The Two Numbers That Actually Build Wealth as a Medical Professional (It’s Not Cutting Your Amazon Budget)

If you're a PA, NP, pharmacist, or physician looking to grow your net worth in 2025, you’ve probably been told to:

- Cancel subscriptions

- Stop ordering takeout

- Book budget travel instead of luxury hotels

- Avoid Target like the plague

Sound familiar?

The truth? Those things barely move the needle. If you want to actually build wealth, there are two key numbers that matter more than anything else:

✅ Your income

✅ Your investing rate

Let’s break down how these two levers work and what happens if you ignore them.

Why Most Medical Professionals Focus on the Wrong Financial Fixes

We get it, you’re busy. You’re working full-time (or overtime), possibly paying down six figures in student loans, and the internet is flooded with advice to “spend less on lattes.”

💡 Here's the truth:

You can’t budget your way to millionaire status.

The tiny tweaks (like skipping brunch or canceling Netflix) don’t make you financially free. And while frugality has its place, it’s not your main path to wealth.

The Two Levers That Actually Build Wealth: Income & Investing Rate

There are only two levers that truly move your financial future:

- How much you earn

- How much you invest

Most people try to increase their income (which is great), but forget to check their investing rate, and that’s why they end up earning more... but feeling like they have nothing to show for it.

Investing Rate: What It Is and Why It Matters More Than You Think

Your investing rate = the percentage of your gross income that you consistently invest every year.

📉 The average medical professional invests only 7–12% of their income.

📈 But to actually retire comfortably (not relying on Social Security), most need to be investing 20–25% or more, especially if you start late.

Why? Because you’ll likely need $5–7 million to retire well by age 65, factoring in inflation and rising medical costs.

Real Math: How 7%, 15%, and 25% Investing Rates Impact Your Future

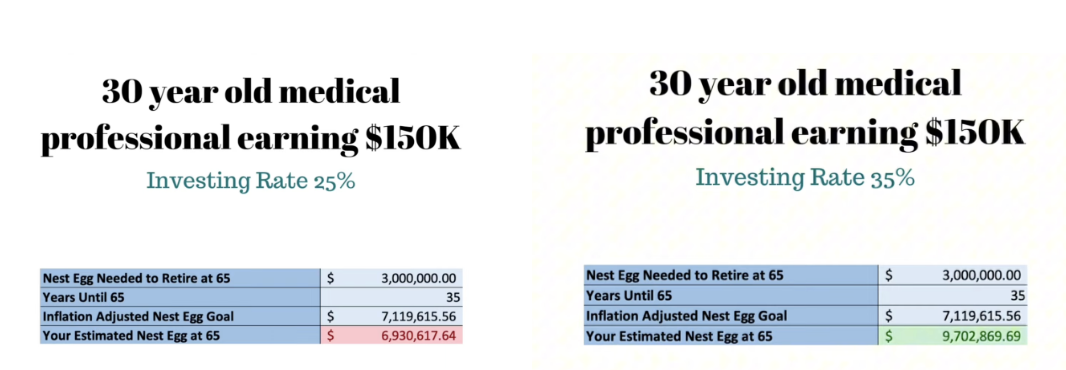

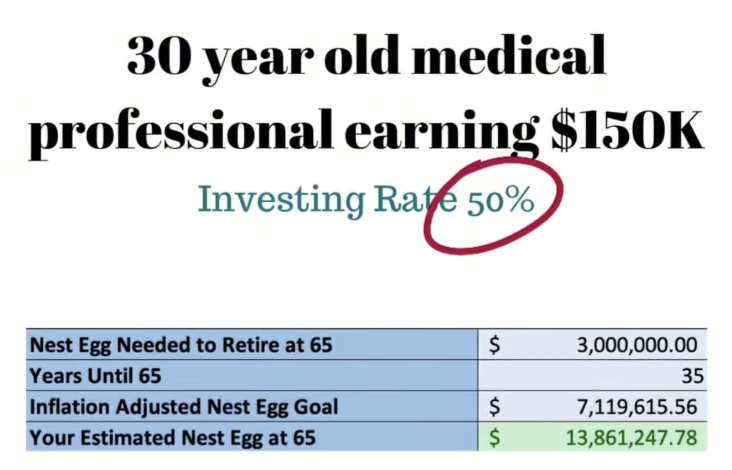

Let’s run the numbers for a 30-year-old medical professional earning $150K/year:

📊 7% Investing Rate

- Ends up with $1.9 million at retirement

- Needs $7.1 million

- Shortfall: over $5 million

- ❌ Not enough to retire safely

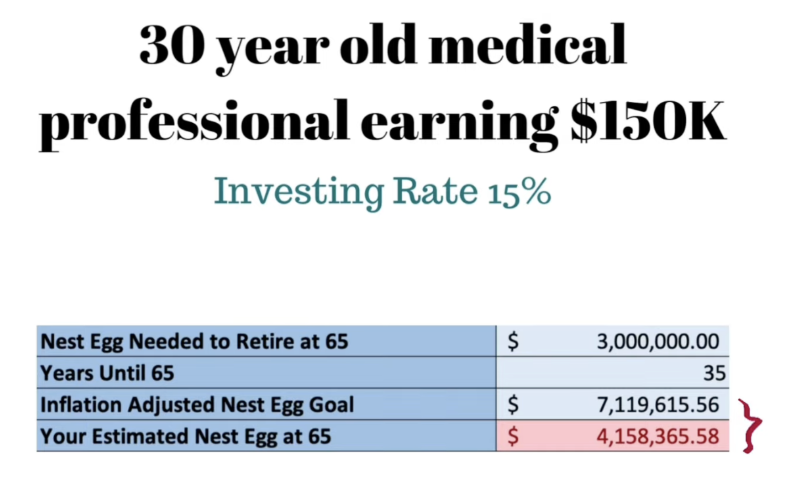

📊 15% Investing Rate

- Ends with $4.1 million

- Better… but still short

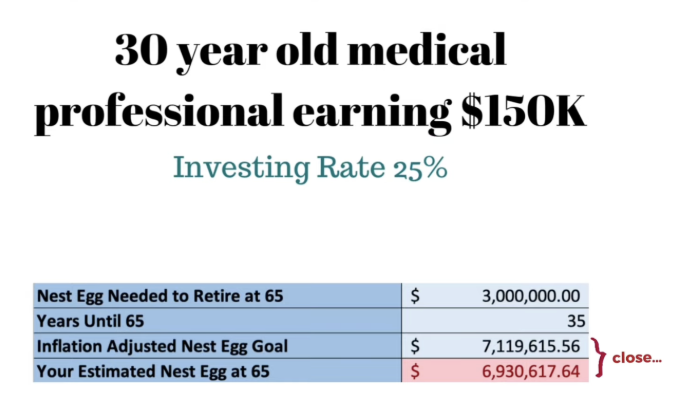

📊 25% Investing Rate

- Ends with $6.9 million

- ✅ Almost fully on track

The earlier you start, the lower your rate can be. But the later you begin investing, the more you need to contribute to catch up.

The Age Factor: Why Starting Late Requires Bigger Investing Commitments

You didn’t start earning at 22. You went through years of:

- Undergrad

- PA school, pharmacy school, or other graduate program

- Clinical rotations

- Credentialing delays

By the time you earn a full-time paycheck, you’re already behind—which means your investing rate has to be higher just to hit the same goal.

Start at 20? You might get away with 15%.

Start at 30? You’ll probably need 25–35% just to catch up.

What Happens When You Hit 35% or 50% Investing Rate?

Here’s where it gets exciting.

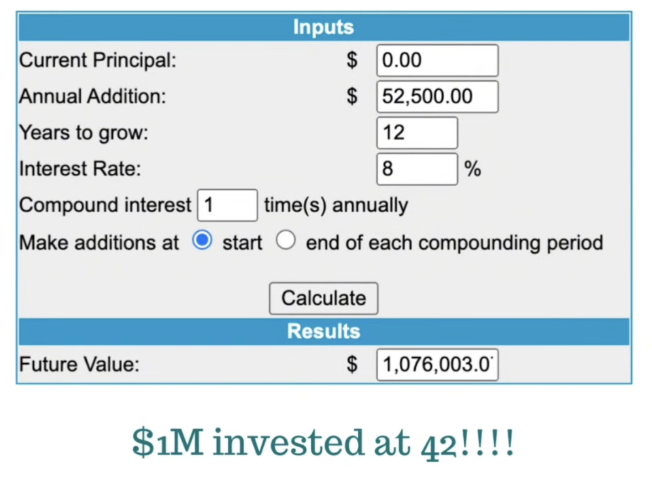

📈 35% Rate

- Ends with ~$10 million

- Becomes a millionaire by 42

- Early retirement is possible

- Major flexibility: work less, give more, leave a legacy

📈 50% Rate

- Ends with $13 million

- Crosses $1 million invested by age 39

- Can retire by 50 if desired

- Needs intentional living, low overhead, and smart systems (but no, it’s not impossible)

This is what FIRE (Financial Independence, Retire Early) looks like in real life for medical professionals.

Becoming a Millionaire Early Without Earning $500K

You don’t need a half-million salary to build serious wealth.

With a solid income ($130K–$180K), low overhead, and a high investing rate:

- You can hit $1M net worth in your 30s

- You can retire in your 50s (or earlier), or have the flexibility to reduce hours early

- You can give, rest, or pivot careers without fear

This is what happens when you stop obsessing over Starbucks and start focusing on pulling the right levers.

Want to Grow Your Net Worth in 2025? Pull the Right Lever.

If you want to grow real wealth in 2025:

🔁 Don’t just budget harder.

💸 Don’t just earn more.

📈 Invest more.

Your investing rate is one of the most powerful predictors of future wealth—and most medical professionals don’t even know theirs.

📢 Ready to Build a High-Investing Strategy That Works?

📢 Join the Millionaires in Medicine Club for FREE: https://www.millionairesinmedicine.com/community

📌 Get 1:1 coaching to boost your investing rate and grow your net worth! → https://www.millionairesinmedicine.com/coach

📲 Follow us on Instagram for More PA-C & NP Financial Tips: https://www.instagram.com/millionairesinmedicine