Why I Stopped Paying for Someone To Manage My Investments, and Saved Over $1.5 Million

If you're a PA, NP, or pharmacist and you've ever thought, "Personal finance is just too complicated for me," you're not alone. That’s exactly what most of us are conditioned to believe.

But here's the truth: learning to manage your own money could save you more than $1.5 million in your lifetime. I know this because I’ve lived it.

My Story: From Student Debt to Seven Figures

When I graduated as a critical care PA, I had $161,000 in student loans and zero assets. Like many new grads, I was eager to "do the right thing", so I hired a financial advisor and opened a Roth IRA through Edward Jones.

It felt like I was checking all the right boxes. But years later, I realized I had paid thousands in fees without even realizing it: fees that were quietly dragging down my returns.

Once I learned to manage my portfolio myself, everything changed. Less than a decade later, I hit $1 million in net worth at age 31.

The Cost of Not Learning Personal Finance

Most medical professionals fall into one of two traps:

- Avoidance — They put off learning personal finance, promising themselves they’ll “deal with it later.”

- Delegation — They hire a financial advisor too early, without understanding what they’re paying for.

Neither option serves you well in your first 5–10 years of practice.

“If you don’t invest intentionally, it won’t happen by itself. You’ll look up decades later with nothing to show for your six-figure salary.”

And it’s not just about what you miss, it’s about what you lose.

Let’s break it down.

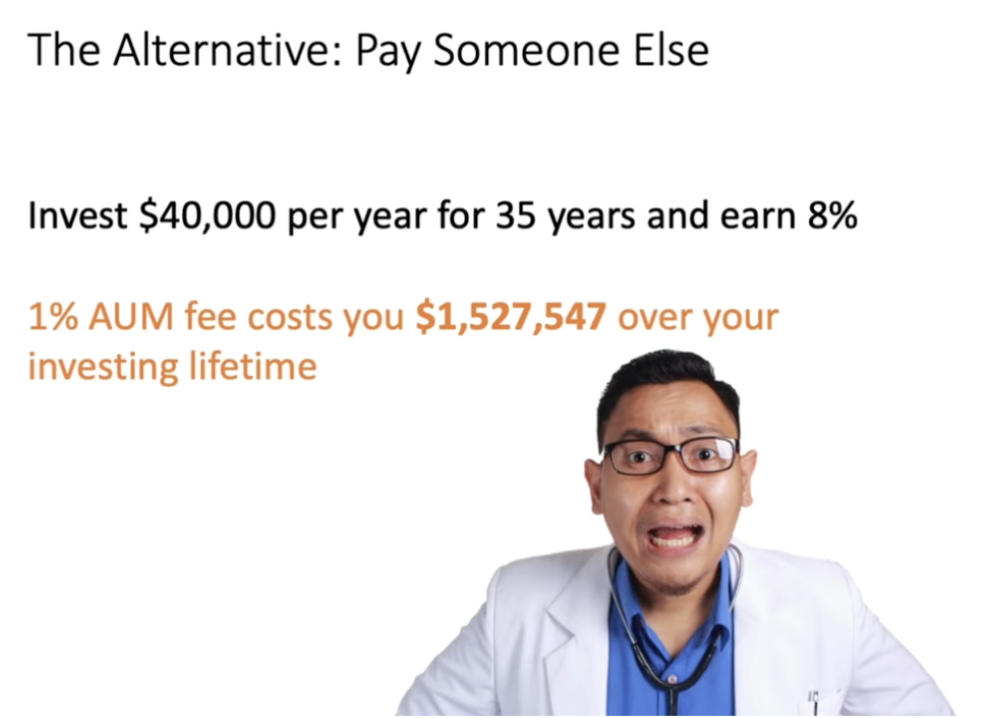

The $1.5 Million Mistake

If you're investing $40,000 a year and paying an advisor a 1% fee (typical for “Assets Under Management”), here’s what that fee actually costs you over 35 years:

> $1.5 million.

That doesn’t even include high expense ratios, front-load fees, or poor fund selection—all of which were part of my early experience.

Real-Life Example

When I switched to managing my own portfolio through Vanguard and stopped paying advisor fees, I realized just how much I was losing. I had front-load and back-load fees. My funds had high expense ratios. Every trade cost me more than it should have.

Had I stayed the course with that advisor? I would’ve lost over a million dollars.

What I Do Instead (And What You Can Do Too)

I spend less than an hour per month managing our investment portfolio. Everything is automated.

Our strategy involves: :

- Low-cost index funds and ETFs (e.g., through Fidelity, Vanguard, Schwab)

- An intentional asset allocation plan that doesn’t shift with the news cycle

- Tax-advantaged accounts like 401(k), Roth IRA, HSA - in addition to a brokerage account and real estate as another asset class

The only time investment was learning how it all works. And that return? It was life-changing.

When You Do Need an Advisor

There’s a time and place for professional financial guidance, especially when:

- You’ve built a 6–7 figure portfolio (most can DIY their way to a $500K plus portfolio without much difficulty)

- You’re 5–10 years from retirement - advisors are great for helping with distribution strategies and social security planning

- Your financial situation has multiple moving parts (e.g., business ownership, trusts, multiple properties) or you’re investing in alternatives and need help with due diligence

But if you’re just starting out?

Learn the basics. Build your foundation. Get to critical mass before you pay for complexity you don’t have.

Why This Matters for You

Learning personal finance isn't just about saving money. It’s about gaining control.

- Control over your work hours

- Control over when and how you retire

- Control over how you raise your kids

- Control over whether you take that dream sabbatical

You don’t have to become a full-blown financial nerd. But if you can learn how to take care of patients, you can absolutely learn how to take care of your money.

No One Cares About Your Money Like You Do

And they shouldn’t have to.

But you do.

So take the time. Build the skills. Stop outsourcing your financial future.

If you're ready to feel empowered and build a system that serves you, not just someone else’s commission? Start today.

Want Help Getting Started?

📢 Join the Millionaires in Medicine Club for FREE:

https://www.millionairesinmedicine.com/community

📌 Get 1:1 coaching to build wealth & optimize your finances:

https://www.millionairesinmedicine.com/coach

📲 Follow us on Instagram for more tips:

https://www.instagram.com/millionairesinmedicine