How to Not Lose Money In The Stock Market

As a medical professional, you work tirelessly to care for your patients. Your income is hard-earned, and the last thing you want is to see it vanish into thin air due to stock market ups and downs. It's completely understandable to feel hesitant about investing, but let's break down the fear and explore how you can build wealth while navigating market volatility.

I've been in your shoes. As the founder of Strive Coaching, I've helped countless medical professionals turn their six-figure incomes into seven-figure net worths. I’ve also personally experienced the gut-wrenching feeling of losing over $25,000 in a single day in the stock market. Trust me, I understand the fear.

Zooming Out for the Big Picture

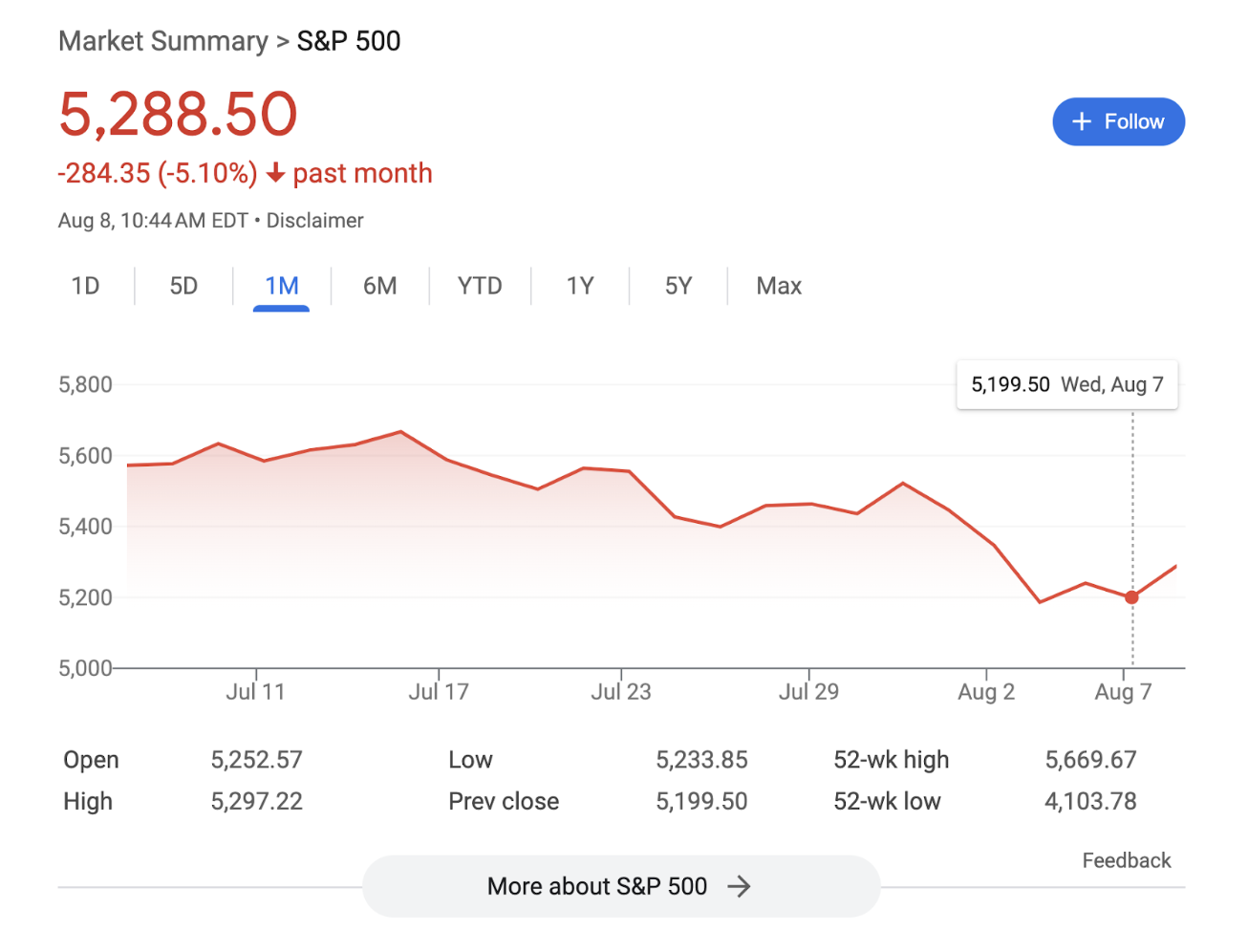

Right now, the market might be feeling a bit rocky. You might be wondering if it's even worth starting to invest or if you should pull out your money altogether. Let's take a step back.

While short-term market fluctuations can be scary, history tells a different story. Over...

Retire Early From Medicine - Don't Want To See Patients Until 65?

If you're a healthcare professional, especially one who worked through the pandemic, the traditional idea of working until you're in your late 60s might not be appealing. Constantly seeing patients can take a toll, and the thought of being work-optional—where you don’t have to work for a paycheck unless you want to—can be very enticing.

But achieving this freedom isn’t about age; it's about reaching a specific financial milestone known as your financial independence number or financial freedom number. If you aren't sure what your financial freedom number is, click here to get it in <60 seconds. This means having enough assets to live comfortably without needing to earn another paycheck- something to look forward to, right?

I’m a critical care PA who worked through every wave of the pandemic in an ICU. Even before the pandemic, but especially by the end of it, I knew I didn't want to work until I was 65. So, I dove into figuring out how to become work-optional much sooner. My init...

Make Your Choice: Roth vs Traditional 401k

When you're planning for your financial future, one big decision is choosing between a Roth and a Traditional 401(k). It's a common question - don’t worry - especially for medical professionals who are looking to maximize their retirement savings.

Let's break it down in a way that’s easy to understand and apply to your own situation.

The Basics

- Traditional 401(k): Contributions are made with pre-tax dollars, which means you get a tax deduction now. However, you will pay taxes on the withdrawals during retirement at your ordinary income tax rate.

- Roth 401(k): Contributions are made with after-tax dollars, so there is no immediate tax benefit. But, the withdrawals during retirement are tax-free.

It's All About Taxes

Remember, choosing between Roth and Traditional doesn’t change the actual investments you make. It only affects how your contributions and withdrawals are taxed.

A Simple Guideline

Here's a quick rule of thumb:

- Choose Roth if your current tax rate is ...

Money Hack for Medical Professionals - You Need to CLAP!

I'm a firm believer of automating most aspects of personal finance, but I also believe that what gets measured gets improved and managed. Over the years, I've developed end-of-month and end-of-financial-quarter routines that have guided me from paying off $161,000 in student loan debt to reaching millionaire status through investing. Today, I'll break down my monthly routine that ensures long-term financial success.

If you have any debt with an interest rate above 10%, you need to snag this free checklist before you implement the CLAP system

CLAP: A Simple, Effective System

To remember this routine, I use the acronym CLAP. It's catchy and easy to remember. Here’s what each letter stands for:

C - Categorize

Start by categorizing every single financial transaction into appropriate buckets. Whether it's on your credit card or debit card, each transaction needs a specific category. This helps you track where your money is going and prevents any single category, like "miscella...

BANG Your Money - Routine for Wealth Building

If you're a medical professional aiming to build long-term wealth, a simple monthly cash flow tracking system might not be enough. To truly secure your financial future, you need a comprehensive approach. I've used a system called BANG to go from $161,000 in student loan debt to becoming a millionaire as a PA. This routine, done at the end of each fiscal quarter, ensures that the big, impactful financial moves are made. Let me walk you through it.

(Before I do, you may notice that this routine is heavily focused on ensuring you manage your debt AND build assets. If you're not sure how the two fit together, watch this free video training.)

B - Bring Your Financial Partner

First, Bring your financial partner into a scheduled, genuine sit-down conversation. If you handle your finances solo, consider an accountability partner, like a trusted long-term friend, to discuss your goals without sharing specific account details. If you have a long-term partner or spouse, this should be a...

How Much Money To Retire From Medicine?

Unless you plan on seeing patients until the day you drop dead, you need to read this.

Having an understanding of how much money you need invested in order to retire is a basic requirement of success.

What’s the Right Amount to Retire from Medicine?

If you don't know where you're going, you will definitely not get there.

Let me break down but it looks like to figure out your "financial independence number". First things first, retirement is not an age. It is actually a mathematical destination where you can live off of your investments. We all need to hit this mark (hopefully at least by 65), but some folks (like myself) set themselves up to hit it far sooner.

So what's your number?

1) Calculate how much money you spend in one month. Unless you have a budget, you likely do not know the answer to this question. In my experience with working with thousands of medical professionals, when people attempt to guesstimate this number they typically guess a number about 20 to 30% less tha...

What Am I Investing In?

This post may contain affiliate links. If you make a purchase, I will be compensated at no additional cost to you. For my full disclosure, click here.

For many medical professionals, the roadblock to successful investing is just knowing HOW. Understanding what accounts to use, how to select funds, and what fees you are paying are the foundation to becoming a saavy investor - and future Millionaire in Medicine.

Broad Categories of Funds

When you go to select your investments within your 401(k), other retirement account, or miscellaneous investments, how do you know what investments you're choosing? Remember, a 401(k) or Roth IRA is simply a tax designation for an investment. The tax treatment matters greatly, but so does what you choose to invest in within it.

HAVING A BASIC UNDERSTANDING OF YOUR INVESTMENT SELECTIONS WILL EMPOWER YOU TO MAKE BETTER CHOICES.

Let's review a few basic investments types:

1. ACTIVELY MANAGED MUTUAL FUNDS

- When you select a mutual fund to put your mo...

Are Your 'Retire Early' Numbers Wrong?

If your plan is to retire early, you need to make sure you don't have your numbers all wrong.

Is Your Investment Portfolio Ready for Early Retirement?

Retirement has nothing to do with age. I actually prefer the term work optional, as I think it more adequately describes the financial circumstances that create your ability to retire. When you are able to live off investments indefinitely, you are "work optional". At that time, you have the option to retire.

When you decide to quit earning an income and live off your investment portfolio, you're deciding to use a portion of it each year. So how much can you use without running out of money?

For those retiring at 65, the classic answer is 4% of your portfolio per year.

This means that having $1,000,000 invested will provide you only $40,000 per year to live off of. My suspicion is that this may be a lot less than you thought.

Most of the data behind this is relatively old, and there are plenty of critiques on the methodologies used. ...

Roth Hacks for High Earners

Roth IRAs are one of the best tax-favored accounts to use for retirement investing. Many have heard that high earners are out of luck when it comes to Roth IRAs! This is a money myth, and one I can't wait to bust.

A Roth IRA is one of MANY accounts you should be using in order to build wealth in the best way possible. If you aren't sure what accounts should be in your lineup, watch this free video training.

What is a Roth IRA?

Within a Roth IRA, you invest "after tax" dollars (meaning your contributions are not tax deductible). The contribution limits for this account are much lower than your employer accounts. After age 59 and 1/2, all of the funds in the account can be accessed TAX FREE. Yes, you read that right. Tax free. In addition, Roth IRAs have several other benefits:

- You can withdraw your contributions (not the growth) at any time.

- You can make a withdrawal without the 10% penalty before 59 and 1/2 if you use the funds for qualified educational expenses (you will still pa ...

Earn more money, without picking up extra shifts

I started my career picking up extra shifts to make my financial goals happen. I wanted to pay off my debt early and build wealth. I had $161K in student loan debt to contend with. My income felt like it wasn’t enough, so my solution was to work evenings, weekends, and my scheduled days off to make up the difference. I used that to pay off $161,000 in student loans in 16 months, but quickly realized the downfalls to that strategy.

How to Increase Income Without Sacrificing Time?

While the “working extra shifts” strategy may work for short term financial goals, like paying off credit card debt, it’s not a viable long-term solution. It can lead to burnout, and if it ultimately reduces your career longevity it may reduce your long-term income.

The most underleveraged wealth hack is to negotiate more compensation for what you’re already doing, and then use the increased income to reduce debt & build assets.

Here’s a few pearls for the negotiation process itself:

- Calculate yo ...