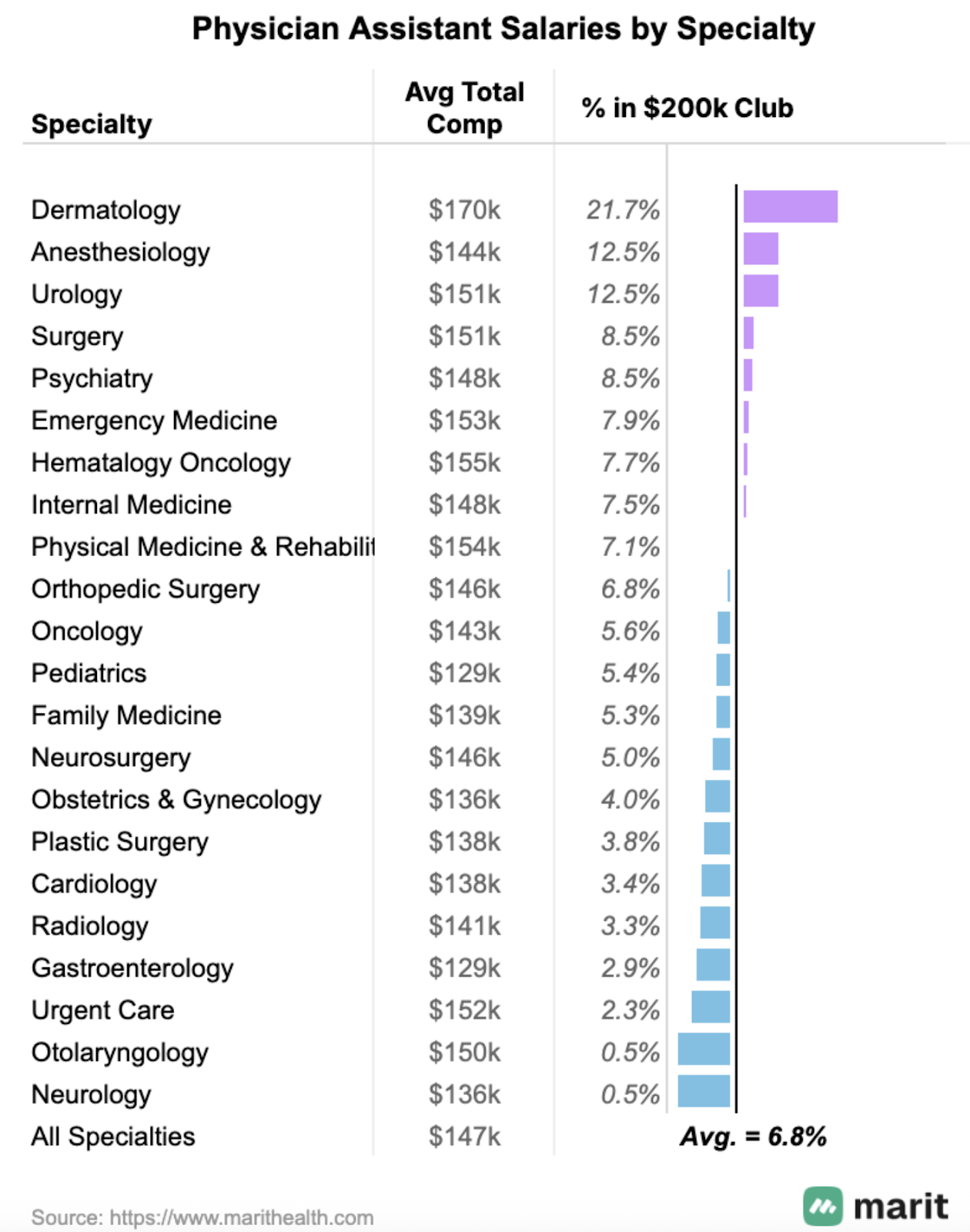

Step 1: Cross the $200K Mark with Your Primary Job

This is where most PAs tap out, but it’s also where the biggest growth potential starts.

📊 According to data from Marit Health, 1 in 14 PAs already earn over $200K/year.

Here’s how to increase your odds of joining them:

✅ Choose a High-Earning Specialty:

Dermatology, critical care, cardiothoracic surgery, and PM&R consistently top the list. But it’s not just about the specialty—it’s about where you land within it.

💡 Specialties like dermatology, plastic surgery, and psychiatry have high intraspeciality variance in pay, meaning some PAs are crushing $200K+ while others are barely above average. Don’t just switch specialties… switch to a better-paying role within your speci...

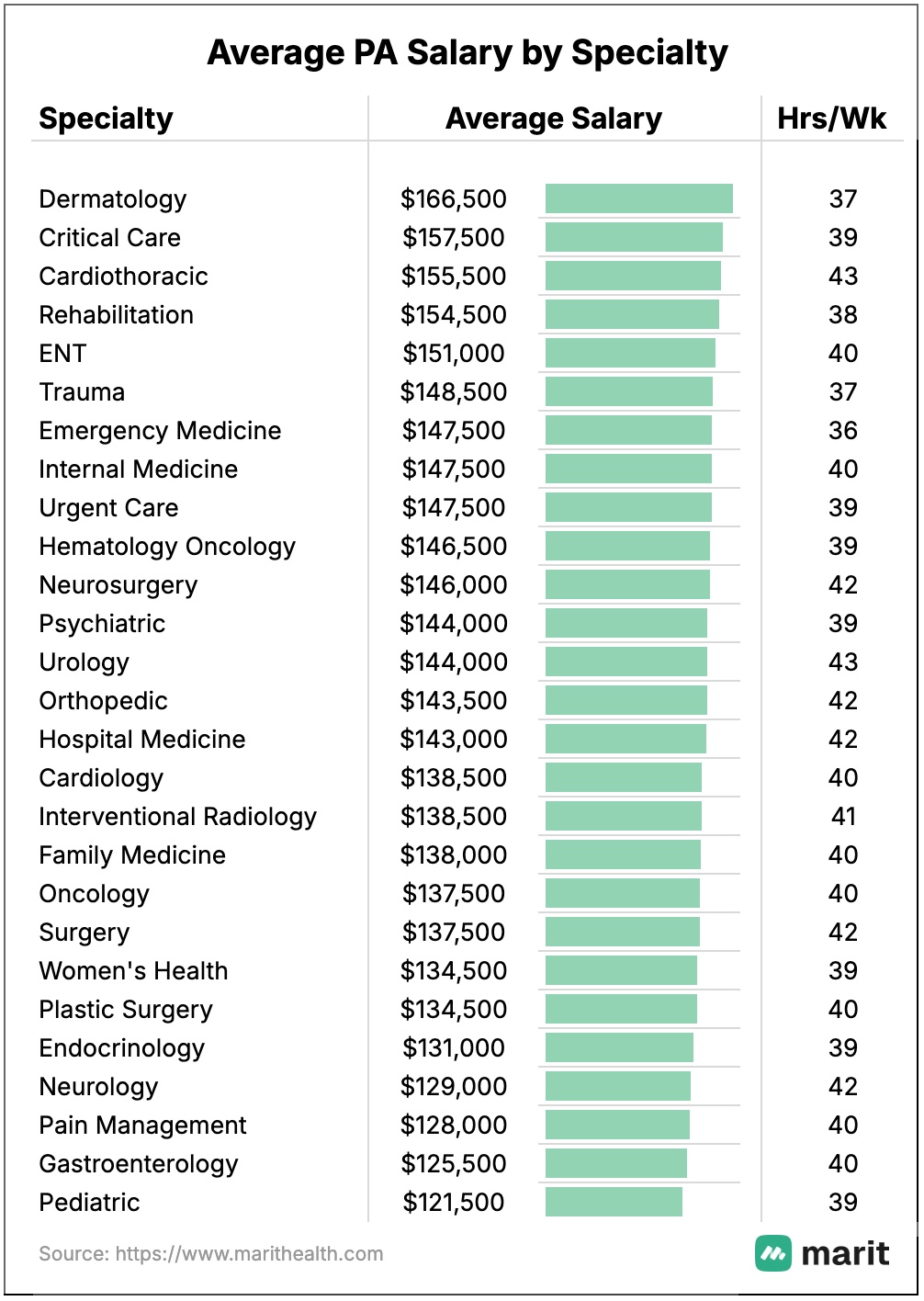

Top Paying PA Specialties in 2025: Where Physician Associates Are Earning the Most (and Least)

If you're a practicing PA, a PA student, or even considering PA school, you're probably asking yourself: Is the debt worth it? The good news? PA salaries are going up. The better news? You have more control over your income than you might think.

PA Salaries Are On the Rise (But Uneven)

According to the latest AAPA Salary Report, PA earnings rose 5.5% in 2024 alone. MGMA data shows:

- Surgical PAs: median is up 15% since 2020

- Non-surgical, non-primary care PAs: median is up 21%

- Primary care PAs: median is up 30%

Sounds great for primary care, right? Not so fast. That percentage growth only tells part of the story. You need to look at absolute numbers and actual earning potential across subspecialties.

The 3 Highest Paying PA Specialties in 2025

Using Marit Health salary data, these are the current top-paying specialties:

- Dermatology — Average: $166K/year

- Avg. weekly hours: 37

- Also has highest percent of PAs earning $200K+

- Critical Care — (as a critical care PA myse...

How to Make Your Kid a Millionaire by Age 35 (Yes, Really)

If you're a medical professional and either have kids or want kids someday, you've probably wondered:

How can I give them a financial head start I never had?

Let me show you how we’re doing it.

I’ve set up a system where both of my kids will be millionaires by the time they’re 35—and it doesn’t require hundreds of thousands of dollars.

It just takes intention, a few monthly contributions, and the right accounts.

First—This Is Not All or Nothing

Let me be clear:

You don’t need to hit millionaire status for this to be worth it.

Even if you can only do a fraction of this plan, you're still setting your kid up with a financial launchpad that most of us never had.

Even $100/month over time = six figures by adulthood. That’s still a huge win.

But if you do want to go all in, here’s exactly how we’re making millionaire status happen by age 35:

Step 1: Open a UTMA Account

We start with a UTMA account (Uniform Transfers to Minors Account)—

✅ It’s flexible

✅ It’s taxable

✅ And the mone...

How to Build Wealth When the Economy Feels Like a Dumpster Fire

Spring 2025 came in hot with tariff wars, rising inflation, student loan chaos, and stock market volatility that has a lot of medical professionals wondering...

“Is it even possible to build wealth in a season like this?”

Short answer: yes.

But you need a strategy—and some serious emotional discipline.

Why Personal Economics > Macroeconomics

The truth? You could come out of this economic mess ahead—if you have your personal financial systems dialed in.

✅ No high-interest debt

✅ 3–6 months of cash reserves

✅ Multiple income streams

✅ A student loan plan

✅ A long-term investing system

If you don’t have these in place, this season can wreck you.

If you do? You can use it to build wealth while everyone else panics.

What Investing in a “Down Market” Actually Feels Like

Whether you’re:

- A new investor putting in your first $1,000

- Or a seasoned one watching $70K disappear from your account in a day

It still stings.

But this is where people either panic and pull out...

Or keep go...

What Most New Grad PAs Realize After Their First Paycheck

You graduate. You pass your boards. You land the job.

That six-figure paycheck hits—and then... reality sets in.

If you’re a brand new PA, you know exactly what I’m talking about.

It’s not quite the dream you imagined. Expenses feel overwhelming. Loans are looming. And you’re wondering, “Wait… where did my paycheck go?”

Let’s walk through exactly what you should be doing in your first year of practice to get your money right.

Why Generic Budget Rules Don’t Work for PAs

You’ve probably heard of those 50/30/20 budgeting rules:

- 50% to needs

- 30% to wants

- 20% to savings/investing

I hate those.

They’re made for the masses—not for people like us.

If I followed that rule? I wouldn’t be a millionaire by 31. I needed a lot more than 20% going toward debt and wealth-building.

What you really need is a cash flow system that helps you grow your net worth—not just track your spending.

Inside the Millionaires in Medicine Club, I break down exactly how to do this with a free tracker you c...