How Medical Professionals Can Earn $10K+ a Year in Passive Income (Without Working More)

How Medical Professionals Can Earn $10K+ a Year in Passive Income (Without Working More)

What if your money could work harder, so you don’t have to?

Whether your goal is an extra $10K, $20K, or $50K/year, building passive income as a PA, NP, pharmacist, or physician is 100% possible. But not all passive income streams are created equal.

In this post, we’re breaking down the top 3 cash-flowing investment strategies that medical professionals are using in 2025 to earn more: without picking up extra shifts.

1. Dividends from the Stock Market – True Passive Income

Barrier to entry: Low

Truly passive: ✅

Tax advantages: ✅ (qualified dividends = long-term capital gains rate)

But here’s the catch:

To earn $50K/year from dividends, you’d need to invest $1 million at a 5% dividend yield. Most people can’t do that in the early wealth-building years.

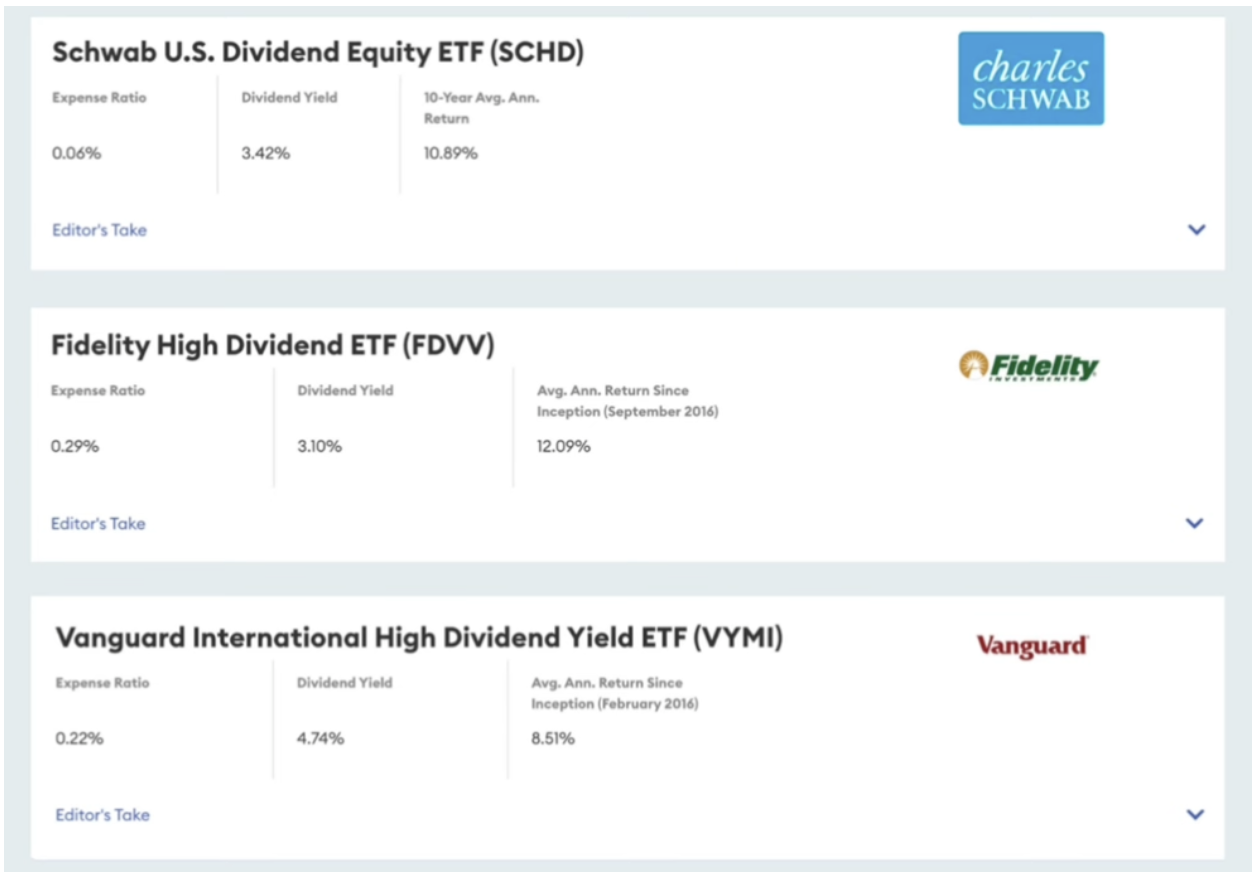

This is the easiest place to start. Open a brokerage through Fidelity, Vanguard, or Schwab and invest in ETFs and index funds that pay dividends.

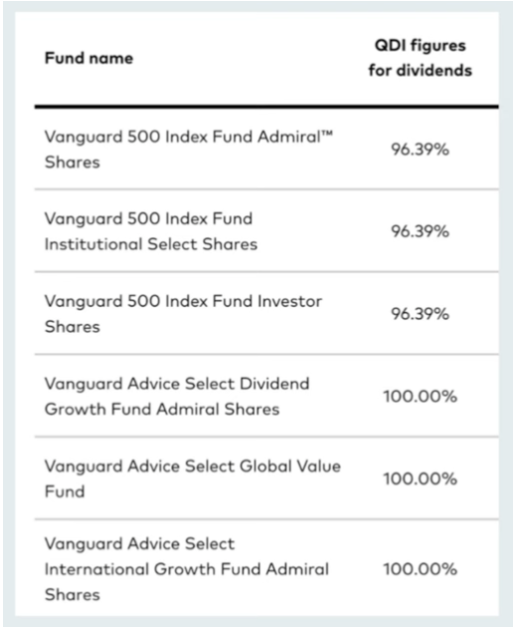

💡 You can even check what percentage of a fund’s dividends are qualified. In many cases, the percentage is very high, meaning a bigger portion of your passive income gets taxed less.

These are examples from Vanguard:

But here’s the tradeoff:

To earn $50K/year in dividend income, you'd need to invest $1 million at a 5% yield. That’s a steep capital requirement, especially for medical professionals still early in their wealth-building years.

Now here’s where things get technical, but important:

If you choose to reinvest your dividends, your portfolio’s average return can exceed 10% annually (assuming historical returns would continue into the future). But if you withdraw your dividends to use them as income, your return drops closer to 6%, reducing your long-term growth significantly.

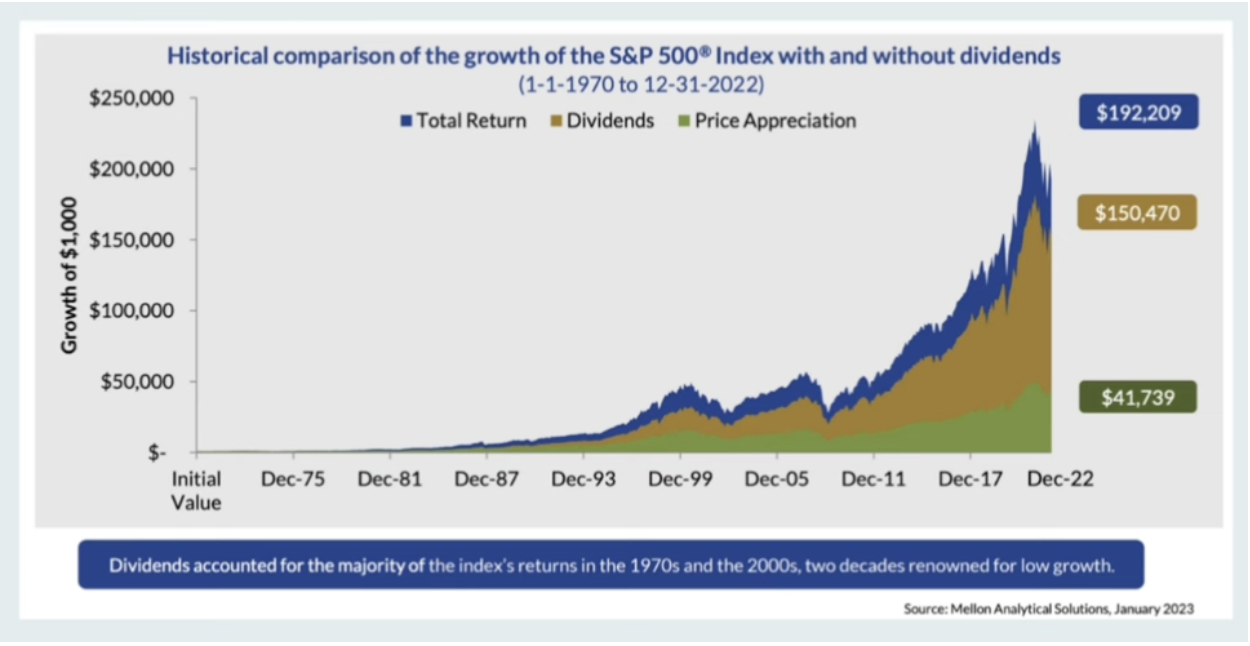

Here if you look at the returns of the S&P 500 in the graph above, the green is actually price appreciation (the increase in share price itself). The gold section is the dividend portion of the return. It’s easy to see how your long term wealth building potential drops if you live off of dividends during the wealth accumulation phase.

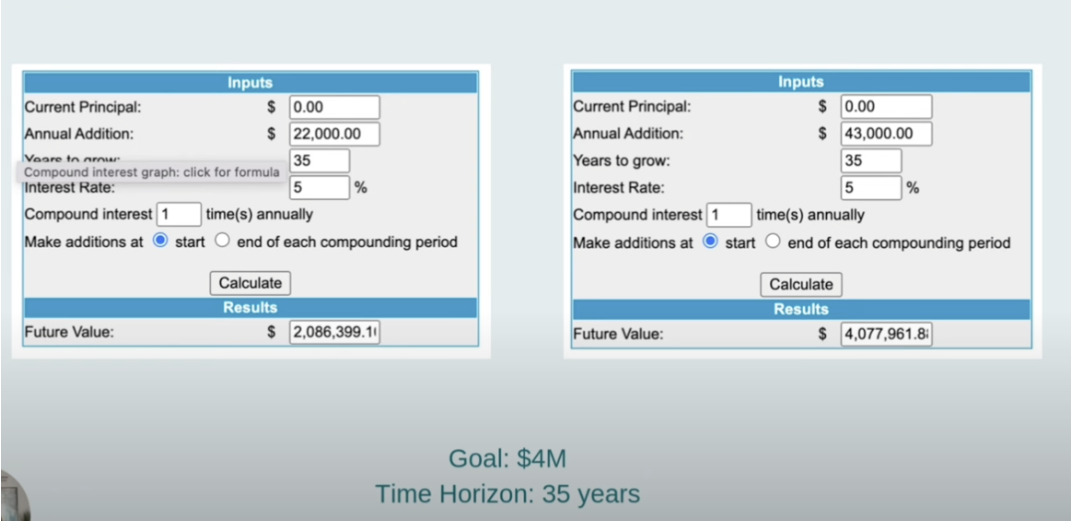

Example:

- A PA who starts investing at 30 and wants to retire at 65 with $4 million

- If they reinvest dividends: ~$22K/year invested gets them there

- If they withdraw dividends: they need to invest $40K/year instead

So while dividends are passive, they’re not always ideal during your early investing years. If you're still growing your net worth, reinvest first, withdraw later.

2. Rental Real Estate – Semi-PassiveInvesting

Barrier to entry: Moderate to high

Passive? Semi-passive (especially if self-managed)

Returns: Cash flow + appreciation + tax savings + loan paydown

Downside: Poor projections = negative cash flow, using leverage (debt) adds risk

Rental properties give you 4 income streams:

✅ Monthly cash flow

✅ Property appreciation

✅ Tax deductions

✅ Loan paydown (via tenants)

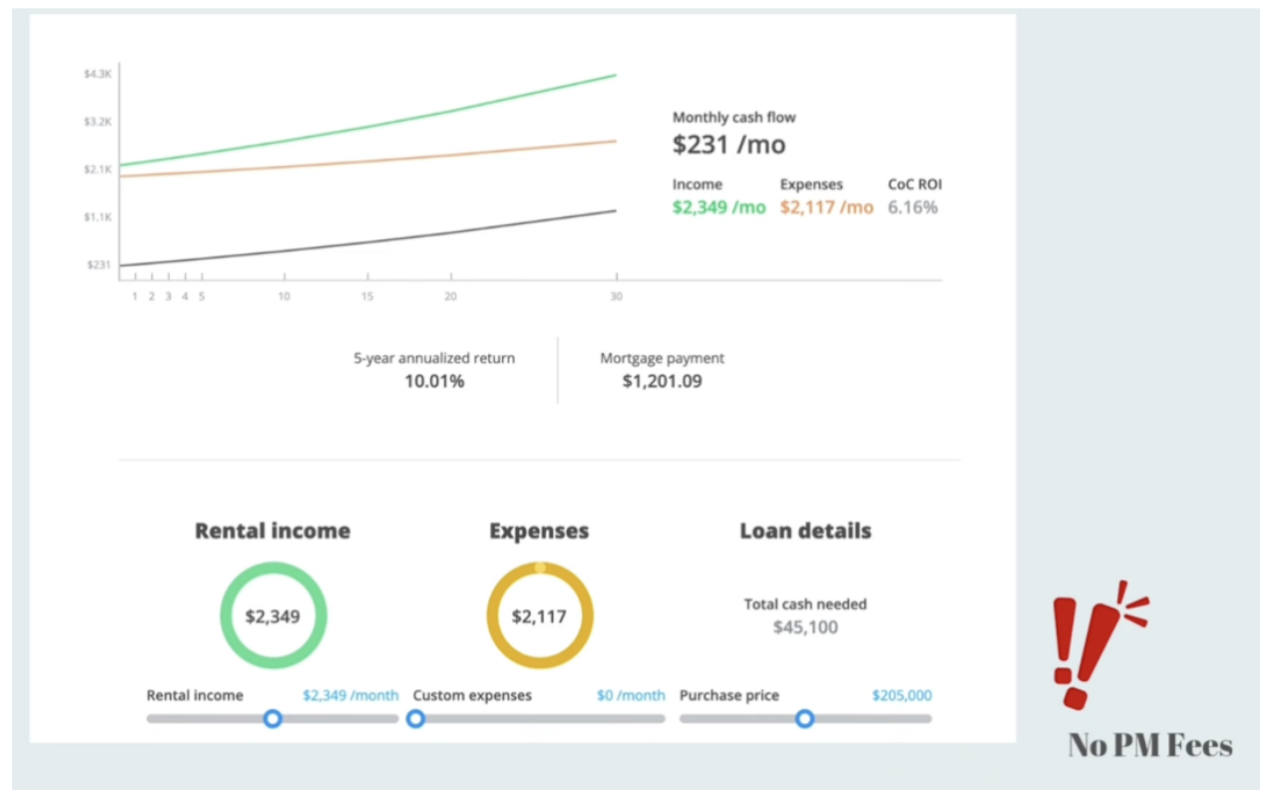

Real Example: Indiana Property Breakdown

This is based on a real long-term rental in Indiana:

- Purchase Price: $205,000

- Cash to Close (20% down): $45,100

- Monthly Rental Income: $2,349

- Monthly Expenses: $2,117

- Monthly Cash Flow: $231

- 5-Year Annualized Return: 10.01%

- Cash-on-Cash ROI: 6.16%

Note: This projection does not include property management (PM) fees. If you choose to hire a PM, which typically costs 8–10% of rental income, the monthly cash flow will drop, but so will your involvement.

While $231/month might seem modest, this figure is only part of the return. You're also building equity through loan paydown, gaining appreciation over time, and benefiting from tax strategies unique to real estate.

What Medical Professionals Should Know

One of the most common mistakes clinicians make when jumping into real estate is underestimating expenses and overestimating income. Cash flow projections must be built on conservative estimates: not hopes.

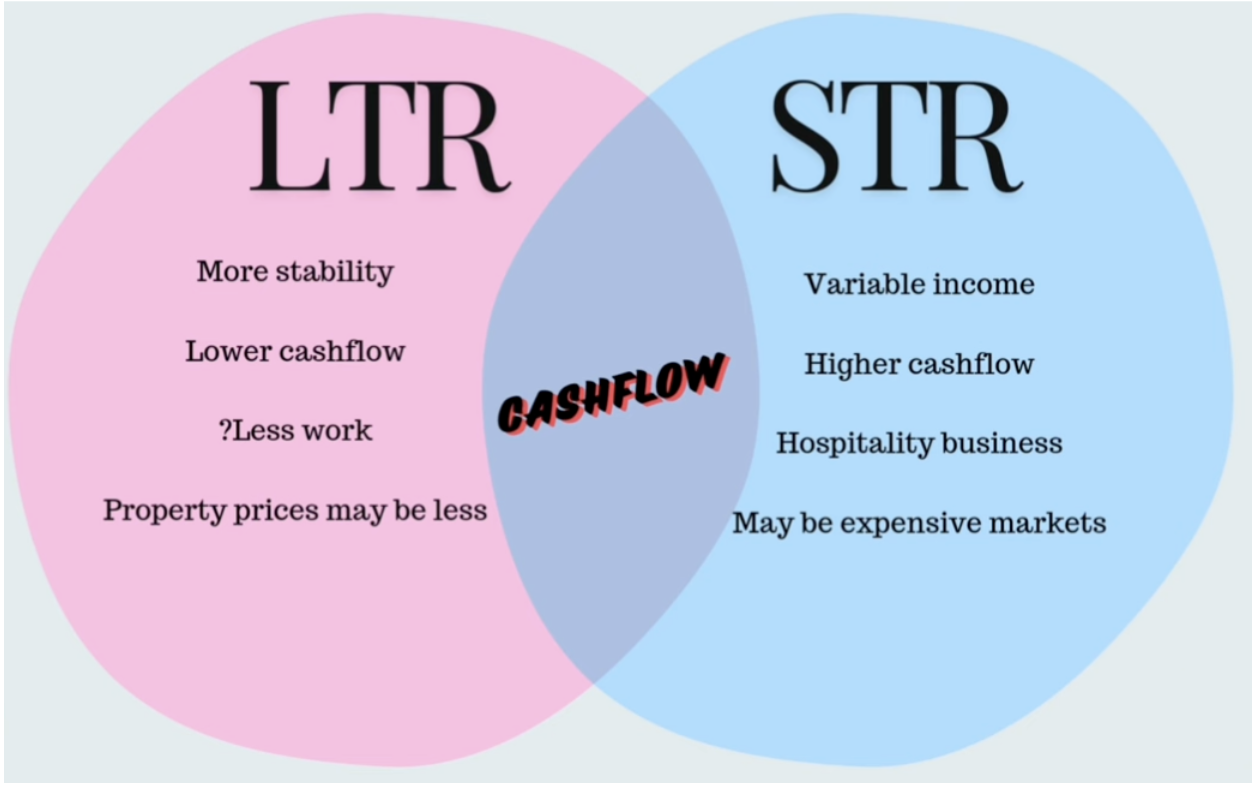

Short-term rentals, while potentially more lucrative, come with more complexity:

- Seasonal income swings

- Higher maintenance and guest turnover

- More active management or higher PM fees

Long-term rentals, by contrast, offer greater stability, making them a strong first step toward building passive income.

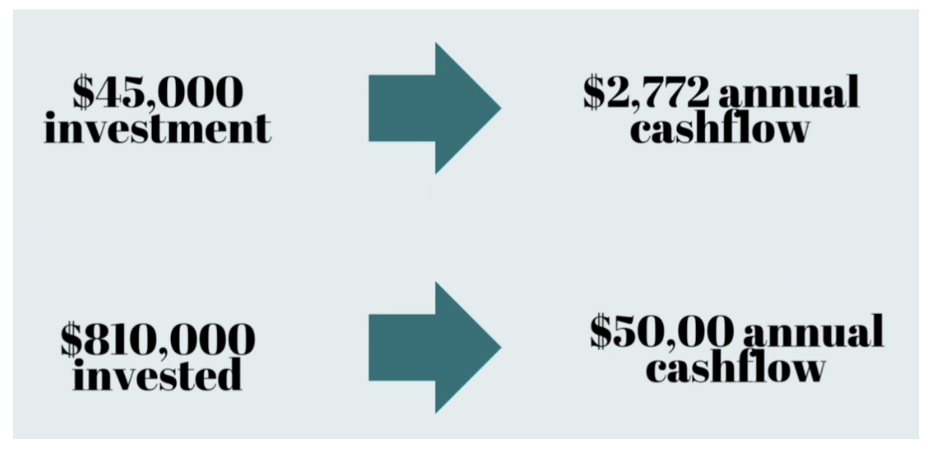

How Much Do You Need to Earn $50K in Cash Flow?

To generate $50,000/year in passive income, you'd need to invest around $810,000 into long-term rentals. While still a significant amount, it's notably less than what you’d need in dividend-producing investments—thanks to the power of leverage.

Bottom line:

Rental properties can be a powerful wealth-building tool—if approached with realistic expectations and solid projections. Start with one property, learn the ropes, and scale intentionally. This strategy requires a strong financial position BEFORE you start. Unless you have 3-6 months expenses in cash reserves, a separate down payment for the property, AND a separate emergency fund for the investment property - do not proceed.

Pro tip: Most new investors go wrong by overestimating cash flow and underestimating expenses. Always run full projections with conservative estimates and multiple data points.

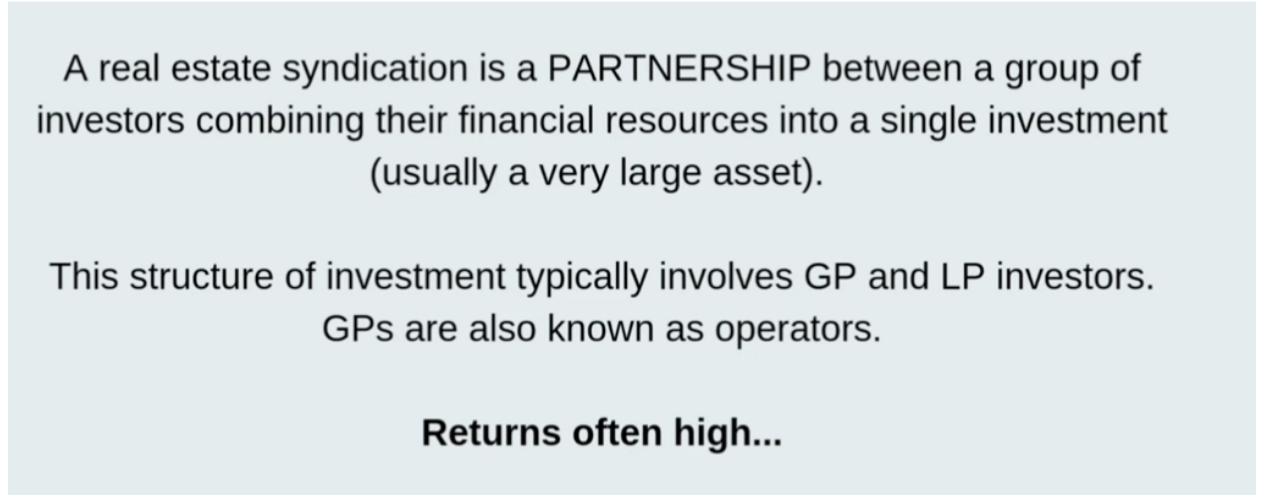

3. Real Estate Syndications – The Ultimate Mailbox Money

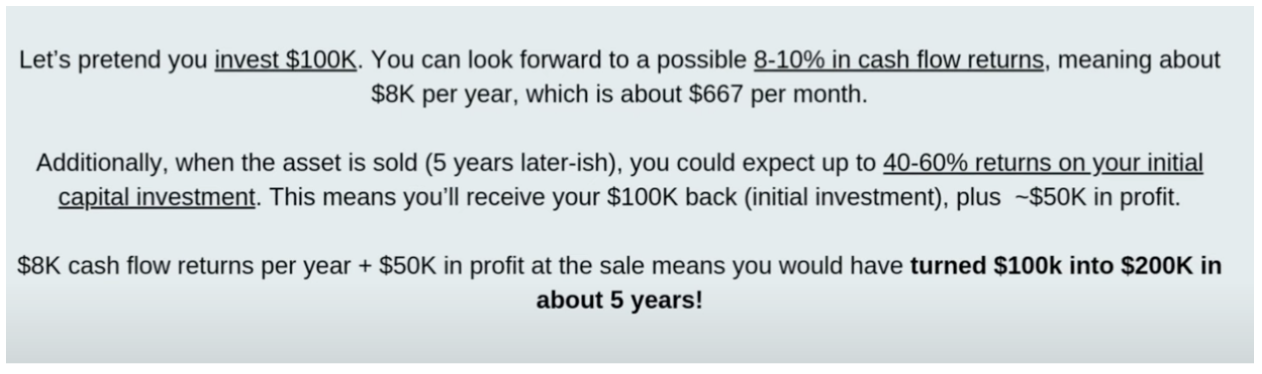

Barrier to entry: High (often $50K–$100K minimum)

Truly passive: ✅

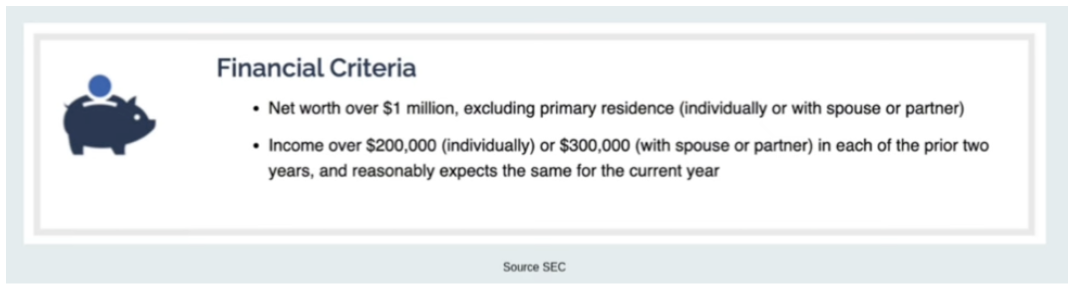

Accredited investor required? Often

Returns: Vary, may strongly exceed the stock market or may result in total loss of capital

Downside: Zero liquidity + higher risk

Want 100% passive income without managing properties?

Syndications pool investor money to buy large assets like apartment complexes.

Here’s what to know:

- You’re a Limited Partner (LP): no decision-making, just income

- Returns are not guaranteed: you can lose your full investment

- Most require you to be an accredited investor

- Watch out for capital calls (they can request more money from you later)

These are sample numbers. Nothing is ever guaranteed, and every deal is different. Do your due diligence.

If you know how to vet operators, markets, and deal terms, this is one of the few ways to earn passive income truly hands-free.

💡 Not All “Passive Income” Is Created Equal

|

Investment Type |

Barrier to Entry |

True Passive? |

Risk Level |

Scalability |

|

Dividends |

Low |

✅ |

Low |

Medium |

|

Rentals |

Medium |

❌ (semi) |

Medium |

High |

|

Syndications |

High |

✅ |

High |

Medium |

Want Passive Income Without More Shifts?

If you’re tired of the “work more to earn more” cycle, this is your path out.

You don’t need a $500K salary to earn real passive income. You need a repeatable system, strong due diligence, and a mindset shift from consumer to investor.

Start small. Learn one modality. Then scale.

Ready to Create Your Personalized Financial Plan?

📢 Join the Millionaires in Medicine Club for FREE:

https://www.millionairesinmedicine.com/community

📌 Get 1:1 coaching to build your investing & cash flow plan:

https://www.millionairesinmedicine.com/coach

📲 Follow us on Instagram for more financial tips:

https://www.instagram.com/millionairesinmedicine