Medical Professionals: Should You Pick a Roth or Traditional 401(k)?

Roth or Traditional 401(k)? Here's What I Tell Every Medical Professional

Choosing between traditional and Roth contributions to your 401(k) or 403(b) isn’t just a random checkbox—it could mean tens of thousands of dollars saved or lost across your career.

Let’s break down what actually matters in 2025 and beyond.

💡 Start with the Basics: What’s the Difference?

- Traditional = Pre-tax contributions

✅ Lowers your taxable income today

⚠️ But you’ll pay taxes when you withdraw the money in retirement. - Roth = After-tax contributions

✅ You’ve already paid taxes upfront

⚠️ Withdrawals in retirement are 100% tax-free

The key thing to remember: Your 401(k) or 403(b) is one account, but it can have both traditional and Roth “buckets” inside. In 2025, your total contribution cap is $23,500—whether you do Roth, traditional, or a mix of both.

And no—this has nothing to do with your Roth IRA. Entirely separate thing.

🔁 What You’re Really Doing Is This: Tax Bracket Guesswork

When you pick Roth or traditional, you’re essentially betting on your current vs. future tax bracket.

- If you expect your taxes to be higher later, Roth wins.

- If you think your taxes will be lower in retirement, traditional wins.

But none of us have a crystal ball, right?

So let’s look at a little history: Tax brackets today top out at 37%. But in the past? We've seen 70%–90% top marginal rates. So, Roth could be your hedge against future increases.

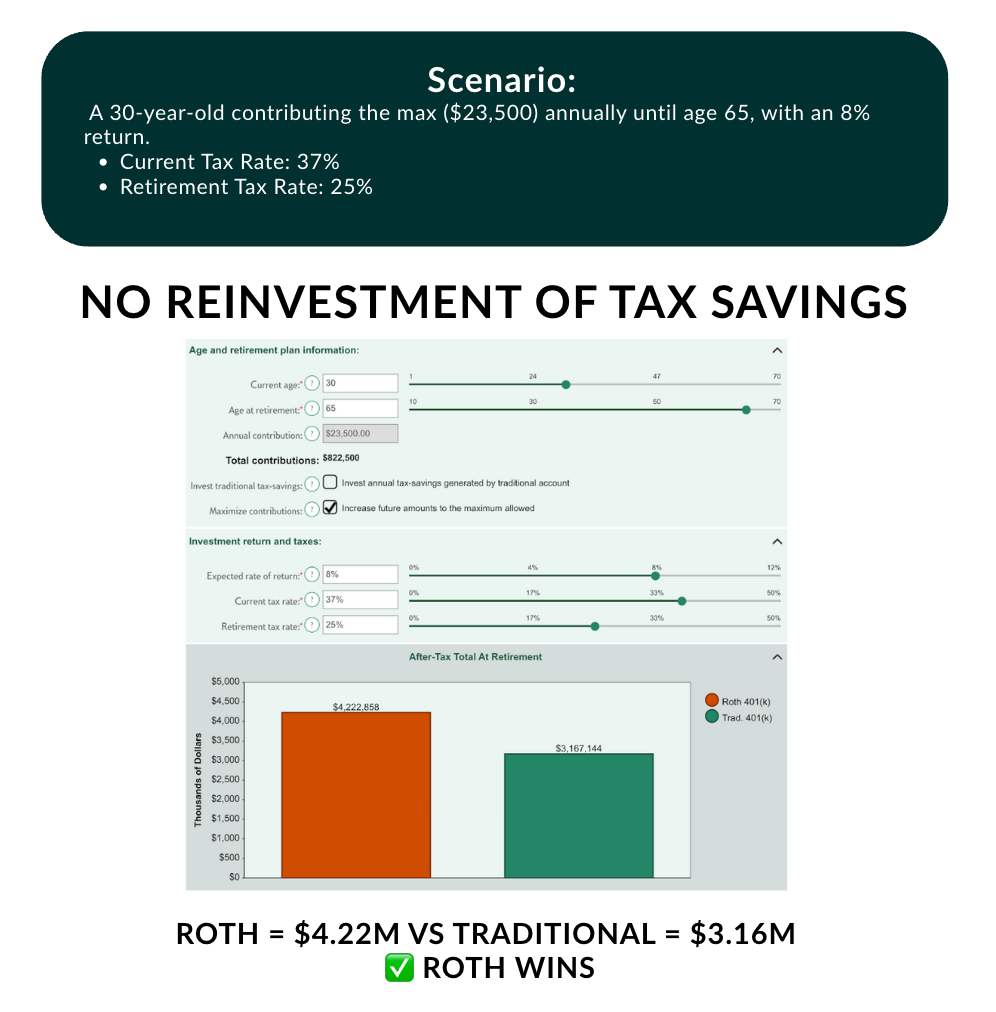

Roth vs Traditional: What Happens Over Time?

Reinvestment:

💰 Why Your Student Loan Strategy Changes Everything

This is where most financial advisors drop the ball.

If you’re pursuing PSLF or any income-driven repayment (IDR) plan, your adjusted gross income (AGI) determines your monthly payment.

And guess what lowers your AGI?

✔️ Pre-tax 401(k) or 403(b) contributions

✔️ HSA contributions

✔️ Tax-deductible FSA contributions

Lower AGI = Lower loan payment

Lower loan payment = More forgiveness at the end

It’s a win-win. In fact, we’ve had clients slash payments and build wealth at the same time by using this strategy.

🧠 Real Life Example: How One Pharmacist Maxed the System

One of our pharmacist clients had a debt-to-income ratio of 3:1. Here’s what he did:

- Maxed out his 403(b)

- Maxed out his 457

- Maxed out his HSA

- Did a Backdoor Roth IRA for tax-free growth

He built serious wealth and slashed his student loan payments—all without sacrificing future financial flexibility.

🧮 But What About RMDs?

If you hate the idea of forced withdrawals in your 70s (aka required minimum distributions), Roth contributions can help:

➡️ Roth 401(k) → Rolled into Roth IRA = no RMDs

➡️ Traditional 401(k) → Rolled into Roth IRA = taxable Roth conversion

If you want to avoid RMDs without creating a tax headache, having some Roth money already helps you stay flexible.

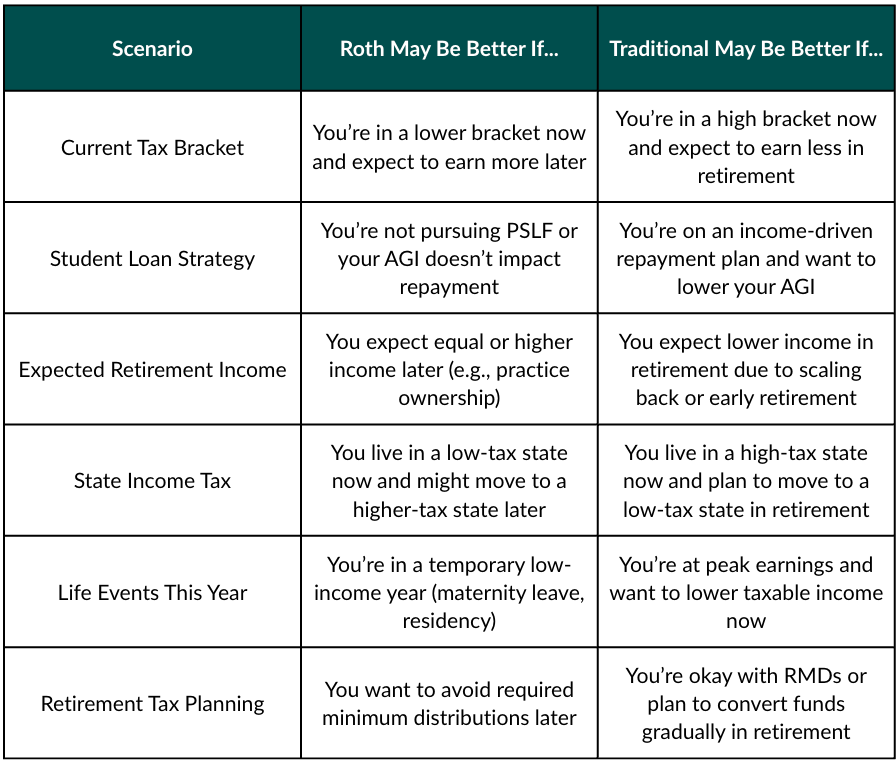

When Roth Wins vs. When Traditional Wins

Choosing between Roth and Traditional isn’t just about income today, it’s about what you expect in the future. Below is a simplified guide to help you see where each option shines based on common financial situations faced by medical professionals.

🎓 Want to Master Wealth Building as a Medical Professional?

📢 Join the Millionaires in Medicine Club for FREE:

https://www.millionairesinmedicine.com/community

📲 Follow me on Instagram for more tips:

https://www.instagram.com/millionairesinmedicine