The Debt Avalanche Strategy Every Medical Professional Needs to Know in 2025

If you're a PA, NP, or pharmacist with any debt that's causing you stress, this guide is for you.

Forget random payment orders or blind budgeting apps. It's time to get strategic about your debt and your future wealth. In this blog, you'll learn the smarter way to tackle debt (hint: it's not the snowball method), how to save thousands in interest, and when to start investing while still paying off loans.

Snowball vs. Avalanche: What Actually Saves You Money?

You've likely heard of the Debt Snowball, a method where you pay off the smallest debt first regardless of interest rate. It's emotionally satisfying, sure. But if you're carrying any high-interest debt (like credit cards or personal loans), it's costing you thousands more over time.

Instead, opt for the Debt Avalanche strategy:

- Step 1: List your debts from highest to lowest interest rate (not balance).

- Step 2: Make minimum payments on all debts.

- Step 3: Throw all extra payments at the highest-interest debt first.

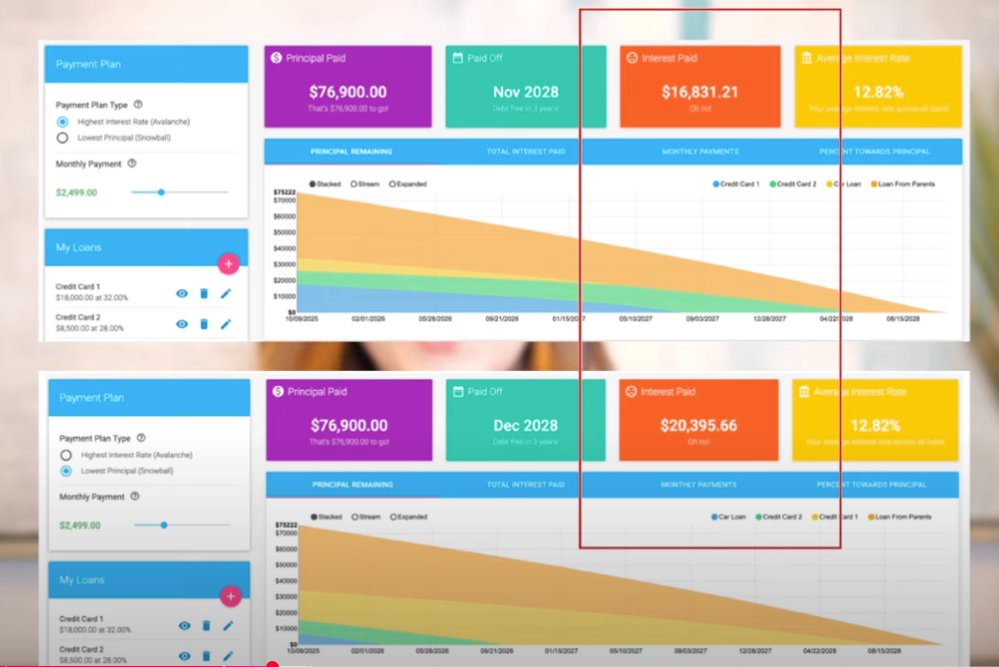

💡 Example: Say you’re allocating $2,500/month toward your debt. If you use the snowball method, you’d pay ~$20,000 in interest.

But with the avalanche method? Just $16,800. That’s over $3,000 saved simply by changing the order.

When to Start Investing While Paying Off Debt

If you’re a medical professional, you likely started investing late—maybe late 20s or early 30s. That means your money has less time to compound. But here's the catch:

You shouldn’t wait until you're 100% debt-free to invest.

The rule:

- If your debt has an interest rate over 10%, tackle it first.

- Once you’re under that 10% mark, it’s time to split your dollars between debt and investing.

Why?

Because the longer you delay investing, the more you have to save later to hit your retirement goal.

📊 For most PAs or NPs, hitting financial independence by 65 means having at least $4M+ invested. Start early, and compounding does the work. Start late, and the burden falls on your monthly budget.

Use "Progress Dollars" to Track Your Momentum

Most money apps don’t help you track actual financial progress. That’s why Kristin recommends creating a simple system:

- Track a category called Progress Dollars — this includes:

- Extra debt payments

- Emergency fund contributions

- Retirement or brokerage account deposits

Aim for at least 20% of your income going into Progress Dollars.

✅ Example: If you're earning $6,000/month and not putting at least $1,000 toward progress, you're moving too slow. Period.

Can't Pay Off Credit Cards in 6 Months? Try These:

If your credit card interest is dragging you down, consider using tools like:

- 0% APR Balance Transfer Cards

- Can save you ~$2,000 in interest if you pay off within the promo window (12–21 months)

- Warning: Only works if you stop using both old and new cards

- Personal Loans

- Lower interest than credit cards

- Still considered "high interest," so should be paid off fast

Remember: These are not long-term solutions. They're short-term tools to help reduce interest while you fix the underlying issue.

Your Action Plan to Build Wealth Faster

- List your debts by interest rate.

- Use the Avalanche Method. Focus on high-interest first.

- Track your Progress Dollars. Aim for 20% of income.

- Start investing once debt is <10% interest.

- Avoid "frictionless spending." (Food delivery, impulse Amazon buys, etc.)

- Join a support system.

Ready to Ditch the Debt and Build Real Wealth?

📢 Join the Millionaires in Medicine Club for FREE: https://www.millionairesinmedicine.com/community

📌 Get tools, trackers, and trainings to fast-track your financial freedom

📲 Follow on Instagram for more money tips: @millionairesinmedicine

You didn’t go into medicine just to survive paycheck to paycheck.

You can be debt-free and wealthy. You just need the right plan.