Are You Underpaid? The 6-Step Salary Check Every PA, NP, and PharmD Needs

📉 You might be underpaid by $10,000—or more.

If you're a PA, NP, or pharmacist and you're relying on vibes and guesswork instead of real data to evaluate your compensation, you could be losing tens of thousands of dollars every year. That’s money that could be funding your investments, knocking out debt, or helping you reach financial independence faster.

So let’s fix that.

Below is the 6-step system to figure out what you should be earning—and what to do if you're falling short.

Step 1: Find the Median Salary for Your Subspecialty

First, you need a benchmark.

It’s shocking how many medical professionals skip this part. Before asking friends or Facebook groups if a salary is “good,” go to actual data sources.

📊 Try:

- MaritHealth’s Salary Explorer (most granular + updated for 2025)

- AAPA Salary Report

- Bureau of Labor Statistics

- Salary.com

- Glassdoor’s Know Your Worth tool

For example:

- 🩺 CT Surgery PA Median = $158,000

- 👶 Pediatric PA Median = $127,000

👉 Write this num...

Are You On Track for Retirement as a PA, NP, or PharmD?

You finally did it! You finished training, you’re earning six figures, and you’re doing the “right” things: tackling student loans, saving a bit, maybe even investing.

So why does it still feel like you’re behind?

Here’s the truth: as a high-income earner who started late (thanks to years of school and training), your path to financial freedom looks different. And if you're under 40, there’s really only one metric that matters right now:

👉 Your investing rate.

Let’s break down exactly what it takes to retire comfortably—without relying on guesses or generic advice built for people who started saving at 22.

Why High Earners Still Fall Short in Retirement

Let this stat sink in:

📉 Nearly 50% of households earning $200K+ are on track to retire with less than 60% of their current lifestyle.

That means half the Teslas in the hospital parking lot are headed for a lifestyle downgrade in retirement. Scary, right?

And the reason? It’s not their income—it’s that they started investing too ...

PA vs MD: Who Builds More Wealth by Age 50?

When you walk into a hospital room, who do you assume is swimming in cash?

The attending physician with years of training under their belt? The surgeon who drives a luxury car and racks up high six-figure paychecks?

What if the real millionaire in the room isn’t the MD—but the PA?

Today, we’re pulling back the curtain and looking at real investment projections, salary timelines, and wealth trajectories to answer the ultimate money question:

Who ends up richer by age 50… a PA or an MD?

Let’s find out. 👇

The Head Start Advantage: PA vs MD Timeline

On average, PAs enter the workforce by age 26, while physicians don’t reach full attending status until around age 32–35, depending on specialty.

That’s quite the investing head start for the PA. While a physician may earn an income in residency or fellowship, it’s often barely enough for them to get by and investing isn’t an option.

Even if physicians make 2–3x more than PAs in gross salary once they complete training, the compounding...

What $133K Really Means as a New Grad PA in 2025

So, you landed your first job as a PA and the contract says $133,000. Cue the confetti, right?

Not so fast.

That six-figure salary might look like you’ve made it—but once taxes, benefits, student loans, and cost of living enter the chat? Your paycheck starts looking eerily similar to... a seasoned second-grade teacher.

Let’s break down what $133K actually looks like in your bank account—and what you can do to stretch it farther.

Step 1: Understand Where Your Money’s Really Going

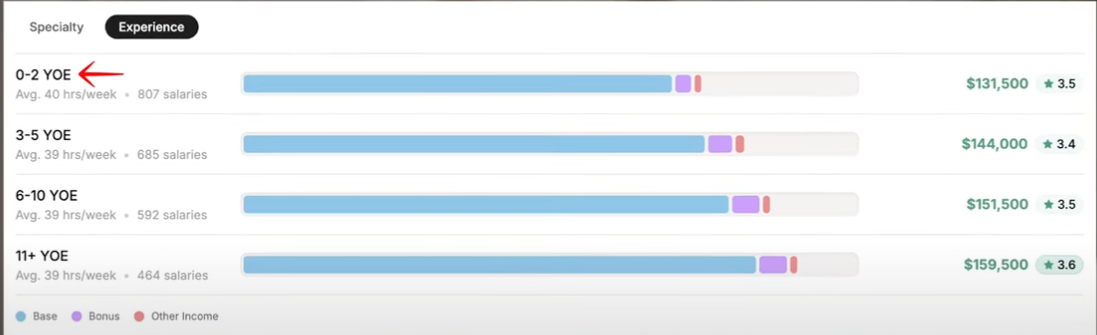

On paper, the median PA salary is about $133,000/year, according to the Bureau of Labor Statistics (2025). But new grads with 0–2 years of experience are earning just under that, around $131,500.

Source: Marit Health

Once we break it down:

- Federal income tax (24%): ~$31,500

- State tax (5%): ~$6,500

- FICA (7.65%): ~$10,000

- Medical, dental, vision insurance: ~$2,400/year

- 401(k) contribution (5%): ~$6,500

🎯 Take-home pay? Roughly $75,000

That’s about $6,250/month—and we haven’t touched student lo...

The Debt Avalanche Strategy Every Medical Professional Needs to Know in 2025

If you're a PA, NP, or pharmacist with any debt that's causing you stress, this guide is for you.

Forget random payment orders or blind budgeting apps. It's time to get strategic about your debt and your future wealth. In this blog, you'll learn the smarter way to tackle debt (hint: it's not the snowball method), how to save thousands in interest, and when to start investing while still paying off loans.

Snowball vs. Avalanche: What Actually Saves You Money?

You've likely heard of the Debt Snowball, a method where you pay off the smallest debt first regardless of interest rate. It's emotionally satisfying, sure. But if you're carrying any high-interest debt (like credit cards or personal loans), it's costing you thousands more over time.

Instead, opt for the Debt Avalanche strategy:

- Step 1: List your debts from highest to lowest interest rate (not balance).

- Step 2: Make minimum payments on all debts.

- Step 3: Throw all extra payments at the highest-interest debt first.

💡 Exa...

How to Save as a PA-C (or Any Medical Professional Earning $100K+)

If you're a PA, NP, or pharmacist earning over $100K a year but your savings account still looks like it belongs to your student days... you're not alone.

I became a millionaire by age 31, not by winning the lottery or flipping houses—but by mastering the basics: saving, investing, and being intentional with money. In this post, I’ll walk you through how to calculate your real savings rate, strategies to save more without sacrificing joy, and how to build wealth faster.

Step 1: Know Your Actual Savings Rate

Most medical professionals have no idea what their savings rate is. If that’s you? Let’s fix that.

To find your savings rate:

- Add up ALL dollars you put toward true savings and investments each month. That includes:

- Emergency fund deposits (your sinking funds for vacations don’t count)

- 401(k), 403(b), or other employer retirement plan contributions

- Roth IRA or brokerage account deposits

- HSA contributions

- Then divide that number by your gross monthly income (not your ...

From $0 to $1.2M in 7 Years: How PAs Can Become Millionaires Faster Than You Think

What if I told you that it’s possible to go from zero to over a million dollars invested in just 7 years on a PA salary?

No gimmicks. No crazy frugality. No lottery luck.

Just a clear, proven 3-step strategy any driven PA can follow.

Let’s break it all down.

Step 1: Cross the $200K Mark with Your Primary Job

This is where most PAs tap out, but it’s also where the biggest growth potential starts.

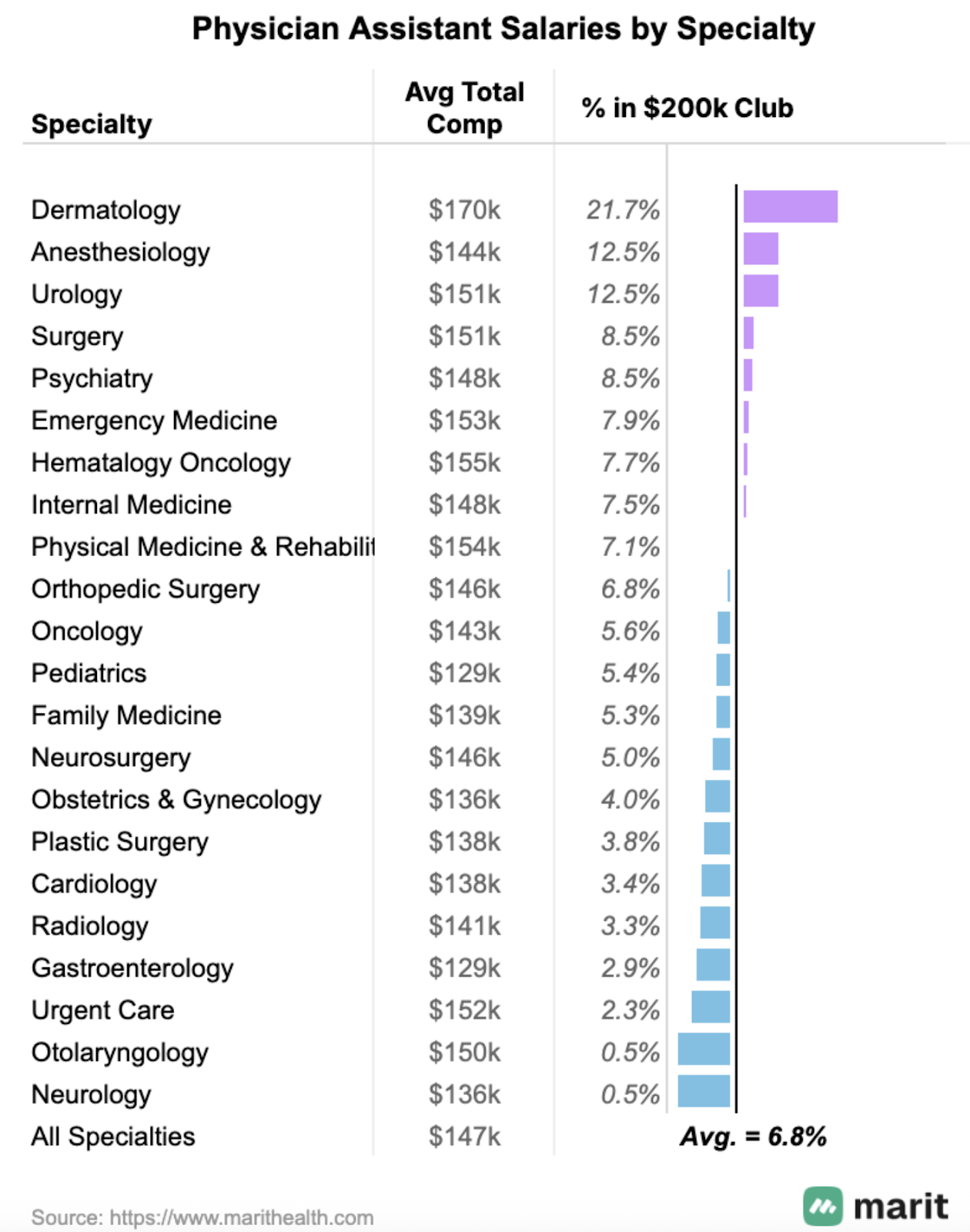

📊 According to data from Marit Health, 1 in 14 PAs already earn over $200K/year.

Here’s how to increase your odds of joining them:

✅ Choose a High-Earning Specialty:

Dermatology, critical care, cardiothoracic surgery, and PM&R consistently top the list. But it’s not just about the specialty—it’s about where you land within it.

💡 Specialties like dermatology, plastic surgery, and psychiatry have high intraspeciality variance in pay, meaning some PAs are crushing $200K+ while others are barely above average. Don’t just switch specialties… switch to a better-paying role within your speci...

Top Paying PA Specialties in 2025: Where Physician Associates Are Earning the Most (and Least)

If you're a practicing PA, a PA student, or even considering PA school, you're probably asking yourself: Is the debt worth it? The good news? PA salaries are going up. The better news? You have more control over your income than you might think.

PA Salaries Are On the Rise (But Uneven)

According to the latest AAPA Salary Report, PA earnings rose 5.5% in 2024 alone. MGMA data shows:

- Surgical PAs: median is up 15% since 2020

- Non-surgical, non-primary care PAs: median is up 21%

- Primary care PAs: median is up 30%

Sounds great for primary care, right? Not so fast. That percentage growth only tells part of the story. You need to look at absolute numbers and actual earning potential across subspecialties.

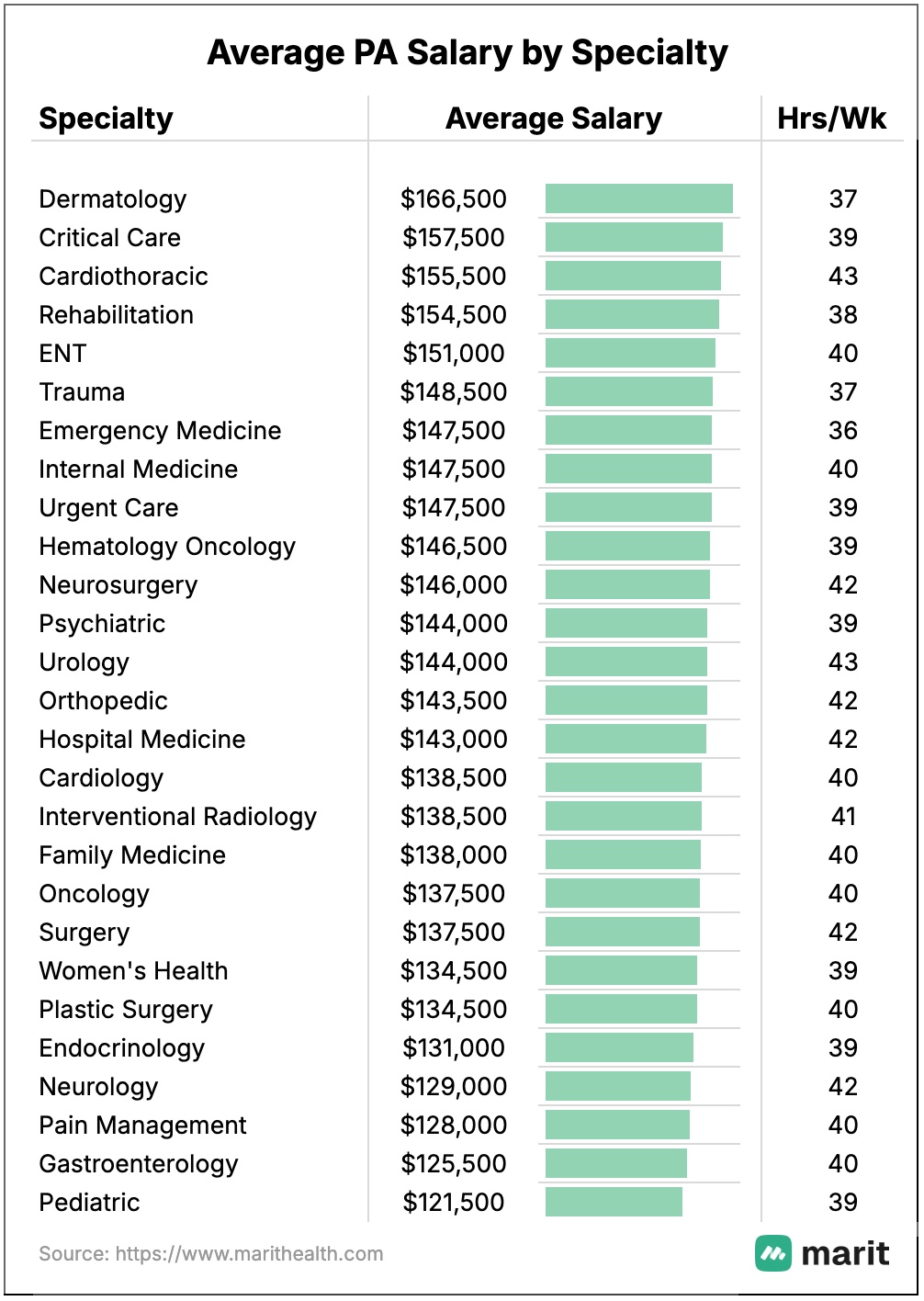

The 3 Highest Paying PA Specialties in 2025

Using Marit Health salary data, these are the current top-paying specialties:

- Dermatology — Average: $166K/year

- Avg. weekly hours: 37

- Also has highest percent of PAs earning $200K+

- Critical Care — (as a critical care PA myse...

Still Treading Water With Money? Lock This In Before 2026 Arrives!

If you're a medical professional who feels like you're working nonstop but not moving forward financially, you’re not alone. We're already more than halfway through the year—and if 2025 hasn’t brought the money progress you were hoping for, it’s not because you’re lazy. It’s because you don’t have the right systems in place.

Let’s fix that.

This moneycheck-in will help you:

- Understand where you are in your wealth journey

- Identify what’s missing from your strategy

- Take specific action steps to make the second half of this year count

The Wealth Building Continuum (and Where You Fit In)

Everyone’s checklist will look different based on where they are in the wealth-building process. Think of it like a continuum. Most medical professionals go through these stages:

- Clear High-Interest Debt — Credit card debt, personal loans with interest rates >10%. These are urgent and must go first.

- Have a Strategy for Moderate-Interest Debt — Studen...

Medical Professionals: Should You Pick a Roth or Traditional 401(k)?

Roth or Traditional 401(k)? Here's What I Tell Every Medical Professional

Choosing between traditional and Roth contributions to your 401(k) or 403(b) isn’t just a random checkbox—it could mean tens of thousands of dollars saved or lost across your career.

Let’s break down what actually matters in 2025 and beyond.

💡 Start with the Basics: What’s the Difference?

- Traditional = Pre-tax contributions

✅ Lowers your taxable income today

⚠️ But you’ll pay taxes when you withdraw the money in retirement. - Roth = After-tax contributions

✅ You’ve already paid taxes upfront

⚠️ Withdrawals in retirement are 100% tax-free

The key thing to remember: Your 401(k) or 403(b) is one account, but it can have both traditional and Roth “buckets” inside. In 2025, your total contribution cap is $23,500—whether you do Roth, traditional, or a mix of both.

And no—this has nothing to do with your Roth IRA. Entirely separate thing.