3 Student Loan Mistakes (That Cost Tens of Thousands)

Are you a medical professional struggling with student loan debt? You're not alone. In fact, many medical professionals are making costly mistakes that can significantly impact their financial future.

Let's look closely into the top three mistakes medical professionals are making with their student loan debt:

1. Accidentally Choosing Taxable Loan Forgiveness

One of the most common mistakes is choosing taxable loan forgiveness without realizing that you’re doing it. When you're on an income-driven repayment plan and your loans aren't paid off after 20-25 years, the remaining balance is typically forgiven. However, this forgiveness is taxable, meaning you'll have to pay taxes on the forgiven amount as though it was ordinary earned income.

Medical professionals often opt for income-driven repayment plans without realizing that the remaining loan balance after 20-25 years is forgiven but taxed as income. This mistake can lead to a substantial tax bill, and may end up being the highest cost way to repay loans when evaluated by total amount paid.. Unlike Public Service Loan Forgiveness (PSLF), which offers tax-free forgiveness after 10 years, taxable loan forgiveness requires careful financial planning to prepare for the future tax burden and extends the time horizon of loan repayment substantially.

Imagine a Physician Assistant (PA) with a $189,000 student loan balance who opts for an income-driven repayment (IDR) plan. In this plan, after 20-25 years of making payments based on their income, any remaining balance is forgiven, but this forgiven amount is taxed as income.

If they choose this taxable loan forgiveness option over something like the Public Service Loan Forgiveness (PSLF), which offers tax-free forgiveness after 10 years of payments while working for a qualifying employer, they might end up paying more in taxes and overall repayment costs.

In this scenario, the PA could face an additional $100,000 or more in total costs due to the tax liability on the forgiven loan balance and increased total number of payments over the long duration. This outcome can make taxable loan forgiveness a much more expensive option compared to PSLF or other repayment strategies.

2. Not Understanding Public Service Loan Forgiveness (PSLF)

If you're a medical professional working for a qualifying employer, you may be eligible for PSLF, which offers tax-free loan forgiveness after making 120 qualifying monthly payments. However, many medical professionals are unaware of PSLF or don't maximize the plan fully.

Public Service Loan Forgiveness (PSLF) is a powerful tool for medical professionals, but it only applies if you work for a qualified employer, such as a nonprofit or government agency. Choosing a private practice over a qualifying employer can result in significantly higher loan repayment costs.

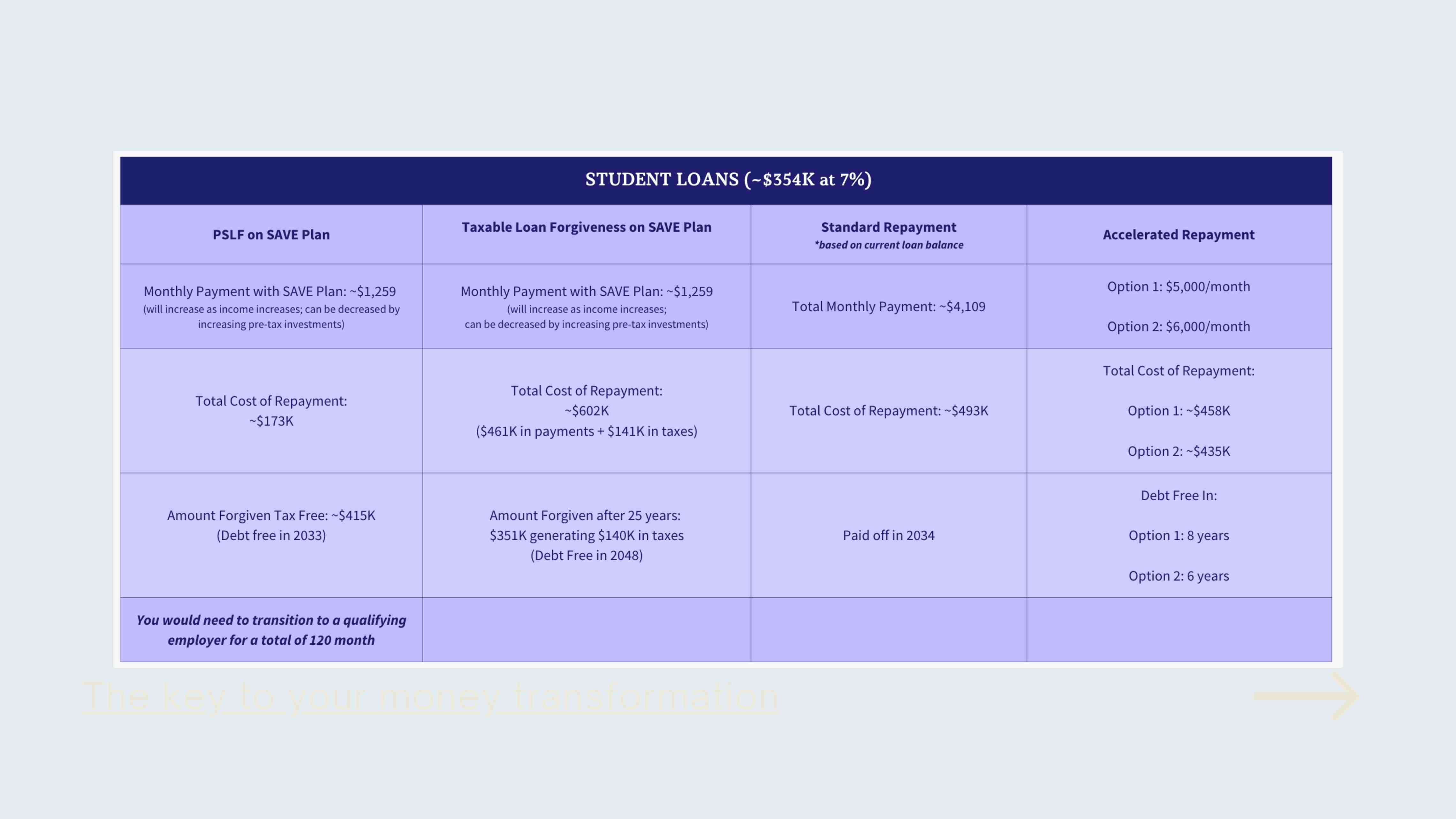

Let’s say you're a Physician Assistant (PA) with significant student loan debt—say $354,000—choosing where you work can make a huge financial difference. By working for an employer that qualifies for Public Service Loan Forgiveness (PSLF), you could save over $300,000. PSLF forgives the remaining balance on your Direct Loans after 10 years of qualifying payments while working full-time for a qualifying employer, such as a government or non-profit organization. This program is particularly advantageous if you have a high debt-to-income ratio, as it can drastically reduce your total repayment costs.

When evaluating job offers, it's essential to consider PSLF eligibility as part of your decision-making process. The long-term savings from loan forgiveness can far outweigh other factors, potentially turning what seems like a modest salary into a much more attractive offer when you account for the significant financial relief PSLF provides.

Remember, there is more to your financial journey than student loan repayment. You need to consider the pathway below and address all aspects of your financial success. In this example, the standard 10-year repayment would exceed 60% of this PA-C’s take home pay. It wouldn’t be feasible to make the rest of the financial pieces work.

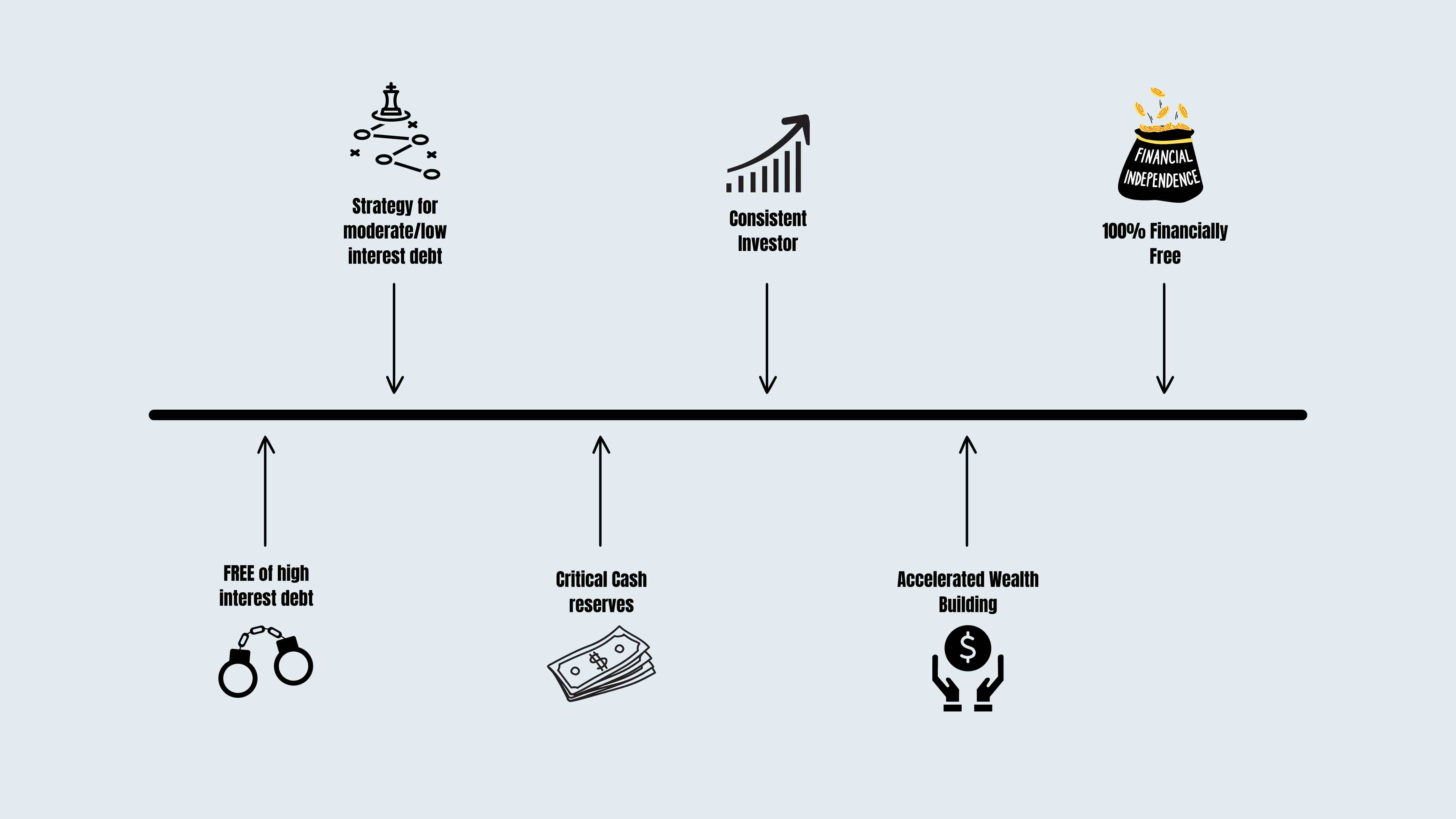

Managing student loans is just one piece of the broader financial puzzle. After addressing high-interest debt, it's essential to consider how your repayment plan supports other key financial goals. A solid strategy should allow you to build an emergency fund and invest consistently. For instance, consistent investing might involve investing at least 20% of your gross income for three months in a row. It’s important that you move forward with a student loan repayment approach that allows you to facilitate this.

For medical professionals looking to expand their financial knowledge, the Millionaires in Medicine Club offers a community where members can learn about investment strategies, real estate, tax planning, and more. Joining a group of like-minded individuals can provide the support and resources needed to not only manage student debt but also build lasting wealth.

3. Not Maximizing PSLF Once You’re On It

Moving beyond the basic tenants of selecting an income-driven repayment plan and finding a qualifying employer for PSLF is the key to maximizing the plan. Considering all levers to lower your adjusted gross income for tax purposes, and your tax filing status, have huge implications for total amount you will pay.

If you're pursuing PSLF and are married, your tax filing status can have a substantial impact on your loan repayment costs. Filing jointly with a high-earning spouse can increase your income-driven repayment amount, leading to higher total repayment costs. For instance, a medical professional with $197,000 in student loan debt could potentially save $80,000 by opting to file separately. While this filing status may mean losing certain tax deductions, the overall reduction in student loan repayment costs can be substantial, particularly when income-driven repayment plans are involved. It's a trade-off that requires careful consideration, balancing immediate tax benefits against long-term financial savings. Discuss this with a good CPA who has experience dealing with clients pursuing PSLF.

By avoiding these common mistakes and taking proactive steps to manage your student loan debt, you can set yourself up for financial success.

Do you have any questions about student loan debt or want to discuss your specific situation?

Feel free to leave a comment below.