Trump Wants to Give Your Kid $1,000—But Is It Worth It?

You’ve probably heard it already:

“Trump wants to give your kid a thousand bucks.”

And if you’re a medical professional trying to build wealth for your family, you’re probably wondering:

Is this legit? Should I open one of these Trump Accounts?

Let’s break it down... money-first, politics-neutral.

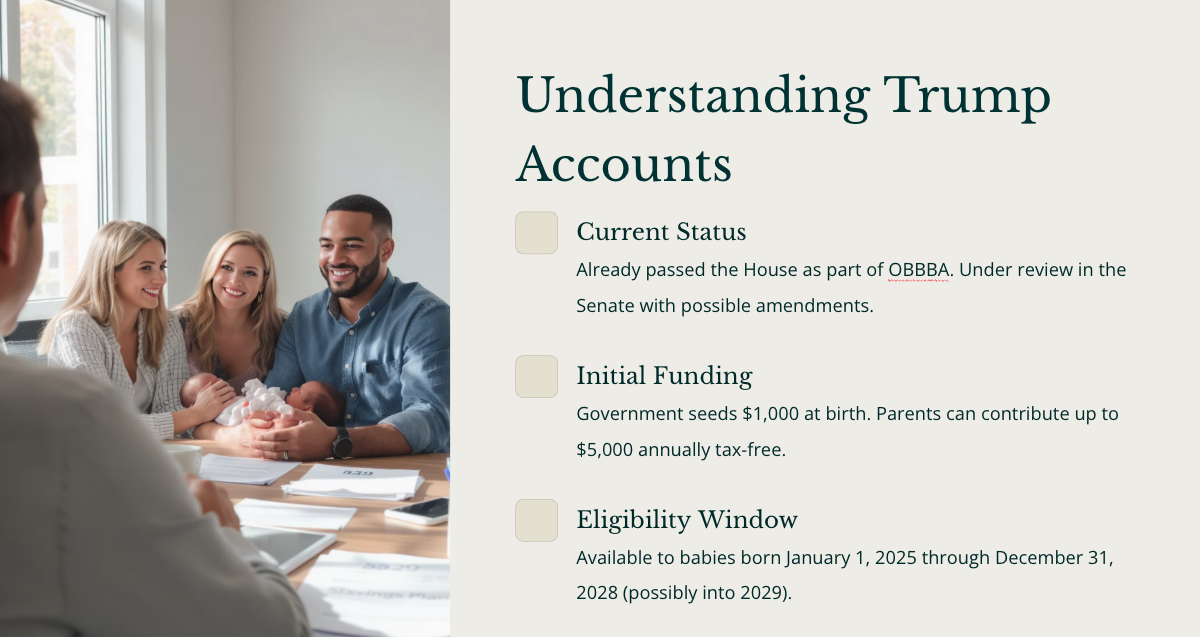

What Is the Trump Account?

This account is part of the One Big Beautiful Bill that’s officially passed and signed into law.

The details are still murky, but here is what the Trump Account for kids plans to offer:

✅ $1,000 in seed money for kids born in a specific time window from the federal government

✅ Up to $5,000/year in parental contributions allowed

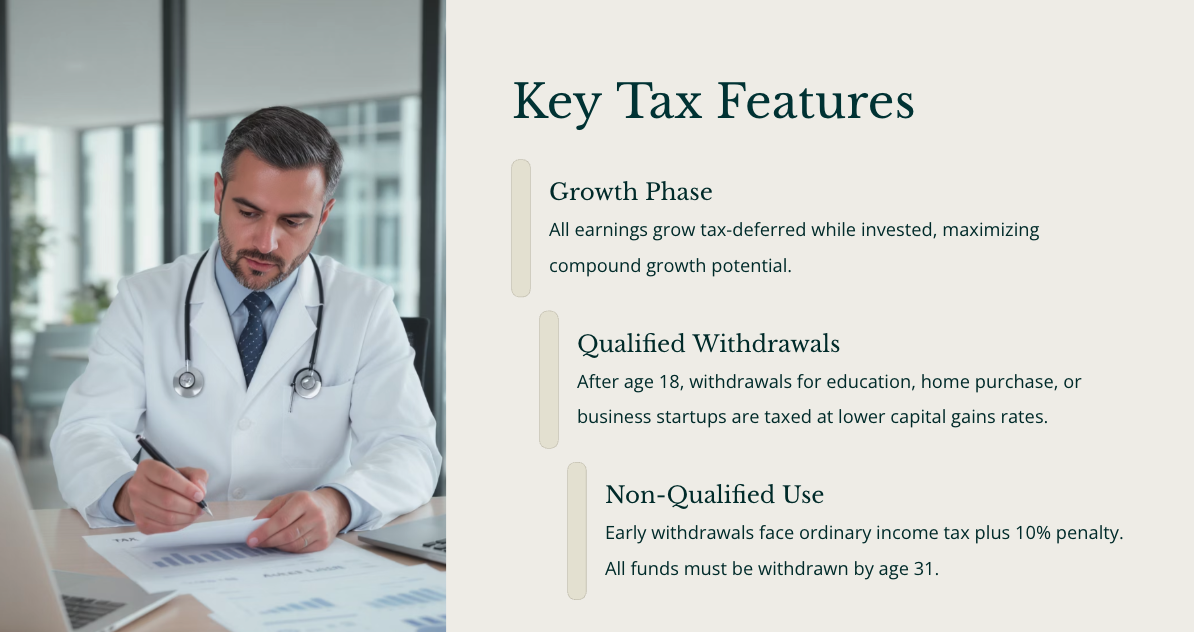

✅ Tax-deferred growth

✅ Tax breaks (specifically taxed at capital gains rates rather than ordinary income brackets) if the money is used for:

- Education

- Housing

- Starting a business

But if the money is used for anything else?

Ordinary income tax + a 10% penalty.

Also, all funds must be withdrawn by age 31.

Sounds Good… But How Does It Compare?

Let’s stack the Trump Account up against two of the best kid-investing accounts out there:

- UTMA (Uniform Transfers to Minors Account)

- Custodial Roth IRA

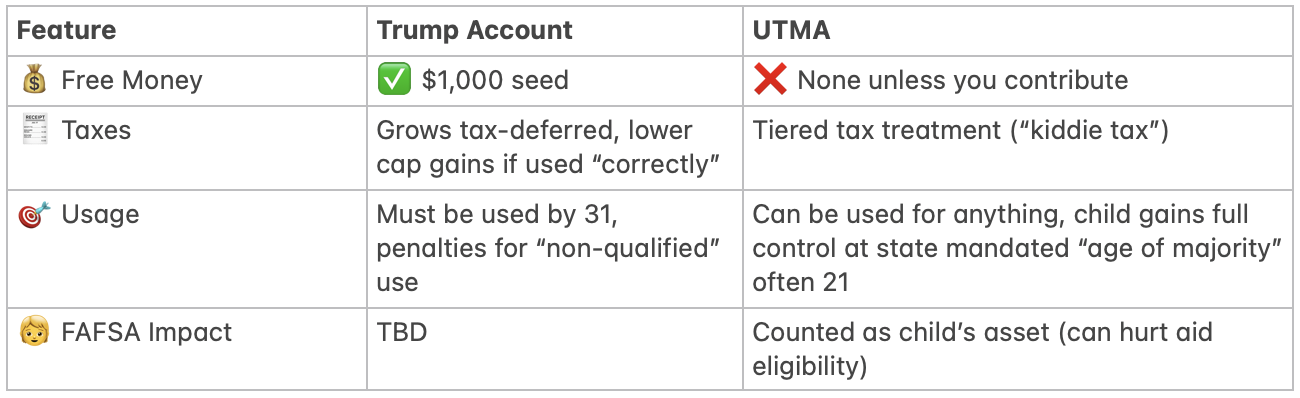

Trump Account vs. UTMA

Bottom line:

Bottom line:

The Trump Account edges out the UTMA on taxes and free seed money.

The UTMA wins on flexibility.

Trump Account vs. Custodial Roth IRA

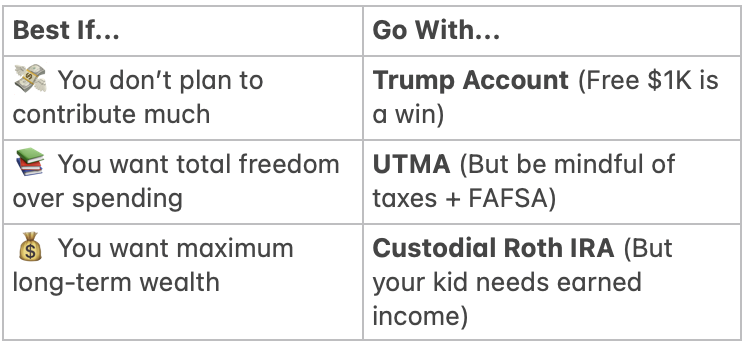

The custodial Roth IRA is still the best long-term wealth builder.

Here’s why:

- 🔒 Contributions are after-tax

- 📈 Growth is tax-free

- 💸 Withdrawals in retirement are also completely tax-free

But there’s a huge caveat:

Your kid must have earned income.

(That’s where baby modeling or small biz gigs come in.)

And the cap? It’s $7,000 in 2025 or your child’s income—whichever is lower.

So Which Account Should You Use?

Here's how I’d break it down:

Whichever you choose, you’re doing a good thing.

Whether it’s $5/month or $5,000/month, you’re building something your kid likely never had. That’s powerful.

One Big Reminder: Prioritize Your Retirement First

Don’t get caught up in the hype.

Yes, the Trump Account could be a great tool.

Yes, it’s exciting to think about wealth-building for your kid.

But if you haven’t run your own inflation-adjusted retirement numbers yet?

If you’re not sure you’ll be able to retire at 65 with the same lifestyle you have now?

Then pause.

Make sure your own investing is on track first.

Want Help Figuring This Out?

📢 Join the Millionaires in Medicine Club for FREE

Over 5,000 medical professionals are inside, learning how to invest smarter and build generational wealth together.

Let’s get your money working for you—and your kids.