Why Every Pharmacist Needs a Student Loan + Investing Strategy (Not Just One)

If you’re a pharmacist and you’ve been told to “just pay off your student loans first,” we need to talk.

Because if you’re like most of the PharmDs I work with (drowning in six figures of debt and feeling like you’ll never catch up) you’ve probably been sold the wrong plan.

I’m not here to tell you debt doesn’t matter. But I am here to tell you: debt payoff alone won’t make you wealthy.

You Need More Than a Student Loan Plan

Here’s the deal. Most people approach student loans and investing separately. But the smartest pharmacists I know have one cohesive strategy that does both and builds net worth 10x faster.

You can’t just think about what’s cheapest this month. You need to think long-term: What will your plan cost you over decades?

Let me show you what I mean.

PSLF vs. Taxable Loan Forgiveness (Why It Matters So Much)

If you're a clinical pharmacist working in a nonprofit or academic setting, chances are you qualify for Public Service Loan Forgiveness (PSLF). And if you're in a residency, that’s prime PSLF time… low income, low payments, and qualifying years stacking up.

But if you’re in retail or industry, that PSLF door might be closed. That means your options shift to:

- Taxable Loan Forgiveness (with a tax bomb later)

- Standard or accelerated repayment (with higher monthly payments)

Either way, don’t wing it. Run the numbers. I’ve worked with pharmacists who were five years away from a $100,000 tax bill… and had no idea. That's avoidable if you plan ahead.

The #1 Mistake Pharmacists Make: Starting Late

Let’s say you finish residency, pay off credit cards, and finally feel ready to invest at 30.

Here’s the truth: The later you start, the more aggressively you have to invest.

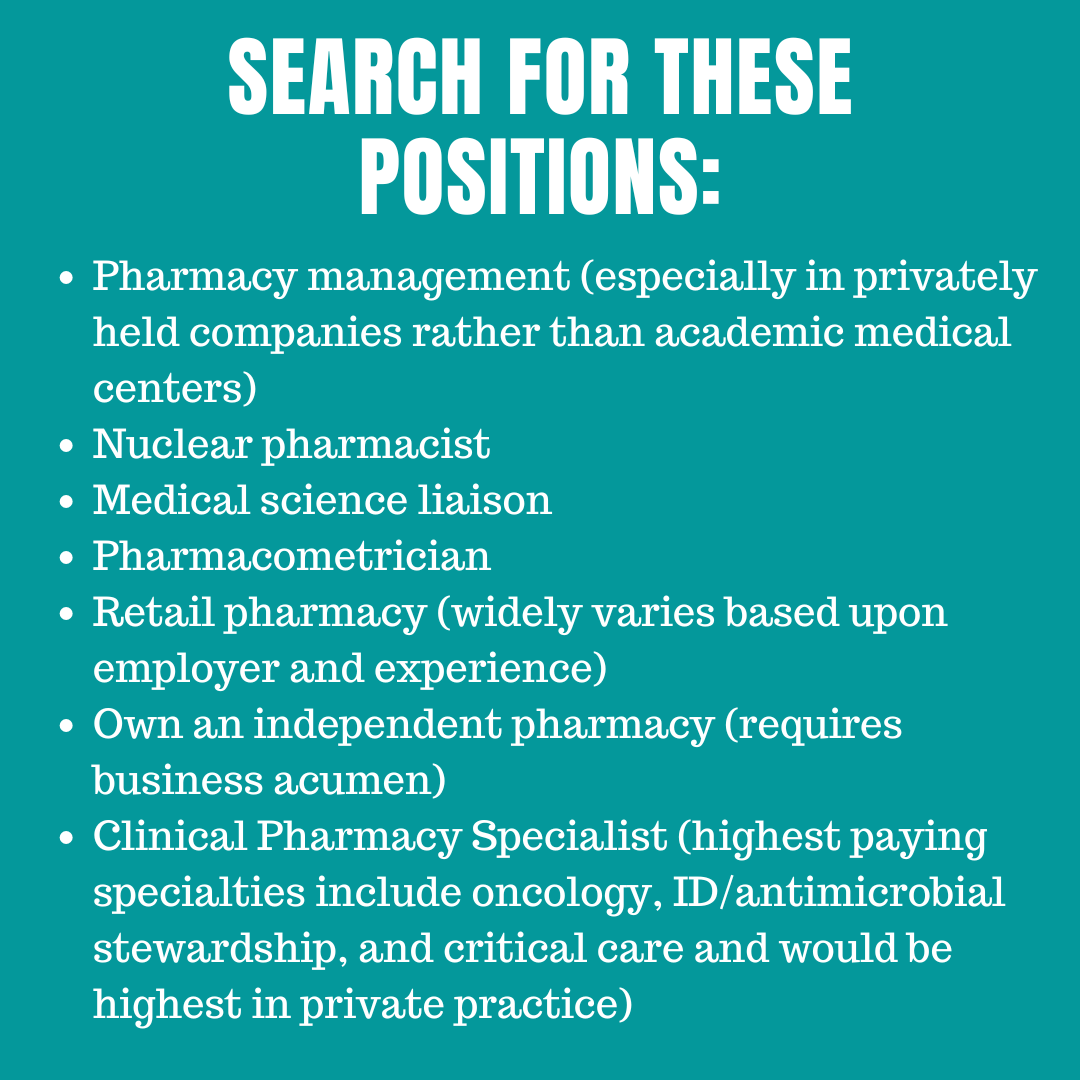

In one real scenario, a pharmacist earning $150K per year had to invest 30% of their gross income just to retire with enough—because they started late.

It’s not that $150K isn’t enough. It’s that TIME is your most powerful investing tool—and once it’s gone, you can’t get it back.

Even $200–$300/month during residency makes a massive difference.

Should You Follow Dave Ramsey?

Here’s an example I see all the time: a pharmacist (we will call her Jess) who followed the “pay all debt first” method and only started investing after loans were gone.

She put 15% of her income into actively managed mutual funds through an advisor—paying over 1% in fees on top of front-load charges.

The result?

She ended up millions of dollars short of what she needed to retire. Not because she didn’t earn enough. But because:

- She started investing too late

- She paid unnecessary advisor and fund fees

- She didn’t use tax-optimized investing accounts

Double Your Income As A Pharmacist

The Right Strategy = Multi-Millionaire Status (Yes, Even on One Income)

If you build the right plan (with smart student loan strategy, low-cost index investing, and tax diversification) you can absolutely retire a multi-millionaire as a pharmacist.

Even if you:

- Work in a lower-paying clinical role

- Live in a high-cost-of-living area

- Are starting later than you’d like

It’s not just possible. It’s necessary. Because $1 million in retirement won’t cut it anymore. With inflation, you’ll likely need $4–7 million to maintain your current lifestyle by 65.

What to Do Next

Here’s my advice:

✅ If you’re in residency or early in your career—lean into Roth investing now

✅ If you’re eligible for PSLF—maximize those low payment years and focus on lowering your AGI

✅ If you’re not—run numbers on the total repayment cost (including tax bomb!)

✅ And no matter what—automate investing now, not later

Because I promise you: if you can handle pharmacy school, you can handle a basic money plan.

📢 Join the Millionaires in Medicine Club for FREE:

https://www.millionairesinmedicine.com/community

📲 Follow on Instagram for more financial tips for PharmDs:

https://www.instagram.com/millionairesinmedicine