The Retirement Mistake Costing Medical Pros Millions

What if I told you that you might be leaving millions of dollars on the table for your future retirement?

And what if that loss came down to one small mistake most medical professionals make without realizing it?

I’m talking about a simple setting inside your employer retirement portal… a single button you likely clicked once, years ago… and never looked at again.

It’s one of the easiest financial pitfalls to fix, but the impact is massive. And with new IRS rules coming in 2026, ignoring it could cost you more than you think.

Today, I want to show you the exact retirement mistake 90% of PAs, NPs, CRNAs, and PharmDs are making — and how to correct it before 2025 ends.

The One Button Most Medical Pros Never Re-Check

A cardiothoracic surgery PA I’ll call Sarah came to us after investing for years. She had originally set her 401(k) contribution to the maximum back when she started her job five years earlier… and then never touched it again.

The problem?

IRS contribution limits change every year.

So while she thought she was still maxing out her 401(k), she had actually been under-contributing for years — costing her tens of thousands in missed tax savings and hundreds of thousands in future investment growth.

This is happening to medical professionals everywhere.

And with new 2026 contribution limits, the gap is about to get even bigger.

2026 Retirement Contribution Limits Every PA, NP & PharmD Should Know

401(k) & 403(b)

- 2025 limit: $23,500

- 2026 limit: $24,500

- Catch-up (age 50+): $8,000

- Total 401(k) max: $72,000 (more applicable to 1099 folks using solo 401(k)s)

Roth IRA & Backdoor Roth

- 2025 limit: $7,000

- 2026 limit: $7,500

- Catch-up contribution (50+): $1,100

And remember: the limit is combined between your Traditional IRA and Roth IRA.

HSA (the most tax-advantaged account you have)

- Individual: $4,400

- Family: $8,750

- Catch-up (55+): $1,000

If you’re contributing to an HSA but not investing it, it’s functioning as a checking account — not a wealth-building tool. Make sure you’ve actually selected investment funds inside your HSA.

How Much You Need to Earn to Max Out Everything

Medical professionals often assume that maxing all three accounts is “impossible.”

It’s not — you just need to know the math.

- If you earn $182,000+ → maxing out everything is just a 20% investing rate

- If you earn $146,000 → it’s a 25% investing rate

- If you earn $121,000 → 30% investing rate

- If you earn $104,000 → 35% investing rate

Yes — even clinicians at $104K can max all three when their overhead is strategic.

And if you’re wondering whether investing 35%+ is realistic… I personally invested over 50% of my income for years (with kids). It’s absolutely possible with structure.

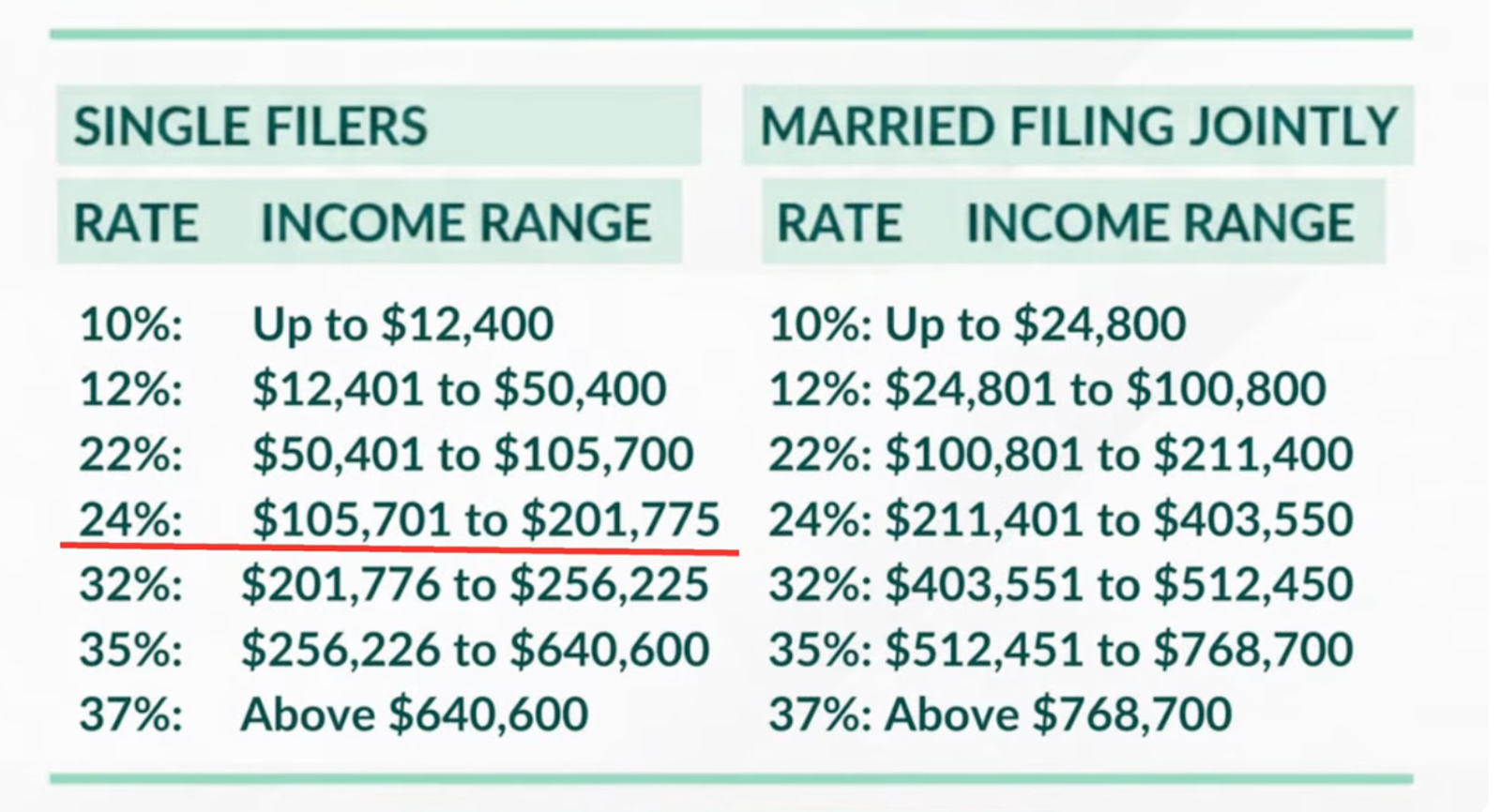

Your Tax Bracket Matters More Than You Think

Most PAs and NPs fall into the 24% federal bracket.

What matters is using the accounts available to you to decrease taxable income and increase long-term compounding.

And if you’re a parent?

You’re leaving money on the table if you’re not using:

- Dependent Care FSA

- Child & Dependent Care Tax Credit

These two combined can shelter thousands of dollars from taxes — for expenses you’re already paying anyway.

Are You Making This Retirement Mistake Right Now?

If you set your 401(k) contribution years ago…

or you picked a random percentage like 5% or 10%…

or you’ve never checked the IRS contribution limits…

You’re almost certainly on track to under-fund your accounts in 2026.

Here’s what to do:

Before the year ends:

✔️ Log into your employer retirement portal

✔️ Check your current contribution rate

✔️ Adjust it to meet the new 2026 limits

✔️ Repeat this for your Roth IRA and HSA

✔️ Make sure your HSA and Roth IRA are actually invested

A 10-minute check could add six or seven figures to your future retirement.

Watch Full Video Here

Want This in One Printable Guide For free?

If you want a simple, easy, step-by-step sheet that walks you through:

- every 2026 IRS change

- updated contribution limits

- tax brackets

- catch-up limits

- investment recommendations

- what to update in your employer portal

👉 Download the FREE 2026 Tax Update Guide

Your future self will thank you for doing this now — not five years too late.