How to Make Your Kid a Millionaire by Age 35 (Yes, Really)

If you're a medical professional and either have kids or want kids someday, you've probably wondered:

How can I give them a financial head start I never had?

Let me show you how we’re doing it.

I’ve set up a system where both of my kids will be millionaires by the time they’re 35—and it doesn’t require hundreds of thousands of dollars.

It just takes intention, a few monthly contributions, and the right accounts.

First—This Is Not All or Nothing

Let me be clear:

You don’t need to hit millionaire status for this to be worth it.

Even if you can only do a fraction of this plan, you're still setting your kid up with a financial launchpad that most of us never had.

Even $100/month over time = six figures by adulthood. That’s still a huge win.

But if you do want to go all in, here’s exactly how we’re making millionaire status happen by age 35:

Step 1: Open a UTMA Account

We start with a UTMA account (Uniform Transfers to Minors Account)—

✅ It’s flexible

✅ It’s taxable

✅ And the money becomes theirs when they hit age 18–21

If you contribute $200/month from birth to age 35, assuming an 8% return.

📈 That turns into $446,000 by age 35.

Not bad for account #1. But we’re not done.

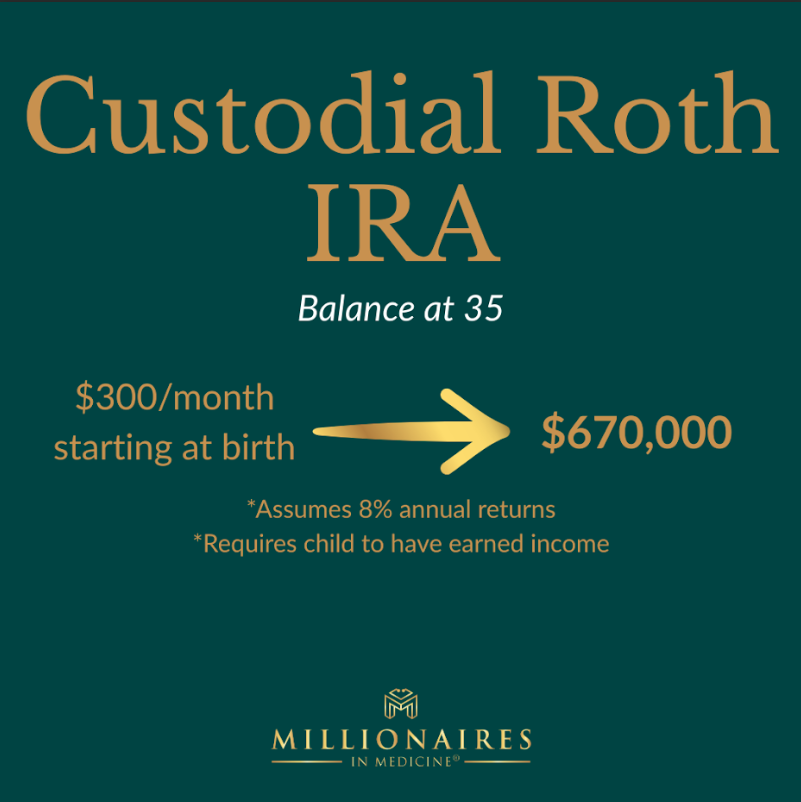

Step 2: Open a Custodial Roth IRA

This is the real wealth builder and hands down my favorite account for kids.The custodial Roth IRA is my favorite account for kids because:

- It grows tax-free forever

- It can be used for retirement, a first home (caps apply),college, educational expenses (with limits), etc.

- And if you start early? Game-changer.

But here's the catch:

Your kid needs earned income to qualify.

If you run a business (like I do), you can pay your kid for legit services.

Baby modeling, helping with brand photos, social media content—whatever is age-appropriate and IRS-compliant.

If you contribute $300/month from birth to age 35.

At 8% returns, that turns into $670,000 by age 35.

💡 Total so far? $446K (UTMA) + $670K (Roth IRA) = $1.1 million

And the Roth IRA just keeps growing.

Step 3: Use a 529 Plan for Education

This part is optional, but if you want to help your kid avoid student loans?

Start a 529 College Savings Plan.

If you contribute $383/month from birth to age 18, assuming a 6% return.

That gives you $150,000 to cover some or all of undergrad.

(Just remember—the 529 gets spent by age 18–22, so it doesn’t count toward long-term net worth. But it frees up their future in a big way.)

Total Results by Age 35

When you stack these accounts:

Your child has over $1.1 million in long-term assets by age 35.

Your child has over $1.1 million in long-term assets by age 35.

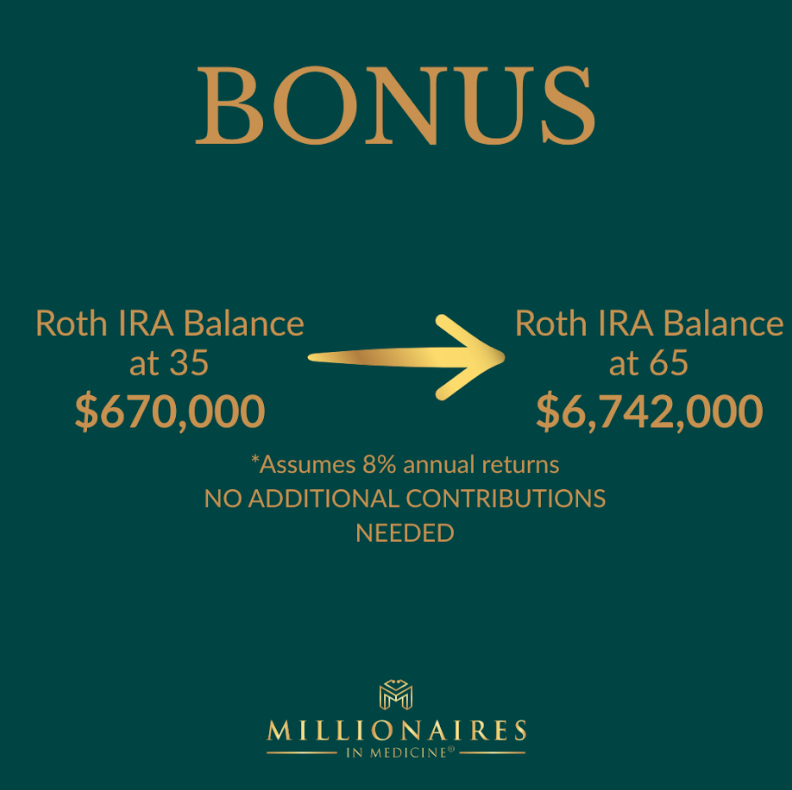

What Happens If They Don’t Touch the Roth?

Here’s where it gets really good.

Let’s say your kid never contributes another dime to the Roth IRA after age 35.

They just let it sit and grow at 8% until retirement at age 65.

That balance becomes…

Over $6 million.

👉 And it’s tax-free.

Can you imagine retiring at 65 with $6 million in tax-free money?

This is the power of starting early and letting compounding do the work.

But Don’t Start This Until You Do This

⚠️ I’m going to say something super important:

Do NOT start this millionaire kid plan until your own retirement is on track.

If you don’t know how much you need to retire (adjusted for inflation), you’re not ready to fund someone else’s.

Once you know your number and you’ve built your investment system?

Then you can decide whether to:

- Invest in these accounts under your kid’s name

- Or go harder on your own financial independence

Either way—there’s no wrong answer.

Only options. And that’s what wealth gives you.

Final Thoughts: It’s Easier to Make Your Kid a Millionaire Than Yourself

Kids have the one thing we don’t: time.

If you invest early and consistently, small monthly contributions can set your child up with generational wealth.

We’re talking about a $6M retirement… from $300/month.

This doesn’t require being rich. It just requires a plan.

Want help figuring out your own retirement first?

📖 Enroll on the Freedom Prescription Course

📢 Join the Millionaires in Medicine Club for FREE

📌 Follow along for more tips