Why Following Dave Ramsey’s Advice Cost Me Thousands as a Medical Professional

When I graduated from PA school back in 2016, I did what a lot of new grads do when they’re desperate for financial guidance:

I followed Dave Ramsey’s plan.

I was told:

❌ Don’t invest until you’re debt free.

❌ Pay off all your student loans as fast as you can.

❌ Use a financial advisor to pick actively managed mutual funds.

And honestly? It cost me a lot of money and years of delayed wealth-building.

If you’re a PA, NP, pharmacist, or physician with over six figures in student loan debt, this post is your warning. Dave Ramsey’s advice might be dangerous for you.

Why Dave Ramsey’s Advice Doesn’t Work for Medical Professionals

Let’s be clear: Dave Ramsey has helped millions of people get out of credit card debt, avoid car loans, and live below their means.

But that advice is great for the masses, not for medical professionals with $100K+ in federal student loan debt.

When your debt is extreme and your income is delayed due to years of training, you’re not on the financial bell curve. You’re an outlier. And that means you need an outlier strategy, not one designed for consumer debt problems.

What the Ramsey Plan Actually Says (and Where It Falls Short)

Here’s the basic breakdown of Dave’s plan:

- Build a $1,000 emergency fund

- Pay off all debt using the debt snowball method

- Only then start investing 15% of your income into actively managed mutual funds using a financial advisor

Sounds simple, right? But if you’re sitting on $100K–$250K in student loans, that plan can leave you:

- Delaying investing for years

- Losing out on compound growth

- Paying unnecessary fees on the back end

Real Example: What Happens When You Follow This Plan Exactly

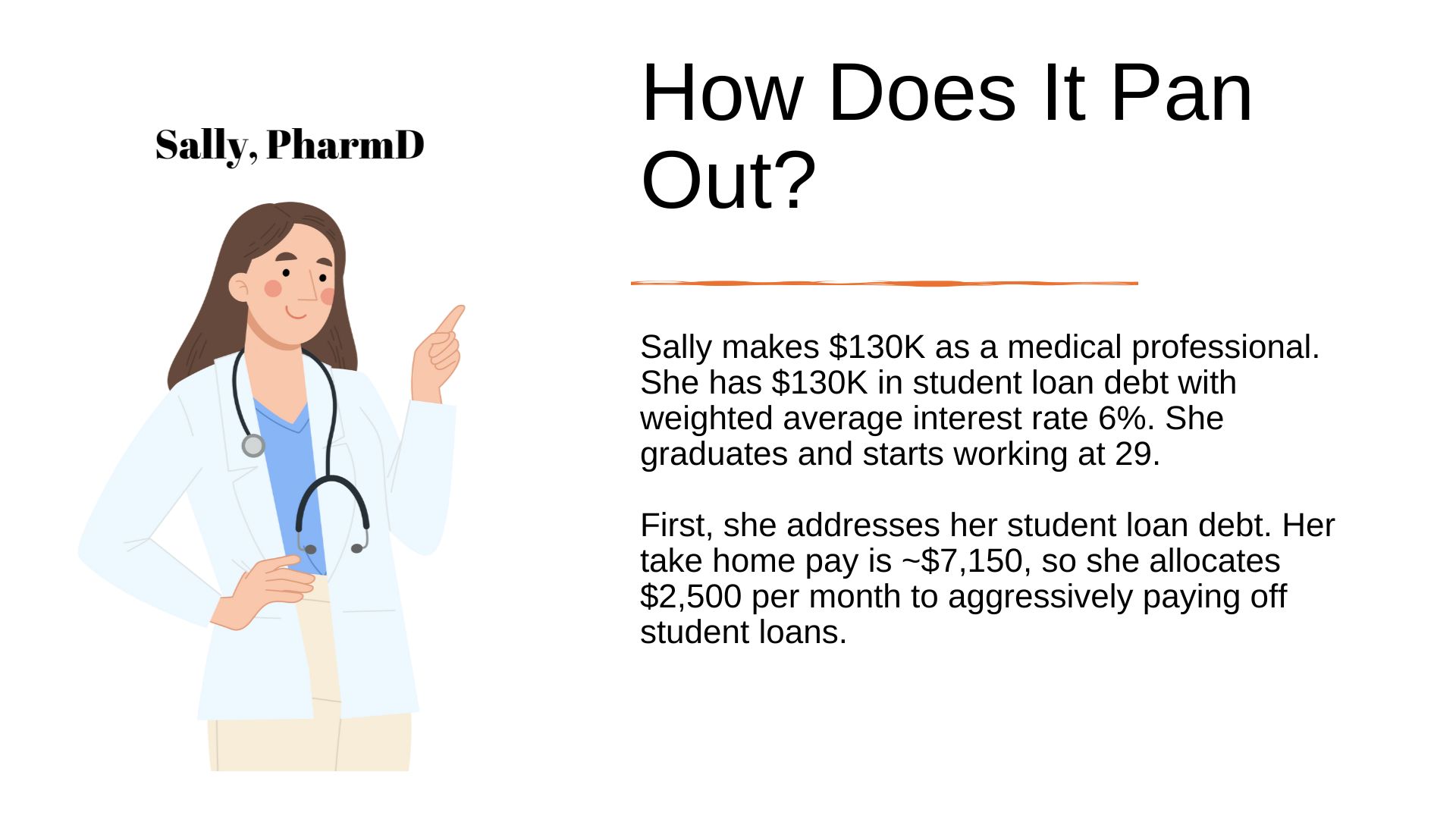

Let’s look at “Sally the Pharmacist.”

Result: She’s debt free in 5 years

Great news… except now she’s 34 and just starting to invest.

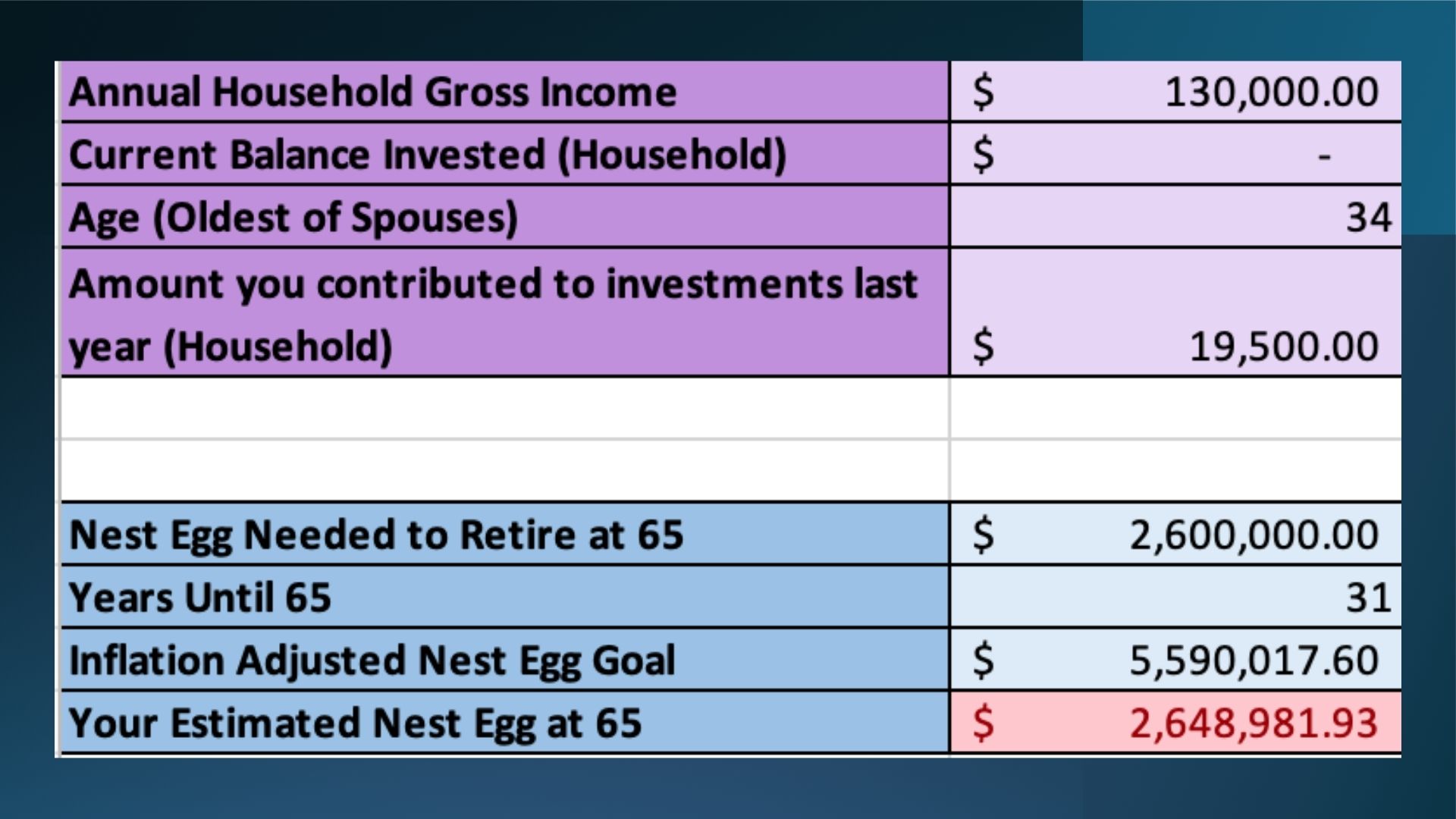

By delaying investing for those 5 years, Sally ends up with only $2.6 million by retirement.

But due to inflation, she really needs $5.5 million.

That’s a $3 million shortfall, and that’s after doing everything “right.”

How Investment Delays Compound Into Huge Losses

The biggest danger of Ramsey’s advice isn’t just missing five years of investing—it’s missing five years of compound interest during your highest “investing power” years.

While Sally was throwing $2,500/month into loan payments, she:

- Delayed her wealth building

- Missed early retirement options

- Sacrificed flexibility and cash flow

And when she finally started investing, it wasn’t optimized either…

The Hidden Cost of Ramsey’s Investment Advice

Here’s where things get worse.

Dave also advises:

- Hiring a financial advisor who charges 1% AUM fees

- Investing in actively managed mutual funds with 1%+ expense ratios

- Ignoring low-fee index funds and DIY investing options

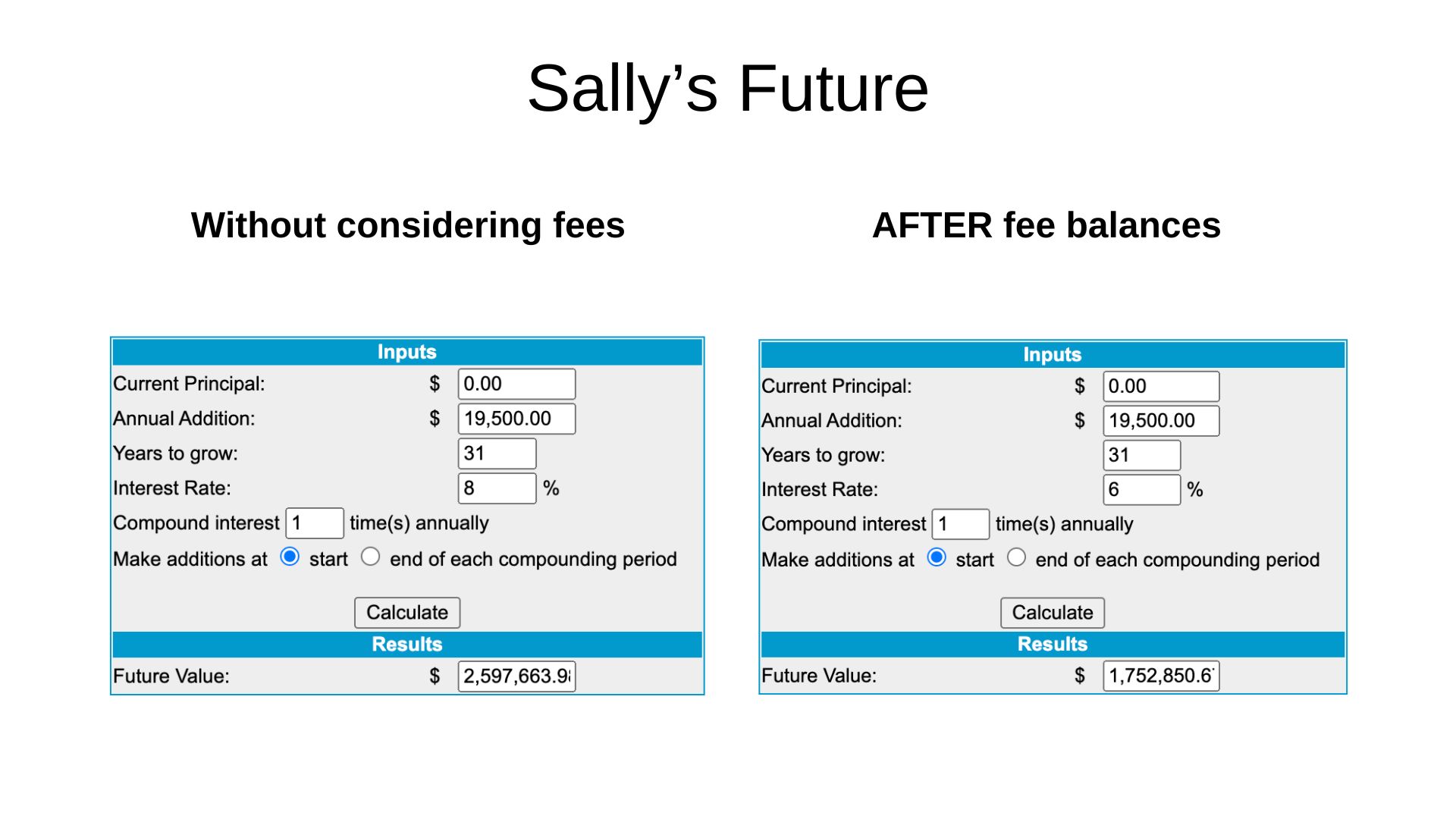

Sally’s $2.6 million in retirement savings?

After fees, it drops to $1.7 million.

She’s millions behind her retirement target, despite being financially disciplined.

What I Did Instead: My Real Strategy as a PA

Now here’s the twist, I did follow Dave Ramsey’s plan.

But the only reason it didn’t wreck my finances is because I was willing to approach my student loan debt in an extreme fashion - which few people are willing to do.

✅ I paid off my student loans in 16 months, not 5 years.

✅ I worked multiple per diem jobs on top of my full-time role (putting in 80 hour weeks)

✅ My husband and I lived on $35K/year and practiced extreme frugality

✅ When we were done, we didn’t increase lifestyle. I cranked my investing rate to 50% of our total income for years.

That’s what saved me. Not the plan: my execution speed + aggressive investing. If you’re not willing to work extra shifts, practice extreme frugality, or invest a very high percentage of your income - the outcome isn’t pretty.

The Right Way: Balance Student Loan Payoff and Investing

For most medical professionals, here’s what makes sense:

- Start investing early, even if it’s small

- Choose low-cost index funds, not high-fee mutual funds (Don’t believe this is the best approach? Go review the annual SPIVA report)

- Consider loan forgiveness options like PSLF before going full attack

- Build a plan that works for your income, your debt, and your goals

⚠️ Blindly following a one-size-fits-all plan like Ramsey’s can rob you of millions in retirement.

Final Thoughts: You’re Not the Average American, and That’s the Point

As a medical professional, your financial life looks different:

- You have more debt

- You start earning later

- You often qualify for forgiveness programs

- And you have higher long-term income potential

So why follow advice made for people with $5K in credit card debt and a $50K salary?

Make your plan based on math—not fear.

Based on your profession—not pop finance gurus.

And based on your future—not just your past.

Watch the full video here

📢 Ready to Build a Real Strategy That Works for You?

Let’s ditch one-size-fits-all money advice and create a custom plan that actually works for your career and your goals.

📢 Join the Millionaires in Medicine Club for FREE: https://www.millionairesinmedicine.com/community

📌 Get 1:1 coaching to build wealth & navigate your student loan plan! → https://www.millionairesinmedicine.com/coach

📲 Follow us on Instagram for More PA-C & NP Financial Tips: https://www.instagram.com/millionairesinmedicine