How to Save as a PA-C (or Any Medical Professional Earning $100K+)

If you're a PA, NP, or pharmacist earning over $100K a year but your savings account still looks like it belongs to your student days... you're not alone.

I became a millionaire by age 31, not by winning the lottery or flipping houses—but by mastering the basics: saving, investing, and being intentional with money. In this post, I’ll walk you through how to calculate your real savings rate, strategies to save more without sacrificing joy, and how to build wealth faster.

Step 1: Know Your Actual Savings Rate

Most medical professionals have no idea what their savings rate is. If that’s you? Let’s fix that.

To find your savings rate:

- Add up ALL dollars you put toward true savings and investments each month. That includes:

- Emergency fund deposits (your sinking funds for vacations don’t count)

- 401(k), 403(b), or other employer retirement plan contributions

- Roth IRA or brokerage account deposits

- HSA contributions

- Then divide that number by your gross monthly income (not your take-home pay).

Why gross income? Because some of your savings (like 401k or HSA contributions) are pre-tax—they come out before your paycheck hits your account. If you just look at net income, you're underestimating what you're actually saving.

Step 2: So, What Should You Be Saving?

My benchmark? 20% of gross income.

That number isn’t random. Over time, I’ve seen it be the sweet spot. For most medical professionals that don’t start investing until late 20s, it’s the bare minimum to ensure you can retire comfortably at 65.

If 20% feels impossible? Start smaller, but work your way there. Every percent counts.

HOUSING & TRANSPORTATION: THE SILENT KILLERS

These two categories quietly dominate your financial life.

Let’s check them:

Benchmarks:

- Housing (rent or mortgage): ≤ 20% of gross income

- Car/Transportation: ≤ 8–10% of take-home pay

It’s really hard to keep housing to <20% of gross in this housing market. I won’t deny that for a second. That being said, it’s achievable. In many areas of the country, you can achieve this metric with median home prices on a med pro income. In HCOL areas, you may need to get creative. This could include house hacking a duplex/triplex, using a separately accessible portion of the property as an STR (think basement with a separate entrance), using an ADU, etc.

Reminder:

You don’t have to “look” like a 6-figure earner to actually build wealth like one.

We Need to Talk About Frictionless Spending

If you’ve ever wondered “Where is all my money going?”—this is probably part of the answer.

Frictionless spending happens when money leaves your account so easily, you barely notice it. But over time, it adds up to thousands of dollars lost that could’ve been building tax-free wealth.

Here’s what we’re talking about:

📦 Amazon Prime:

- Prime members spend ~$1,400/year

- Non-members? Around $600/year

🛵 Food Delivery:

- Average user: ~$407/year in fees and tips

- Heavy user: $2,500+/year

- And that’s just the fees—not the food itself

💡 What if you invested that money instead?

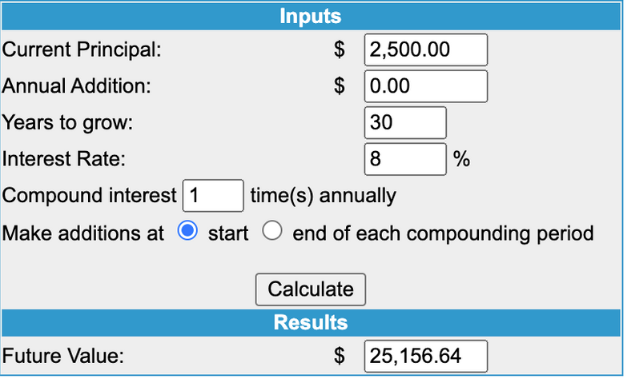

Just one $2,500 investment (from your saved Door Dash fees) in a Roth IRA, left alone for 30 years at 8% growth?

📈 That’s $25,000+ waiting for you at retirement.

It’s not about cutting everything out. It’s about becoming aware.

Because when you stop leaking money on autopilot?

You give your future self options, freedom, and peace of mind.

CREDIT CARD CULTURE

The average American has $7,951 in credit card debt (Experian, 2024).

Healthcare professionals often carry more because of this mindset:

“I work hard. I deserve it.”

We’re not saying you shouldn’t treat yourself... but swiping to cope with burnout won’t move you forward financially.

Pro Tip:

Use apps that categorize your credit card spending. You might be shocked how fast it adds up.

INCOME ≠ SAVINGS (BUT YOU CAN FIX THAT)

Once you’ve plugged the spending leaks, the next step is offense.

Ways to Grow Your Income:

- Renegotiate your PA/NP contract (yes, you can)

- Pick up PRN/per diem shifts

- Use CME funds to learn higher-paying skills

- Explore high-leverage side hustles:

- Expert witness work

- Pharma speaking gigs

- Long term real estate or short-term rentals

Tie-back:

More income + Disciplined expenses = Wealth acceleration

Not About Being Frugal—It’s About Being Free

You didn’t go into medicine just to stress over bills. You deserve options. You deserve to have your money work for you—not the other way around.

Start where you are. Track your real savings rate. Build systems that feel sustainable.

And if you want more step-by-step support?

📢 Join the Millionaires in Medicine Club for FREE

📌 Follow along for more tips