How to Build Wealth When the Economy Feels Like a Dumpster Fire

Spring 2025 came in hot with tariff wars, rising inflation, student loan chaos, and stock market volatility that has a lot of medical professionals wondering...

“Is it even possible to build wealth in a season like this?”

Short answer: yes.

But you need a strategy—and some serious emotional discipline.

Why Personal Economics > Macroeconomics

The truth? You could come out of this economic mess ahead—if you have your personal financial systems dialed in.

✅ No high-interest debt

✅ 3–6 months of cash reserves

✅ Multiple income streams

✅ A student loan plan

✅ A long-term investing system

If you don’t have these in place, this season can wreck you.

If you do? You can use it to build wealth while everyone else panics.

What Investing in a “Down Market” Actually Feels Like

Whether you’re:

- A new investor putting in your first $1,000

- Or a seasoned one watching $70K disappear from your account in a day

It still stings.

But this is where people either panic and pull out...

Or keep going and come out ahead.

The winning strategy is simple:

👉 Dollar. Cost. Average.

👉 Stick to your schedule.

👉 Keep investing even when it feels hard.

Because statistically? It works. Every. Single. Time.

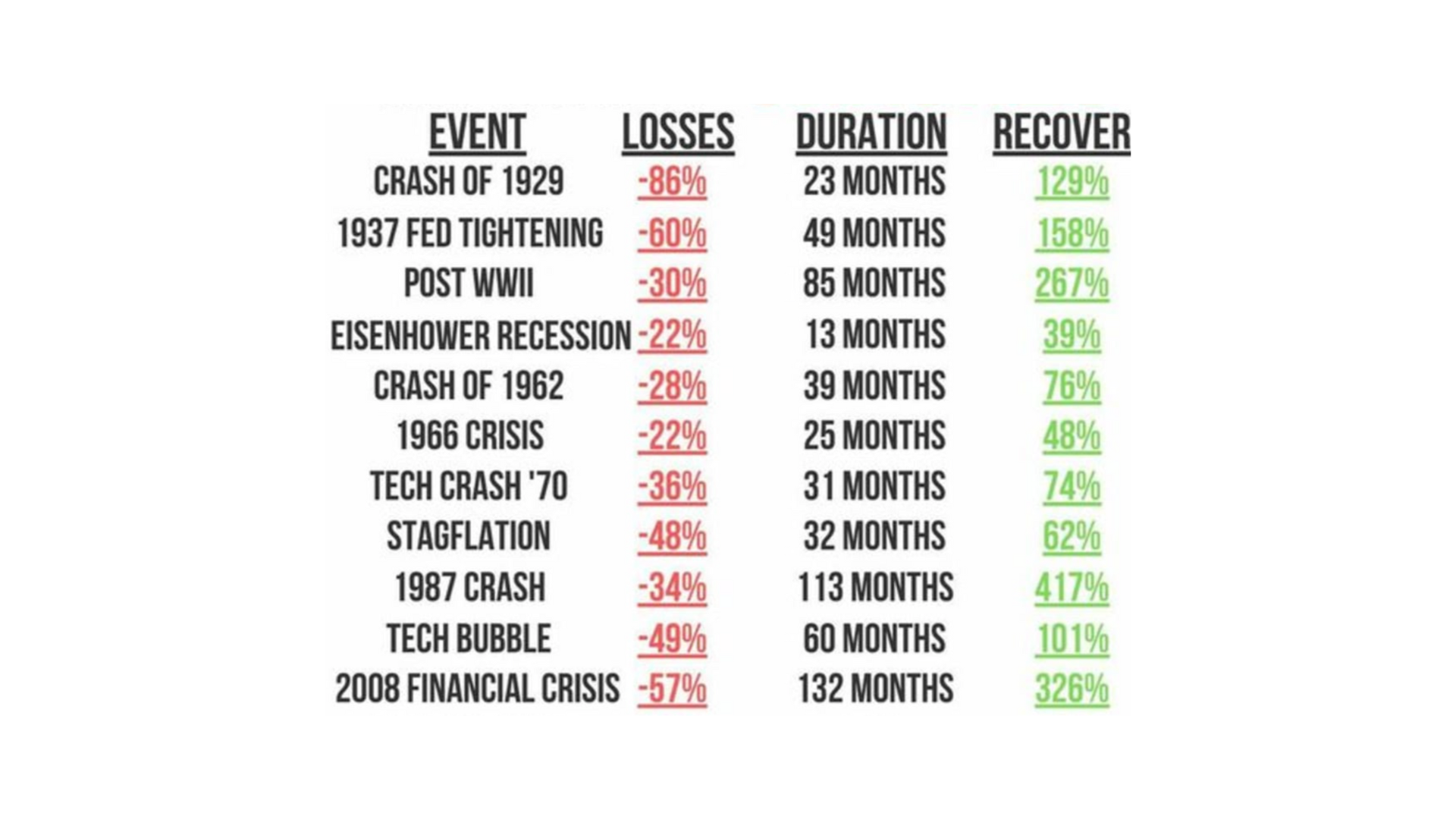

Let’s Talk Math: Why Timing the Market Doesn’t Work

If the market drops 50%, you need a 100% gain to recover.

If the market drops 50%, you need a 100% gain to recover.

Think about that.

If you panic and sell halfway down (or wait until it “feels better” to buy back in) you’ve already lost your shot at the rebound.

And you won’t know when the market hits bottom.

Neither will I. Neither will the news.

What Happens If You Miss the Best Days?

Let’s say you sit out of the market and “wait it out.”

Cool. Except… most of the biggest upswings come right after the biggest downturns.

So if you miss those days?

Your long-term returns could be wrecked.

Here’s the data: just missing the 10 best days in the market over 20 years could cost you hundreds of thousands in lost growth.

Translation:

📉 Panic costs you more than the downturn itself.

“But Kristin, I Feel Like I’m Just Losing Money…”

Yep. It feels like that.

Especially if you log in and see red across your portfolio.

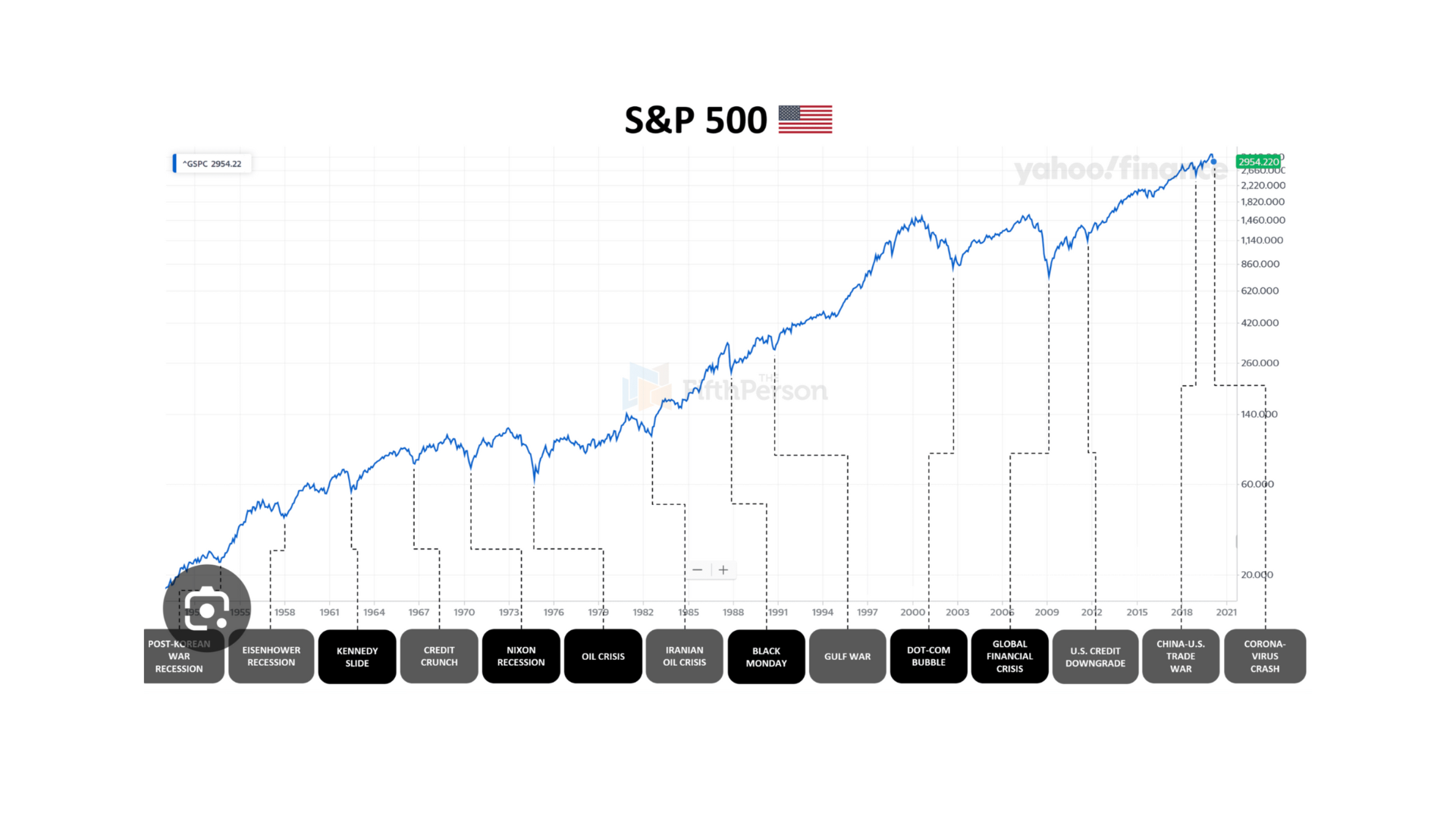

But when you zoom out, the long-term trend of the S&P 500 is clear:

📈 Slow, steady upward climb.

All those scary headlines? Just blips.

The stock market has been through wars, recessions, pandemics, and political chaos—and still delivered long-term gains.

The only people who lose?

👉 Those who stop investing.

👉 Those who don’t have a system.

What You Need to Do Right Now

If you’re a PA, NP, or PharmD feeling unsteady with your finances in this season, this is your wake-up call.

✅ You need a defined investing plan

✅ You need a real student loan strategy

✅ You need a cushion between your income and expenses

✅ You need to know your asset allocation BEFORE volatility hits

When you have those things in place, market drops turn into opportunities—not catastrophes.

You Can't Win From a Place of Weakness

When you’re financially unprepared, the only thing you can do is survive.

But when you’re financially strong—with systems in place?

You get to ask, “How can I come out ahead?”

This is how the wealthy keep getting wealthier during downturns.

They buy when others sell.

They invest when others panic.

They have a system—and they follow it.

You can too.

Want to Build a System That Keeps You Wealthy—Even in a Recession?

📢 Join the Millionaires in Medicine Club for FREE:

https://www.millionairesinmedicine.com/community

📌 Want help designing your student loan + investing plan?

https://www.millionairesinmedicine.com/coach

📲 Follow us on IG for more tools & support:

https://www.instagram.com/millionairesinmedicine