How A Toyota Can Cost You $200K+

As a new medical professional stepping into financial independence, buying a car might seem like one of your first major purchasing decisions. However, before you sign any papers, it's crucial to understand not just the sticker price of your new vehicle but also its long-term financial impact.

Allow me to help you explore the concept of opportunity cost and how choosing the right car can affect your wealth-building journey.

Opportunity cost is what you forgo when you choose one option over another—in this case, the potential gains you miss out on when you invest your money in a vehicle instead of the stock market or other investments. For example, if you opt to buy a more expensive car, the extra money you spend (and its future potential value) could have been invested elsewhere, growing over time.

Case in Point

$45,000 vs. $30,000 Car Purchase

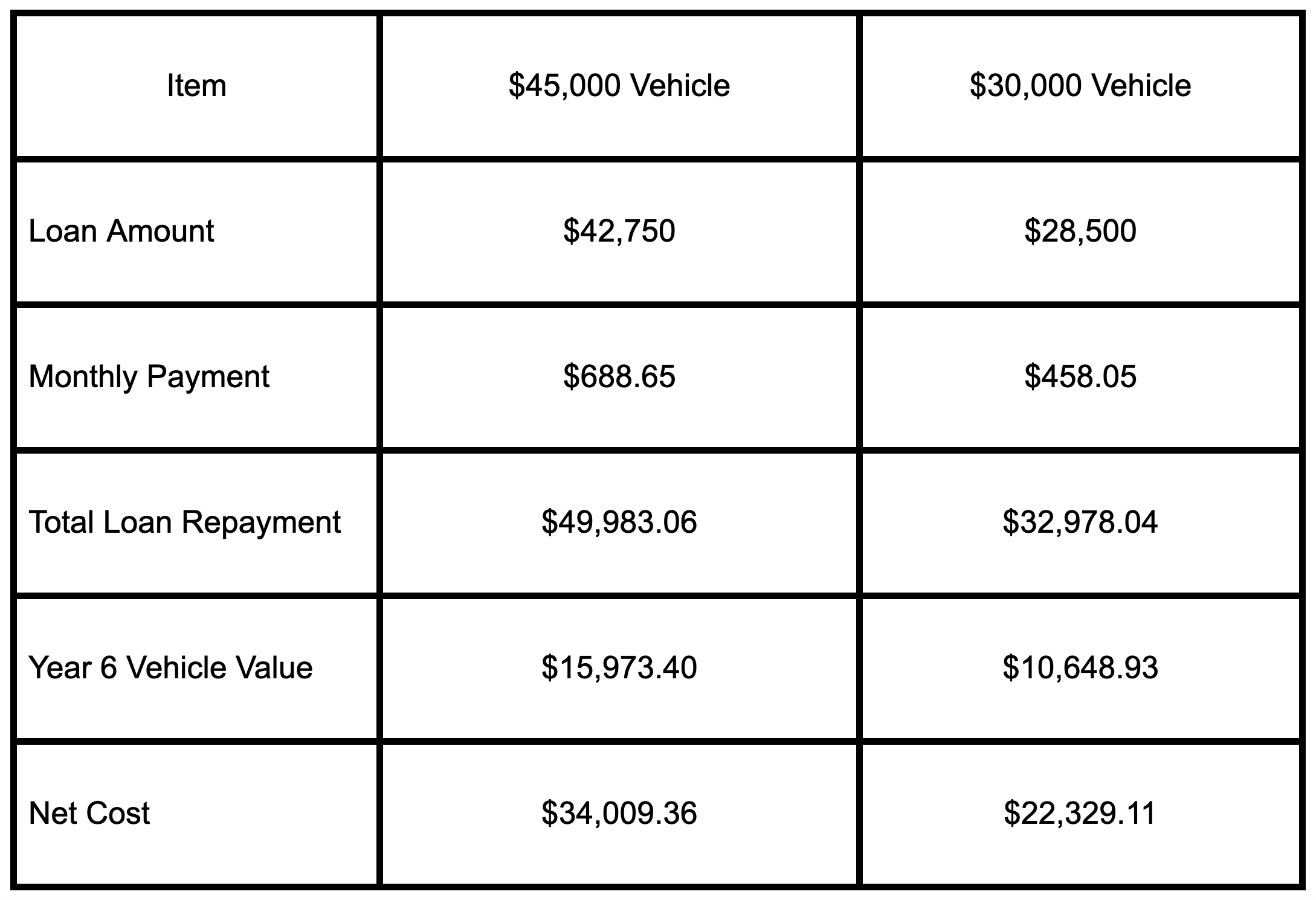

Let's compare two scenarios where you could buy a car for $45,000 or a less expensive model for $30,000. Each choice comes with different financial obligations and potential impacts on your investment opportunities.

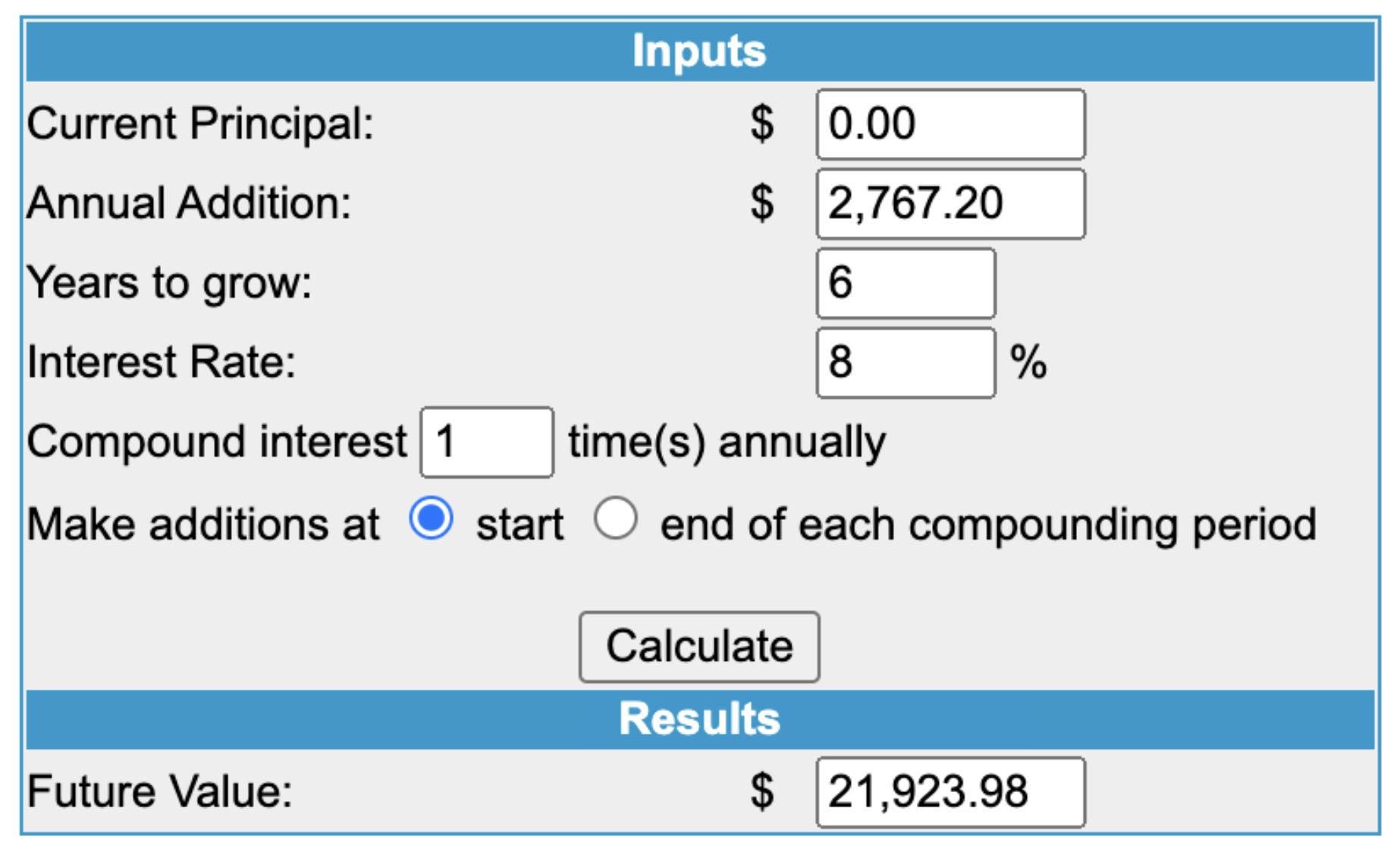

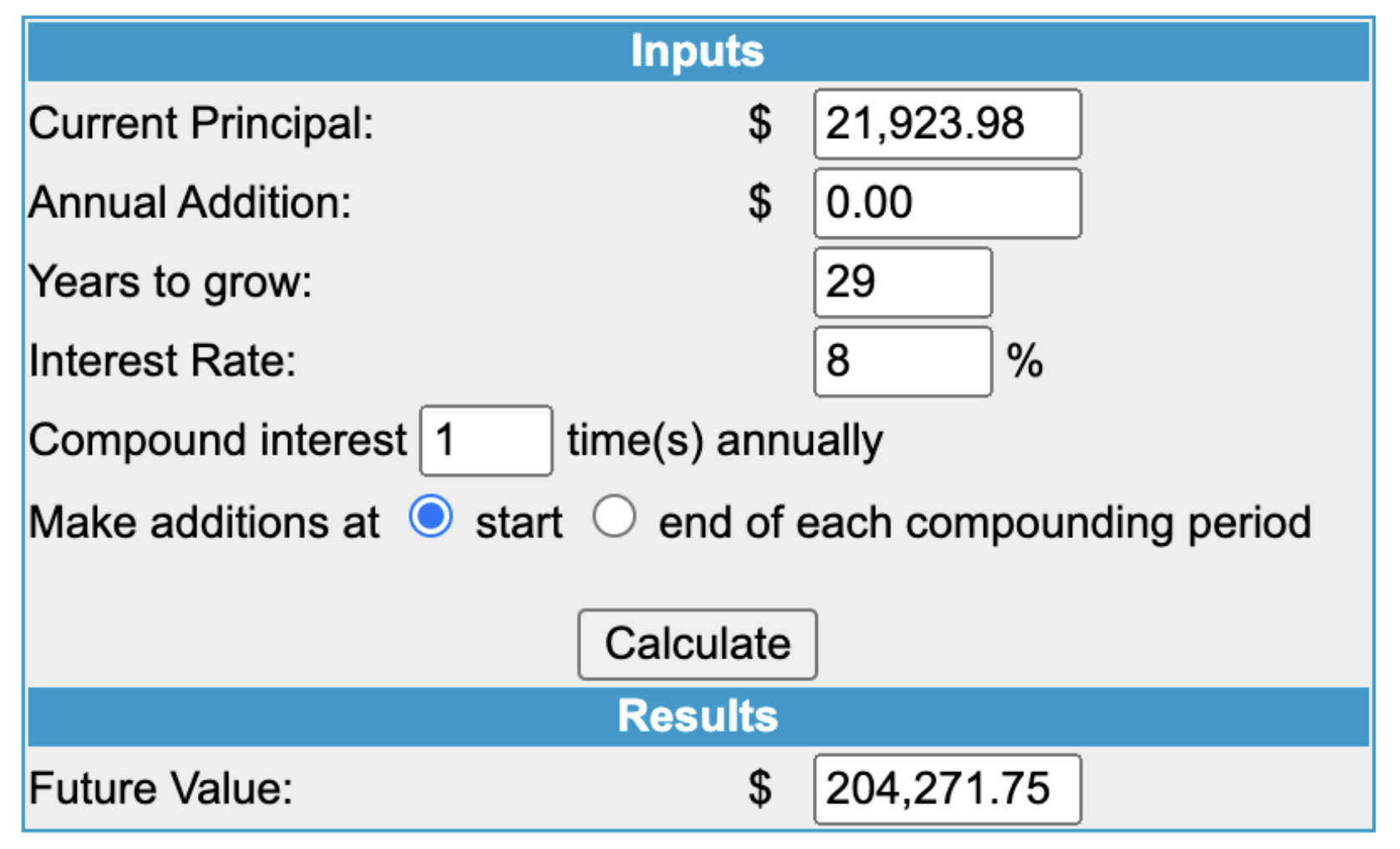

Now, let's calculate the opportunity cost by assuming that the difference in payments between the two vehicles was invested instead of spent.  If you left the $21,923 you generated over the 6 year car loan term invested until retirement, it would actually turn into over $200,000 without you adding a single dollar to it. This is the power of compounding returns over time.

If you left the $21,923 you generated over the 6 year car loan term invested until retirement, it would actually turn into over $200,000 without you adding a single dollar to it. This is the power of compounding returns over time.

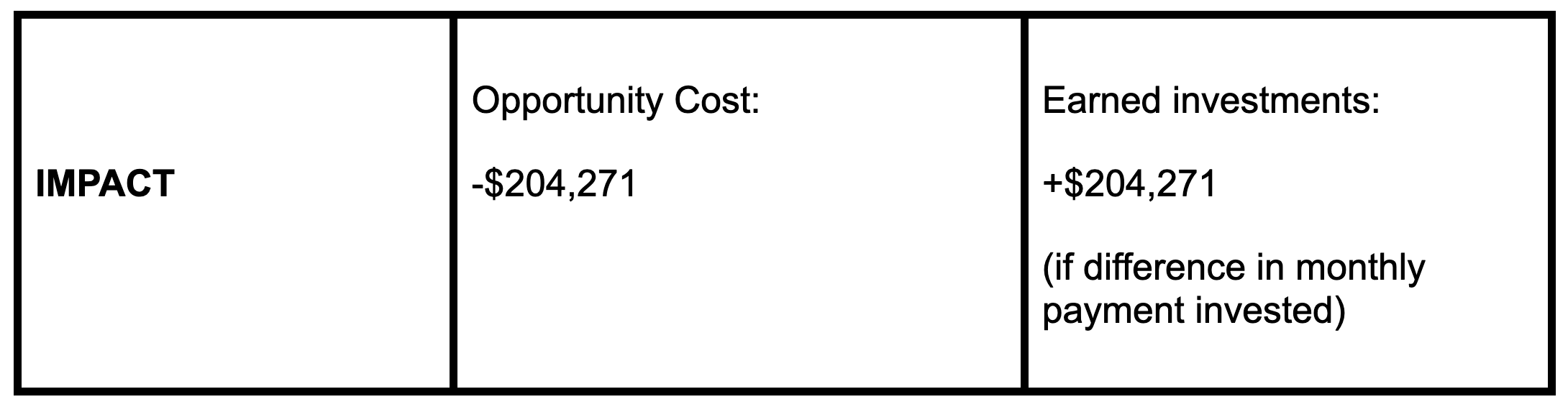

If you would notice from the table, if you chose a 30k vehicle, you end up having lesser net cost plus an additional $204k if you invested the difference on the monthly payment.

For medical professionals like you who are just starting your careers, every financial decision—especially large purchases like cars—should be made with both immediate and long-term financial impacts in mind.

Opting for a less expensive vehicle and investing the savings can contribute significantly to your wealth, providing more security and flexibility in the future.

Remember! Before making a decision, consider all factors, including the opportunity cost of your purchase.

- How will this impact your financial goals?

- Could the money be better invested elsewhere?

As you build your career, these considerations will be crucial in maximizing your financial potential.