How to Buy a House as a PA, NP, or Pharmacist Without Screwing Up Your Financial Future

The fastest way to wreck your finances as a medical professional?

Buying the wrong house.

I’ve seen it too many times—PAs, NPs, and PharmDs rushing into homeownership, only to end up house-poor, underinvested, and stuck in golden handcuffs for decades.

So if you’re dreaming of buying a home in the next 1, 2, or even 5 years, let’s walk through what really matters when it comes to buying a house without sabotaging your future freedom.

Step 1: Don’t Start With the House

Don’t start by asking what kind of house you want.

Start with: “What can I safely afford each month?”

This is one of the biggest money moves you’ll ever make—especially if you’re not planning to become a real estate investor. You’ve got to get this right.

Step 2: Calculate Your Max Monthly Housing Expense

Here’s the formula I use:

1️⃣ Take your gross annual household income (pre-tax)

2️⃣ Divide by 12 to get monthly income

3️⃣ Multiply by 0.2 (that’s 20%)

That number = your max monthly housing cost

✅ If you’re buying: includes mortgage + taxes + insurance

✅ If you’re renting: includes rent + renters insurance

Keep this number sacred.

Because whatever number you land on? That’s your minimum cash outflow every single month. And you need to leave margin for repairs, surprises, and life.

Renting ≠ Wasting Money

Renting often gets a bad rap. But here’s what most people don’t realize:

🧠 Renting caps your max monthly spend

🏚 Homeownership doesn’t—your water heater goes? That’s on you.

So no, renting is not “throwing money away.” It can actually give you financial stability and time to save. While you may build equity in a house while paying down a mortgage on a primary resident, it’s ultimately a “use asset”. Meaning it’s not the same as the income-producing assets that actually make wealthy people wealthy.

Conventional vs Medical Professional Mortgage Loans

There are two main routes to consider:

✅ Conventional Financing:

- Requires 20% down to avoid PMI

- PMI (Private Mortgage Insurance) is an extra monthly fee if you put down less than 20%

- If you cross 20% equity later, you can often remove PMI without refinancing

✅ Medical Professional Loans:

- Available to PAs, NPs, PharmDs, not just MDs

- Some offer 3–5% down with no PMI

- Great for first-time buyers with lower cash reserves

Get matched with the right mortgage lenders and realtors who understand your unique needs as a medical professional. Learn about speciality loan products that may allow a lower down payment and no PMI by connecting with Curbside.

First House vs Dream House: Different Rules

👉 First house? You get grace. Use a medical loan, put 5% down if needed. Just get started.

👉 Dream house? Different story. You should have 20% equity by then. If you don’t, slow down and save.

Example: What You Can Actually Afford

Let’s say two NPs earn $240K/year combined.

- Gross monthly income = $20,000

- 20% of that = $4,000 max monthly housing expense

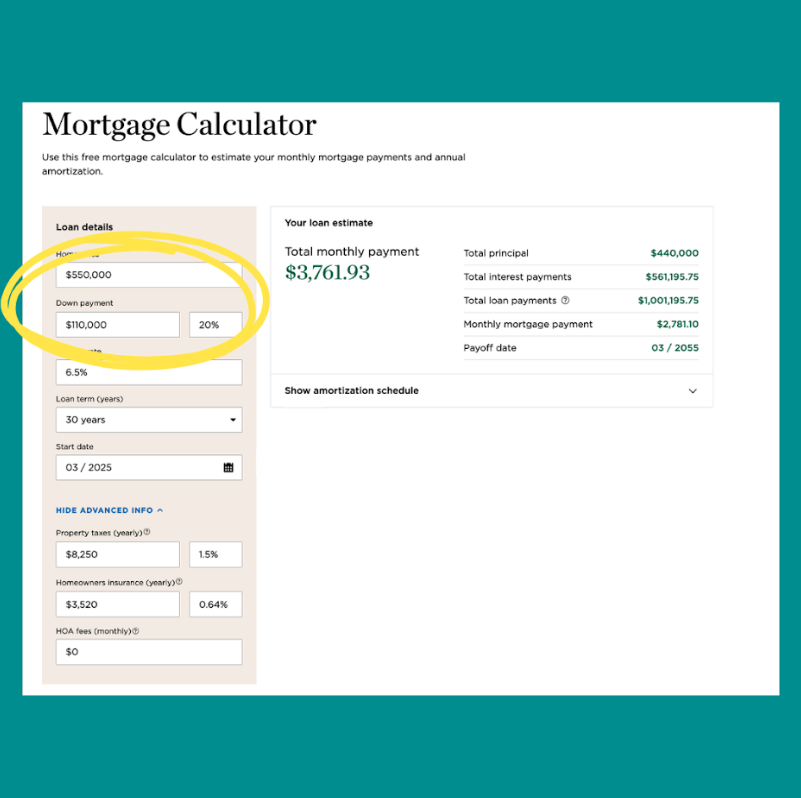

With 20% Down:

You could afford a $550K home

But you’d need ~$110K saved (plus closing/moving costs)

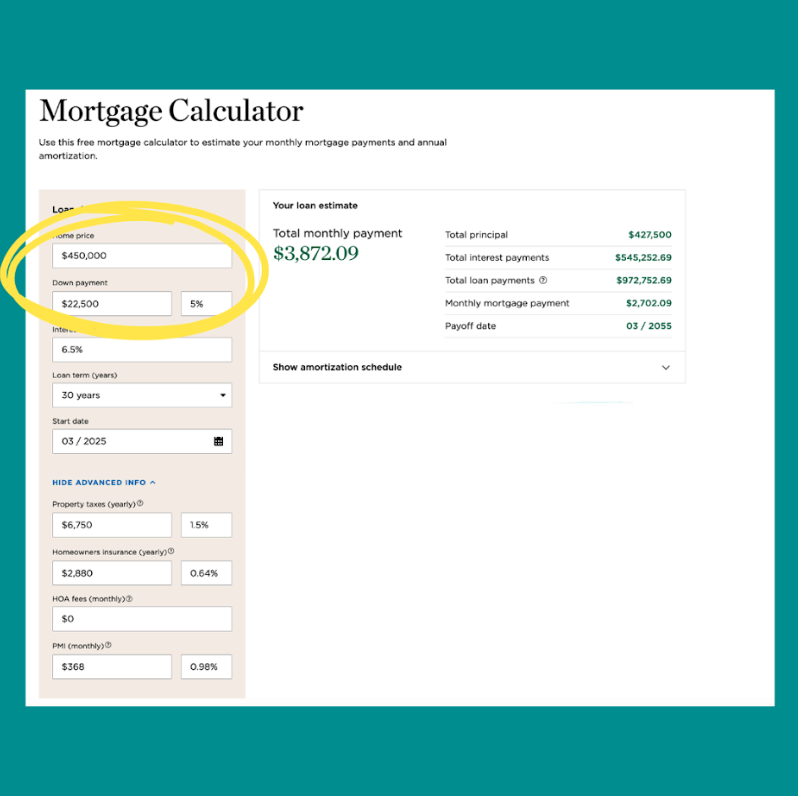

With 5% Down (Medical Loan):

You could afford a $450K home

Your down payment drops to ~$22K

Both are doable—it just depends on where you are financially and how soon you want to buy.

Non-Negotiables Before You Buy

Do not start house shopping until you have:

✅ All high-interest debt paid off

✅ 3 months emergency fund (separate from house fund)

✅ A long-term investing strategy already in place

Otherwise, you’ll move into a great house and…

Work full-time in that house until you’re 72 because you didn’t invest early enough.

The House Is Just One Piece of the Puzzle

Don’t make homeownership your entire financial identity.

You need:

🏠 A housing plan

💰 A student loan or debt strategy

📈 A clear investing system

Only when these fit together can you build a long-term plan that actually gives you freedom.

Don’t Want to Do the Math?

📢 Join the Millionaires in Medicine Club for FREE:

https://www.millionairesinmedicine.com/community

📲 Follow along for more daily tips:

https://www.instagram.com/millionairesinmedicine