How I’m Making My Kids Millionaires... Without Spoiling Them

Yep, you read that right. It's totally possible to turn your kid into a future millionaire—without needing to throw in hundreds of thousands.

I’m doing it with just a few thousand dollars and a lot of intention. And in this blog, I’ll show you exactly how:

👉 The accounts we use

👉 The money system we teach our 3-year-old

👉 And the mindset shifts that actually matter more than the money

Let’s break it all down.

Our Four-Bucket Money System for Kids

You’ve probably heard of the classic give-save-spend system for teaching kids about money.

I hate it.

Why? Because it completely ignores investing—arguably the most important pillar of long-term wealth.

So instead, we created our own version: Give, Save, Spend, and Invest.

Every Sunday, our 3-year-old gets her allowance in quarters (supervised, of course), and she gets to divide those coins between her four jars.

To make the “invest” jar feel real, we created a visual thermometer tracker for her investing goals, broken into:

- 🎓 College

- 🏠 Life Fund (for something like buying her first rental property)

- 👵 Retirement

It’s all about making investing feel tangible, even to a preschooler.

And when she hits $5 in her invest jar? We go online together, pick a stock (last week she chose Disney), and actually buy it. The logistics of this may be complicated as you can’t buy fractional shares of an individual stock at Vanguard, but I simplify the process for her for the lesson learned. She loves seeing her goals grow and proudly tells grandma what she’s investing for.

The Accounts We Use to Make Our Kids Millionaires

Let’s talk logistics. These are the 3 account types we’re using—and the pros and cons of each.

1. 529 College Savings Plan

✅ Tax-free growth when used for qualifying education

✅ Many states offer tax deductions or credits

✅ Flexible for scholarships, military academies, K–12 private school

✅ Flexible for scholarships, military academies, K–12 private school

But don’t open one blindly. Start by running the numbers:

- Will you pay for in-state or out-of-state tuition?

- Just undergrad? Grad school too?

- Are you covering room and board?

Tools like Vanguard’s college cost calculator help set realistic targets. For example, we’re looking at ~$230K for our daughter’s in-state college (assuming 5% annual tuition increases). Yep—wild.

2. UTMA (Uniform Transfers to Minors Account)

✅ Super flexible (can be used for anything, not just college)

✅ Great for early real estate, business, or investing goals

✅ Some early income is taxed at the child’s lower rate

But heads up:

- It counts against FAFSA and financial aid more than 529s

- Once your kid turns 18–21 (depending on your state), they can use it for anything

We use this one as her “Life Fund.” It’s perfect for giving her future options—without locking us into education-only use.

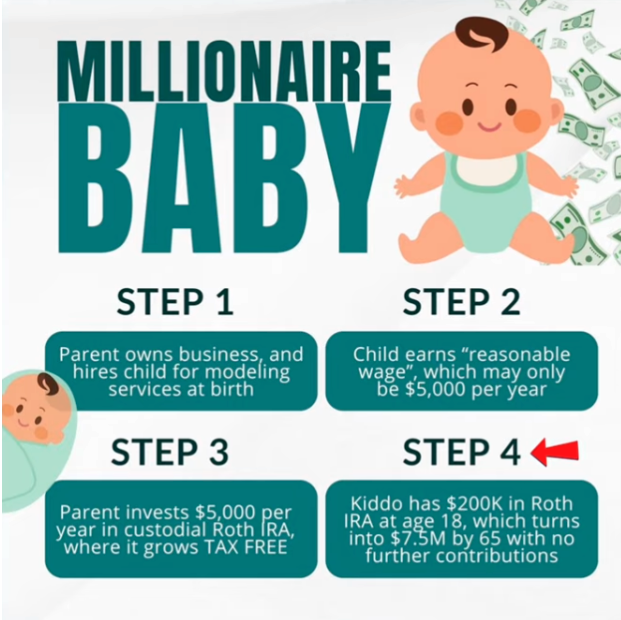

3. Custodial Roth IRA

✅ My absolute favorite

✅ Grows tax-free forever

✅ Withdrawals are penalty-free for education, first home, and more

BUT… your child needs earned income to qualify.

That means either:

- Documented jobs like babysitting or lawn care (with reported income), or

- Legit employment from your business (yes, even toddler modeling for your website counts!

If you invest $5,000 per year into a Roth IRA from age 0 to 18, your kid could hit $200K before adulthood—then let compounding take it from there. Game. Changer.

The Real Millionaire-Maker: Mindset

Here’s the thing: You can have the best account structure in the world, but if your kid has a scarcity mindset, it won’t matter.

You can’t pass on financial skills you don’t have.

So your #1 job is to master money yourself—and model that.

Here’s how we do it at home:

- We avoid saying “We can’t afford that.” Instead, it’s:

“That’s not part of our intentional spending plan right now.” - We explain why we choose certain jobs or lifestyles:

“I love the flexibility this job gives our family.” - We connect work with money early (chores = responsibility, extra tasks = pay).

And eventually, we’ll teach her to break that time-for-money exchange altogether—by building assets.

TL;DR: How to Raise a Millionaire Without Raising a Brat

Here’s what you need:

✅ Weekly money conversations

✅ Visuals and goal-setting that make investing fun

✅ Strategic accounts like 529s, UTMAs, and Roth IRAs

✅ A healthy, abundant money mindset

✅ Your own financial literacy

Remember: more is caught than taught. So if you want your kid to win with money? You’ve got to be doing it too.

Want to Build Generational Wealth?

📢 Join the Millionaires in Medicine Club for FREE:

https://www.millionairesinmedicine.com/community

📲 Follow me on Instagram for more tips:

https://www.instagram.com/millionairesinmedicine