Residential Assisted Living Investing for Medical Professionals: How Clinicians Can Build Passive Cash Flow

Most medical professionals think real estate investing means one of two things:

- Buy a long-term rental and hope it cash flows.

- Run a short-term rental and accept the headaches.

But there’s another option more clinicians should know about: Residential Assisted Living (RAL).

It’s a real estate + business model that can create meaningful monthly cash flow — while also improving senior care in a way many big-box facilities can’t.

In this conversation, I’m joined by Dr. Alex Schloe, a family medicine physician, Air Force serviceman, real estate investor, and entrepreneur, to explain how RAL works and how clinicians can participate without leaving medicine.

What Is Residential Assisted Living (RAL)?

Residential assisted living is typically a large home in a normal neighborhood that’s been renovated to care for seniors — usually 6 to 16 residents depending on the state.

It supports activities of daily living like:

- bathing, toileting, dressing, mobility

- meal support, cleaning, ...

The 3 Investing Lies Keeping Medical Professionals Stuck in 2026

Most medical professionals don’t feel “bad with money.”

You have a six-figure income.

You contribute to your 401(k).

Maybe you max out your Roth IRA.

And yet… you still feel behind.

If that’s you, I want you to know something:

It’s not because you’re irresponsible.

It’s because you’ve likely believed one of three lies that quietly derail wealth-building for PAs, NPs, CRNAs, and PharmDs.

Let’s break them down.

Lie #1: “I Should Just Pay Someone to Invest for Me”

I hear this constantly.

“I’m too busy.”

“I’m not good at math.”

“I don’t understand investing.”

“Successful people hire advisors.”

When I was a brand-new PA, I hired a financial advisor at a large national firm. He was a wonderful human. Truly.

But when I ran the math on the 1% assets-under-management (AUM) fee I was paying?

It was going to cost me over $1 million across my investing lifetime.

Here’s what that can look like:

Assume:

- Age 32

- $100,000 invested

- Investing $18,000 per year

- 8% annual return

A 1% AUM fee...

What Every NP & PA Should Know to Avoid Costly Contract Mistakes (+3 Bonus Tips for Dermatology NPs/PAs)

Signing an employment contract as a nurse practitioner or physician assistant can feel deceptively simple. An offer is on the table. The role sounds exciting.

Yet, the fine print in APP contracts often shapes your workload, compensation, autonomy and long-term satisfaction far more than the job description ever will.

Whether you’re early in your career or an experienced APP considering a change, understanding the key elements of your contract and where problems commonly hide can help you avoid costly missteps—protecting your career.

Below are practical, recruiter-backed tips every NP and PA should know before signing—plus three bonus insights for dermatology NPs and PAs to pay attention to.

1. Compensation Is More Than a Base Salary

Many nurse practitioners and physician assistants / associates focus first on base pay, but NP/PA contracts often include additional components that significantly affect total compensation.

Pay close attention to:

- Productivity bonuses (RVUs, coll...

Protecting the Asset That Helps Build Wealth

Your income drives every financial goal - paying down debt, owning a home, saving for retirement, and building financial freedom.

At Millionaires in Medicine, the focus is on building confidence and structure around budgeting, investing, and long-term planning. That progress depends on consistent income.

What happens if you can’t work?

Disability insurance exists to protect cash flow – the same way diversification protects a portfolio or insurance protects a property. During the accumulation phase of your career, income continuity is the foundation of every financial strategy. Without it, even disciplined savers and investors are forced into damage control.

A medical professional earning $100,000 at age 32 is on track to generate nearly $7 million over his or her career. Shouldn’t that multi-million dollar asset be insured?

Disability Risk is More Common Than People Realize

Many people assume disability only applies to catastrophic events, like paralysis from a car accident or a ...

The Epidemic of Politeness Costing PAs Tens of Thousands in Pay

Most physician assistants don’t earn less because they aren’t valuable.

They earn less because they’re too polite to ask.

I’ve seen it over and over again—smart, capable PAs leaving tens of thousands of dollars on the table simply because negotiation feels uncomfortable, intimidating, or “ungrateful.”

I’m Kristin Burton, PA-C, and I’ve been a PA for nearly a decade. I’ve negotiated primary jobs, per diem roles, investment deals, and business contracts. And I can tell you this with certainty:

Failing to negotiate doesn’t just affect your next paycheck—it compounds into decades of under-earning and lost wealth.

Why Negotiation Feels So Hard for PAs

I still remember my first PA job offer.

I was on rotation when the email hit my inbox. My heart was racing. I was thrilled. They could have offered me almost any number and I would’ve said yes.

I was just grateful to have a six-figure job as a new grad.

Negotiation wasn’t even on my radar.

And that mindset—“Where do I sign?”—follows ...

The Retirement Mistake Costing Medical Pros Millions

What if I told you that you might be leaving millions of dollars on the table for your future retirement?

And what if that loss came down to one small mistake most medical professionals make without realizing it?

I’m talking about a simple setting inside your employer retirement portal… a single button you likely clicked once, years ago… and never looked at again.

It’s one of the easiest financial pitfalls to fix, but the impact is massive. And with new IRS rules coming in 2026, ignoring it could cost you more than you think.

Today, I want to show you the exact retirement mistake 90% of PAs, NPs, CRNAs, and PharmDs are making — and how to correct it before 2025 ends.

The One Button Most Medical Pros Never Re-Check

A cardiothoracic surgery PA I’ll call Sarah came to us after investing for years. She had originally set her 401(k) contribution to the maximum back when she started her job five years earlier… and then never touched it again.

The problem?

IRS contribution limits chan...

Breaking News: The Future of America’s PAs & NPs is in Jeopardy

Sweeping federal loan changes take effect July 1, 2026, under the One Big Beautiful Bill (OBBB). While the bill eliminates the Grad PLUS Loan program for all graduate students, the consequences will not be evenly distributed. In recently released guidance, the U.S. Department of Education classified Physician Assistant (PA) and Nurse Practitioner (NP) degrees as non-professional graduate programs—a categorization that will have profound and harmful impacts on the healthcare workforce.

While professional programs such as medicine (MD/DO), dentistry (DDS/DMD), pharmacy (PharmD), podiatry (DPM), optometry (OD), veterinary medicine (DVM), chiropractic (DC), law (JD/LLB), theology (M.Div.), and clinical psychology (PsyD) remain eligible for $50,000 in annual federal borrowing and $200,000 in aggregate federal loans, PA and NP students will be restricted to $20,500 per year and $100,000 lifetime—with no Grad PLUS option available after July 2026.

For PA and NP education, these limits are s...

Should Medical Professionals Consider a 50-Year Mortgage? The Truth No One’s Telling You

What if you could finally afford your actual dream home — not the starter home, not the condo, but the home with the extra space, the yard, and the room to breathe?

And what if the monthly payment felt like rent?

That’s the promise behind the new 50-year mortgage being proposed. On the surface, it sounds like a solution for medical professionals struggling with high home prices, rising interest rates, and student loan debt.

But is it actually a good idea?

Let’s walk through the real numbers.

Why Housing Feels Impossible for Medical Professionals

Home prices have jumped 30–50% since 2020.

Interest rates climbed.

Saving a six-figure down payment as a new grad PA, NP, CRNA, or PharmD feels unrealistic.

So the 50-year mortgage claims to “solve” affordability by lowering monthly payments.

But lowering payments always comes with a cost.

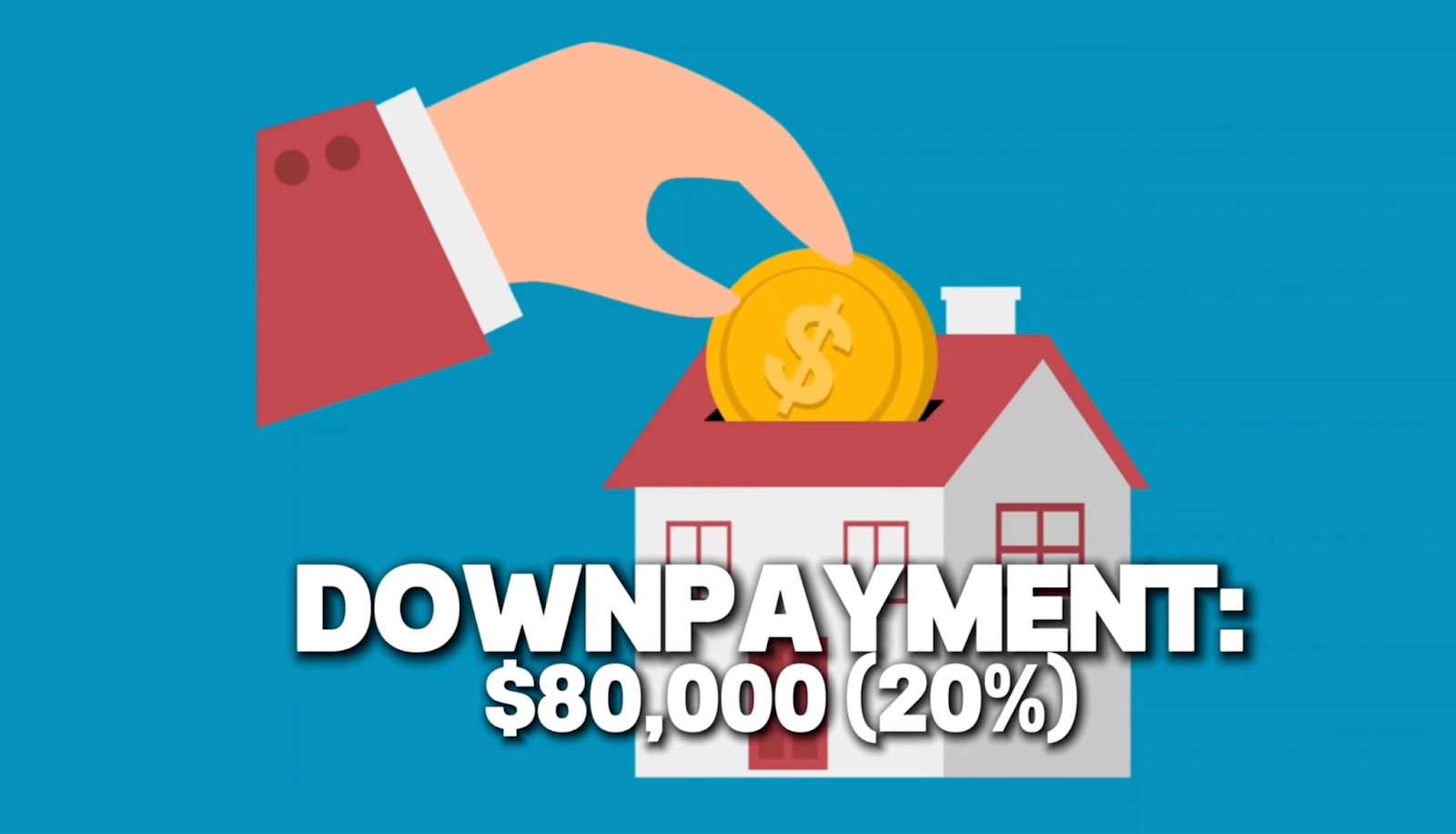

What a 50-Year Mortgage Really Means for a $400K Home

Assume:

- Home price: $400,000

- Loan: $320,000 (20% down)

- Interest rate: 6.5%

30-Year Mo...

Is Being a PA Worth It? The Financial Truth No One Told Me

Is being a PA actually worth it?

I asked myself this exact question when I graduated—bright-eyed, excited about finally making a six-figure income… and completely oblivious to how my student loan debt, training years, and missed investing opportunities would impact my long-term wealth.

I became a PA for all the same reasons most of you did:

I wanted to earn more, build a stable career, and make a difference in medicine.

But here’s the truth I wish someone had told me earlier:

Becoming a PA can put you $800,000 behind financially before you ever see your first paycheck.

Let me walk you through the real math—so you can understand how to make being a PA financially worth it.

PA Salary vs National Averages: The Part That Looks Great at First

Most new PAs graduate in their late 20s or early 30s.

According to Forbes:

- National average income for this age group: $58,500

- New PA salary according to MaritHealth: ~$131,500

When I first saw these numbers, I thought:

“Amazing. I’m u...

Why "I’ll Do It Later" Is Ruining Your Finances (and What to Do Instead)

You just wrapped a 12-hour shift. You’re exhausted. Your feet hurt. The only thing on your mind is crashing into bed or bingeing a comfort show—not logging into your Roth IRA.

We get it.

But here’s the truth no one tells you:

In the world of high-income medical professionals, “I’ll do it later” often turns into never.

And when “never” meets your finances? You miss out on hundreds of thousands—maybe even millions—over your lifetime.

So let’s change that.

Below are 5 quick, high-impact money moves you can set up in a single day that’ll skyrocket your financial independence by 2026.

Hack #1: Automate Your Wealth Machine

Money isn’t like fitness. You don’t need to grind daily to see results.

Set up automation once, and your money will keep working while you rest, chart, and live your life.

✅ Set up automatic transfers from checking → investment account

✅ Go beyond savings—set recurring ETF or index fund purchase orders

✅ Use workplace 401(k)/403(b) + open a Roth IRA and taxable broke...