Can You Really Become a Multi-Millionaire as a PA, NP, or Pharmacist?

When I first became a PA, I thought hitting $1 million in net worth would mean I “made it.”

But now that I’ve actually crossed that milestone, and helped hundreds of medical professionals do the same. I can tell you this:

A million dollars isn’t enough.

If you want to retire comfortably (or early), reduce your clinical hours, or stop working when your health is still good, you’ll probably need $3–4 million or more.

Let’s break down why that number matters, and how I built wealth faster than most people thought possible.

Why $1M Won’t Cut It Anymore

Here’s what most people don’t realize:

If you retire with $1 million, and use the standard 4% withdrawal rule, that gives you just $40,000/year to live on. Not exactly luxurious.

Now add inflation into the mix.

What feels like enough today won’t go nearly as far by the time we’re 65.

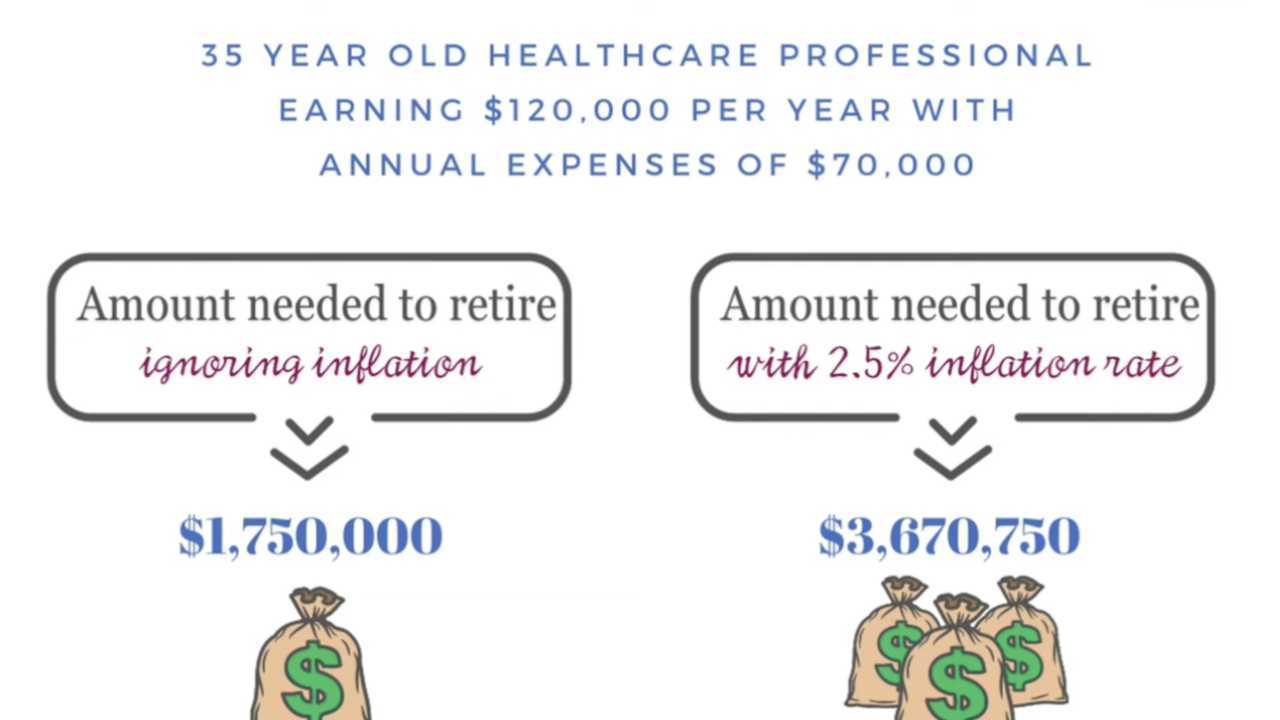

Example:

At 35 years old, if I spend about $70K/year, I’d need $3.7M by age 65 to maintain that lifestyle.

At 35 years old, if I spend about $70K/year, I’d need $3.7M by age 65 to maintain that lifestyle.

(That’s the inflation-adjusted cost.)

So no… you don’t need to be rich just for fun.

You need to be a multi-millionaire just to have a standard retirement.

My Wealth Didn’t Happen Overnight

When my husband and I hit millionaire status in our early 30s, it wasn’t luck. It was strategy.

We were:

- Investing early and often across Roth IRAs, 401(k)s, and brokerage accounts

- Buying short-term rentals for cashflow and tax savings

- Participating in real estate syndications

- And most importantly: keeping our investment rate high (even after kids)

We weren’t just saving. We were building income-producing assets—things that make money for you, even when you’re not working.

The Key Metric: Your Investing Rate

If you’re putting 5–10% of your income into retirement, I’m proud of you for starting, but it’s not enough.

You need to get your investing rate to 20%+ if you want:

- Options to work less

- The ability to take a lower-paying job with no call or weekends

- Real freedom before your 60s

The Strategy That Changed Everything: Coast FIRE

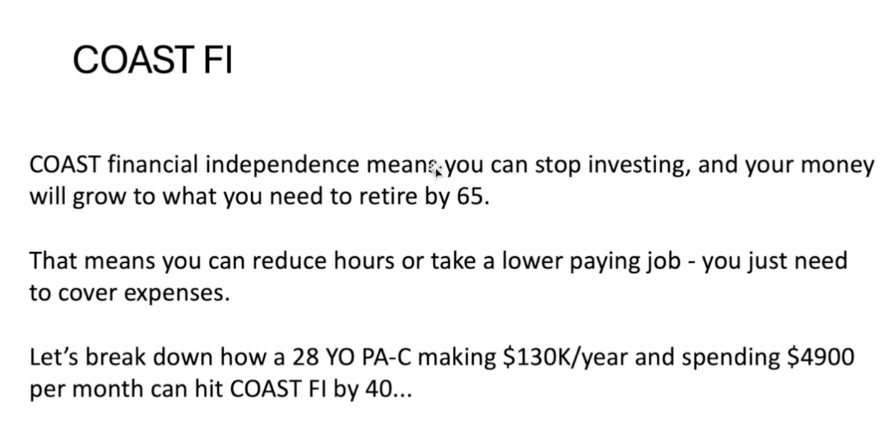

One of my favorite strategies (and what helped many of our clients) is called Coast FIRE.

It means:

You invest heavily up front, build a solid portfolio, and then let compound interest carry you the rest of the way, without needing to keep investing forever.

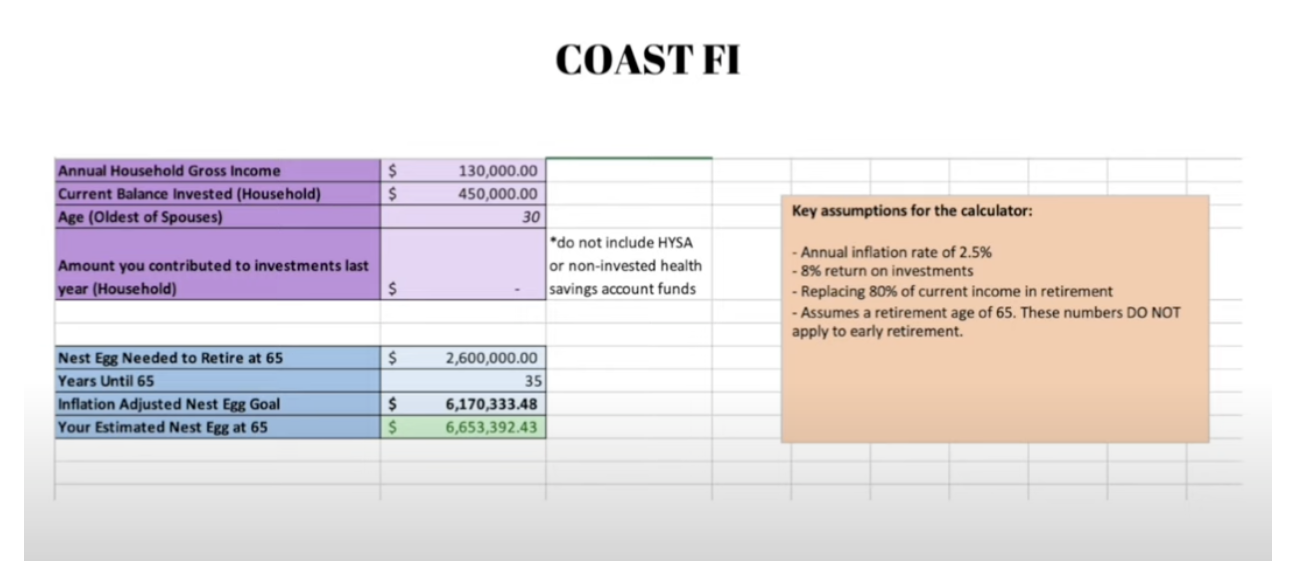

Here’s how we figure it out:

In this example, a 30-year-old household with $450,000 already invested doesn’t need to invest another dollar. They’re on track to retire with over $6.6M: plenty to cover their future lifestyle, even with inflation.

This opens up choices:

- Reduce work hours

- Take lower-paying jobs with better schedules

- Travel or volunteer more

- Spend more time with family

It doesn’t mean you can stop working right away, but it does mean you no longer need to earn just to keep up with investing.

What It Looks Like to Coast FIRE by 40

Let me walk you through another common example.

A 28-year-old making $130K per year and spending around $60K wants to hit Coast FIRE by age 40.

After adjusting for inflation, they’ll need around $3.74M to retire at 65.

If they can build a portfolio of $555K by age 40, they never need to invest again. Their current investments will grow to meet that future number automatically.

How do you hit that $555K?

By investing $28K per year for 12 years, consistently and intentionally.

Tax Diversification Made a Huge Difference

In the beginning, I thought maxing out a 401(k) was enough. But I learned quickly that I needed more flexibility in retirement.

That’s why I built a portfolio with:

- Tax-deferred accounts (401(k), traditional IRA)

- Tax-free accounts (Roth IRA, HSA if used properly)

- After-tax accounts (brokerage)

Different tax buckets = different levers I can pull later on.

What You Need to Know

If your dream is to retire early, reduce hours, or gain more freedom without burning out… you need to start now.

Every year you wait makes it harder to catch up.

This isn’t just about being rich: it’s about being free.

And I’m here to tell you: It’s 100% possible.

I’ve done it. So have my clients. So can you.

Want to Create Your Plan?

📢 Join the Millionaires in Medicine Club for FREE

https://www.millionairesinmedicine.com/community

📌 Get 1:1 coaching to build your early retirement strategy

https://www.millionairesinmedicine.com/coach

📲 Follow me on Instagram for more financial tips

https://www.instagram.com/millionairesinmedicine