What $133K Really Means as a New Grad PA in 2025

So, you landed your first job as a PA and the contract says $133,000. Cue the confetti, right?

Not so fast.

That six-figure salary might look like you’ve made it—but once taxes, benefits, student loans, and cost of living enter the chat? Your paycheck starts looking eerily similar to... a seasoned second-grade teacher.

Let’s break down what $133K actually looks like in your bank account—and what you can do to stretch it farther.

Step 1: Understand Where Your Money’s Really Going

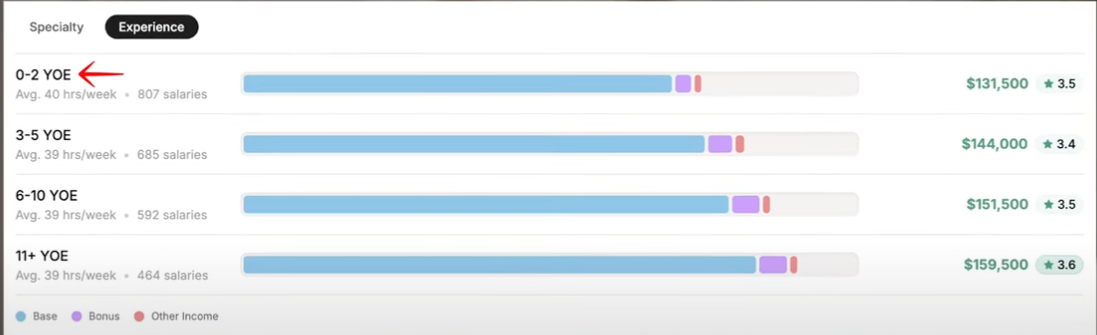

On paper, the median PA salary is about $133,000/year, according to the Bureau of Labor Statistics (2025). But new grads with 0–2 years of experience are earning just under that, around $131,500.

Source: Marit Health

Once we break it down:

- Federal income tax (24%): ~$31,500

- State tax (5%): ~$6,500

- FICA (7.65%): ~$10,000

- Medical, dental, vision insurance: ~$2,400/year

- 401(k) contribution (5%): ~$6,500

🎯 Take-home pay? Roughly $75,000

That’s about $6,250/month—and we haven’t touched student loans yet.

Step 2: Enter the Student Loan Gorilla 🦍

The average PA graduates with $115,000 in student loan debt. Assuming a 6% interest rate on a standard 10-year repayment plan, that’s ~$1,250/month. Because student loan strategy is so variable, it’s almost impossible to create a consensus here. Some PAs have leveraged income driven plans, tax free forgiveness, and strategic AGI levers + income recertification strategies to have a student loan payment next to nothing.

Regardless, in our example…

You’re now down to about $5,000/month.

Which sounds fine—until you consider rent, groceries, transportation, and required PA costs like licensure, CME, BLS/ACLS recertifications, and board fees.

Especially if you live in a high-cost area like California, NYC, or Boston, that $5K doesn’t stretch far.

Step 3: Why Your Salary Feels Smaller Than It Is

It’s not just the taxes and loans—it’s the purchasing power. Living in a “high salary” state doesn’t always mean you’re better off.

📍 Example: States like California and Washington offer high gross salaries—but when adjusted for cost of living, they rank 30th–40th in take-home value. Middle America and parts of the Southeast? Much better bang for your buck.

Step 4: Want to Build Wealth? Here’s What to Do

Being a new grad PA doesn’t mean staying stuck. Here’s how to grow your income and savings:

✅ Negotiate non-salary benefits: CME allowance, licensing reimbursements, relocation assistance.

✅ Explore side hustles: Expert witness work, teaching, pharma gigs, PRN shifts.

✅ Start an LLC: Use it for side income, tax deductions, and a Solo 401(k) to boost retirement savings.

✅ Join the Millionaires in Medicine Club: Free access to strategies from medical professionals already building wealth.

Watch the full video here:

Final Thoughts

Yes, $133K is an incredible starting point—but it’s not the end goal.

The real win? Learning how to keep more of what you earn and turn your clinical income into financial freedom.

Your $200K+ future starts with smart moves today.

Feeling Shocked by How Little of Your $133K You Actually Keep?

📢 Join the Millionaires in Medicine Club for FREE:

https://www.millionairesinmedicine.com/community

📌 Get step-by-step help to keep more of your paycheck—from loan strategies and tax tips to smarter investing.

📲 Follow us on Instagram for daily money tips: @millionairesinmedicine

You worked hard for your six-figure salary.

Now it’s time to make that salary actually work for you.