The One Student Loan Metric Every New Grad PA-C & Medical Professional Needs to Know

If you’re a new grad PA, NP, PharmD, or medical professional trying to figure out how the heck you’re supposed to manage your student loans… there’s one number that changes everything:

Your Debt-to-Income Ratio.

This simple calculation determines:

✅ Whether PSLF is worth it

✅ If private practice is even an option

✅ How painful your monthly payments will be

✅ And how much flexibility you’ll actually have in your career

Let’s break down why debt-to-income ratio (DTI) matters so much, especially if you're just starting out.

What Is Debt-to-Income Ratio (DTI) for Medical Professionals?

Your debt-to-income ratio is your total student loan debt divided by your anticipated annual income.

Example:

If you graduate with $100K in student loans and expect to earn $100K as a PA, your DTI is 1:1.

If you have $200K in loans, and still earn $100K, your DTI is 2:1.

🎯 Key tip: Use starting salary, not median salary, especially if you’re still in school or early in your career.

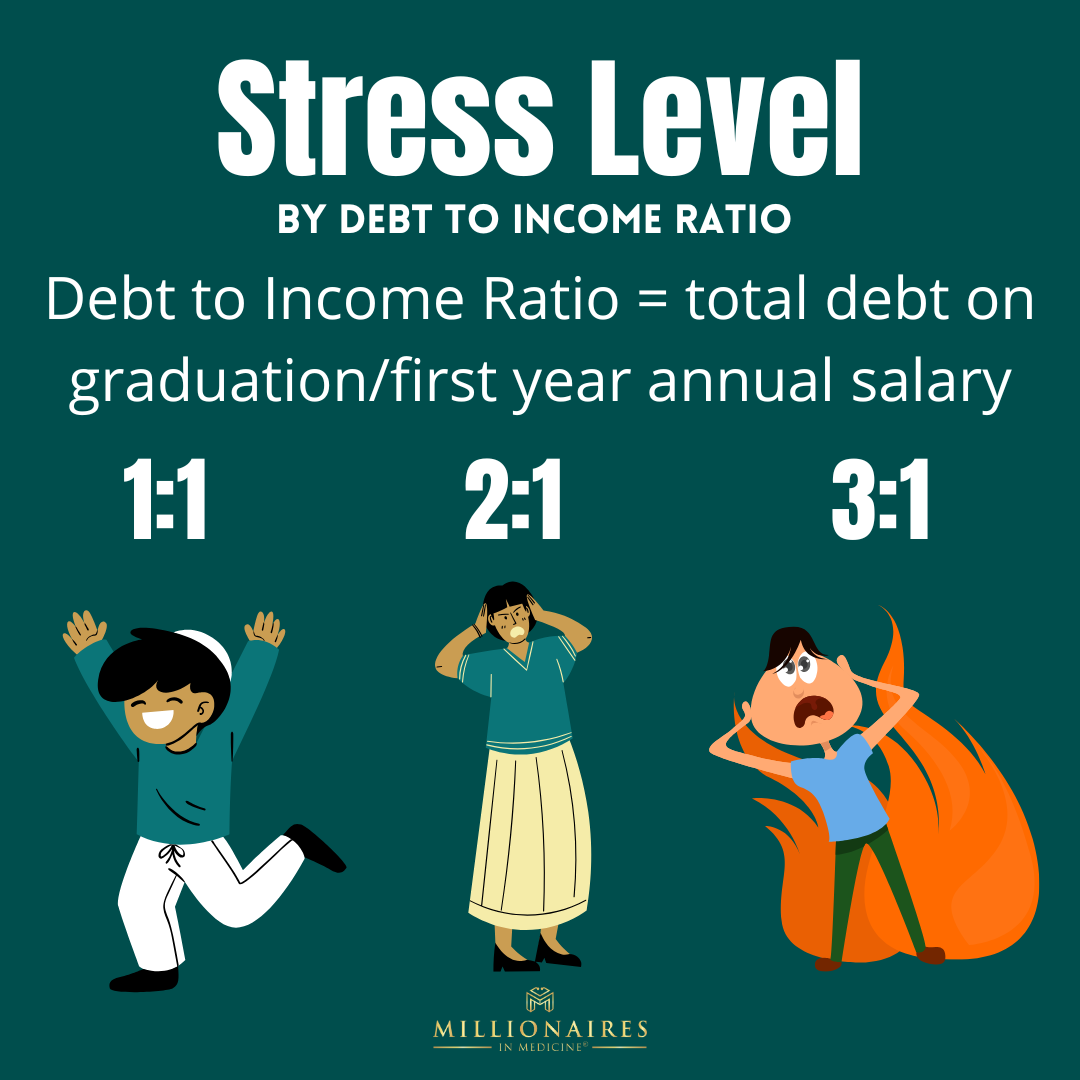

The Ideal DTI Ratio and Why It Matters

📊 Here’s how DTI ranges impact your loan management strategy:

- ✅ 1:1 or lower → You have options. PSLF is great, but you could go into private practice (meaning more job flexibility), pursue a refinance ladder, etc.

- ⚠️ 2:1 → Things get tight. Monthly payments can hit 30%+ of your take-home pay. Your student loan strategy is key to your success.

- 🚨 3:1 or higher → You’re boxed in. PSLF becomes almost necessary to avoid crushing debt. This means hanging in there with the latest swings in the political student loan climate, because the savings are often six figures plus. It also means your student loan strategy is an absolutely vital part of your financial plan!

Why does this matter?

Because your monthly cash flow, job flexibility, and even ability to invest all get squeezed as DTI rises. The higher the ratio, the fewer financial options you’ll have.

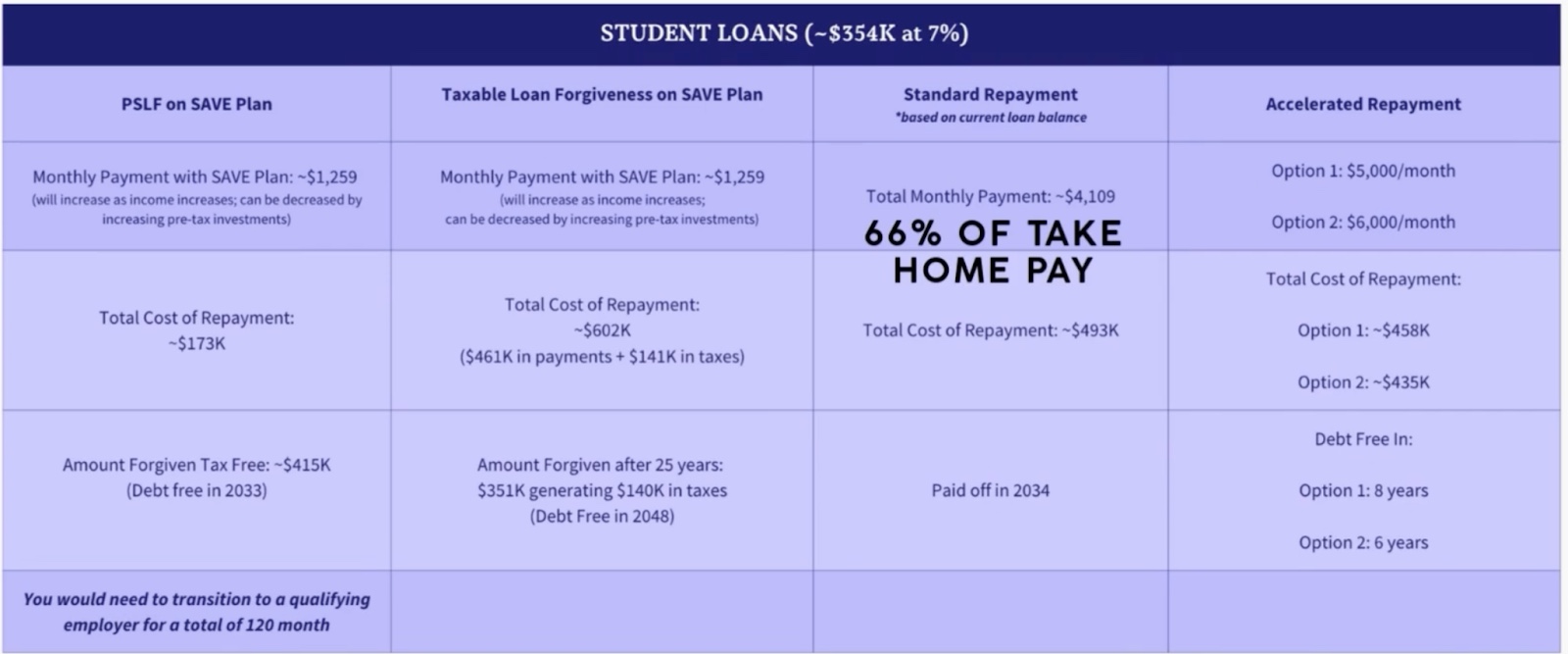

PSLF vs Taxable Forgiveness – Choosing the Right Strategy Based on DTI

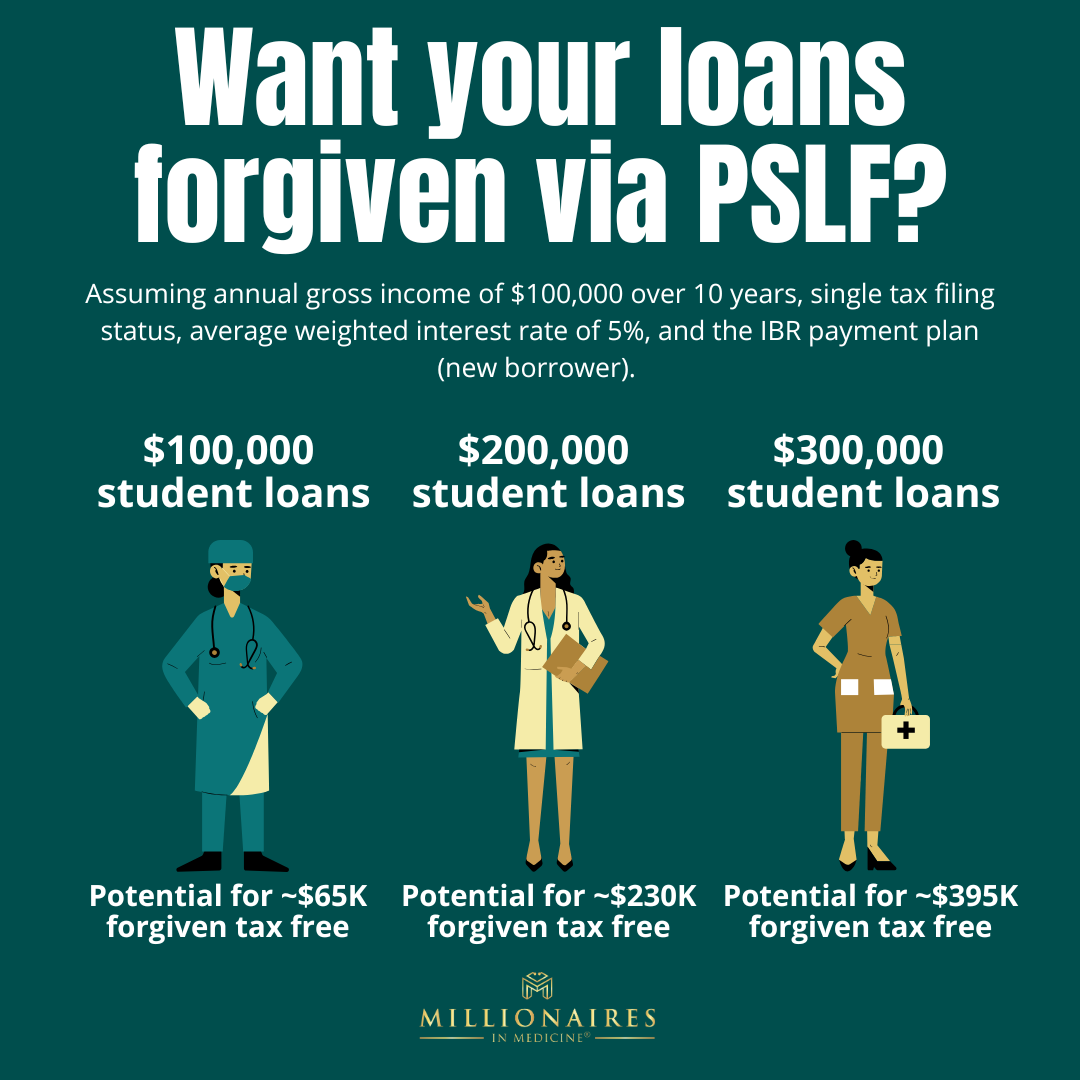

If your DTI is high, say 2:1 or 3:1, then Public Service Loan Forgiveness (PSLF) becomes your best shot at legally getting rid of your debt tax free.

📌 PSLF Requirements:

- Work for a nonprofit or government employer

- Make 120 monthly payments on a qualifying payment plan

- Receive tax-free forgiveness after 10 years

🧾 Taxable forgiveness (IDR plans after 20–25 years) is still an option, but:

- It takes longer

- You owe income tax on the forgiven amount

- It could cost more over time

When your loan balance is 2–3x your income, PSLF may save you hundreds of thousands compared to the taxable route.

Real-Life Impact: DTI, Cash Flow & Career Decisions

Let’s get real: your monthly payment impacts your daily life more than any chart.

For example:

- At 2:1 DTI, your standard 10-year plan may eat 33% of your take-home pay

- At 3:1 DTI, your monthly payment on a standard plan might be so high it’s literally unpayable

- PSLF on an IDR plan could bring your payment down to 10–15% of income but you’re only eligible for PSLF if you work for a qualifying employer

- Switching to an income driven repayment plan without a qualifying employer may save you in monthly cashflow, but taxable loan forgiveness tends to cost more in the long term (in this case, over $600,000).

💡 This is why some grads pass on dream jobs in private practice because they simply can’t afford the monthly payment and retirement savings without PSLF.

How to Calculate Your DTI Before You Graduate

Still in PA or NP school? You can (and should) estimate your DTI now.

Here’s how:

- Estimate total loan amount you’ll graduate with

- Look up average starting salary for your specialty + location

- Divide loan amount by starting salary

🧠 Pro tip: Use cost of living tools + salary calculators to get real numbers. Don’t just guess.

If your projected DTI is 3:1 or higher, consider cheaper programs, apply for more scholarships, or plan for PSLF.

Scholarships & Cost Planning to Improve Your DTI

Don’t underestimate small scholarships or cost differences between schools, they compound!

🎓 How to reduce your DTI:

- Compare total tuition + fees + cost of living across schools

- Use a cost-per-month approach if program lengths vary

- Apply to every scholarship you can (even $1K makes a difference)

Final Thoughts: DTI = Your Early Career Freedom

Your debt-to-income ratio is more than just a number. It shapes your:

- Career options

- Monthly lifestyle

- Ability to invest and build wealth

- Long-term happiness

If you’re still in school or early in your career, this is your chance to optimize your path and avoid a debt trap. If you’re already a few years in, it’s not too late. You just need a strategy.

📢 Ready to Get Help with Student Loans?

Whether you’re calculating your DTI for the first time or choosing between PSLF and private practice…

📢 Join the Millionaires in Medicine Club for FREE: https://www.millionairesinmedicine.com/community

📌 Get 1:1 coaching to build wealth & optimize your student loan strategy! → https://www.millionairesinmedicine.com/coach

📲 Follow us on Instagram for More PA-C Financial Tips: https://www.instagram.com/millionairesinmedicine