How I’m Making My Kids Millionaires... Without Spoiling Them

Yep, you read that right. It's totally possible to turn your kid into a future millionaire—without needing to throw in hundreds of thousands.

I’m doing it with just a few thousand dollars and a lot of intention. And in this blog, I’ll show you exactly how:

👉 The accounts we use

👉 The money system we teach our 3-year-old

👉 And the mindset shifts that actually matter more than the money

Let’s break it all down.

Our Four-Bucket Money System for Kids

You’ve probably heard of the classic give-save-spend system for teaching kids about money.

I hate it.

Why? Because it completely ignores investing—arguably the most important pillar of long-term wealth.

So instead, we created our own version: Give, Save, Spend, and Invest.

Every Sunday, our 3-year-old gets her allowance in quarters (supervised, of course), and she gets to divide those coins between her four jars.

To make the “invest” jar feel real, we created a visual thermometer tracker for her investing goals, broken into:

- 🎓 Coll...

How PAs, NPs, and Pharmacists Are Building Millions (Even Without High Salaries)

If you’re a PA, NP, or pharmacist and think wealth building is only for people in higher-paying specialties or dual-income households with no debt—this blog is for you.

The truth? It’s 100% possible to become a multi-millionaire with a six-figure income, even if you’re working in primary care, living in a high cost-of-living area, or just starting out. How do we know? Because we’ve helped medical professionals just like you do exactly that.

Below are five real client case studies to show you what’s possible with the right systems, strategy, and support.

CASE 1: Kelly, a Primary Care PA, Married to an RN

Challenge: Lower-paying specialty + early 30s with limited investments

Goals: Reduce hours when they start a family, retire early with flexibility

What We Did:

- Optimized their PSLF strategy to save $600/month on student loan payments

- Reallocated that money into an investing system

- Completely overhauled their account structure and monthly contributions

Result:

Kelly and her sp...

Why I Stopped Paying for Someone To Manage My Investments, and Saved Over $1.5 Million

If you're a PA, NP, or pharmacist and you've ever thought, "Personal finance is just too complicated for me," you're not alone. That’s exactly what most of us are conditioned to believe.

But here's the truth: learning to manage your own money could save you more than $1.5 million in your lifetime. I know this because I’ve lived it.

My Story: From Student Debt to Seven Figures

When I graduated as a critical care PA, I had $161,000 in student loans and zero assets. Like many new grads, I was eager to "do the right thing", so I hired a financial advisor and opened a Roth IRA through Edward Jones.

It felt like I was checking all the right boxes. But years later, I realized I had paid thousands in fees without even realizing it: fees that were quietly dragging down my returns.

Once I learned to manage my portfolio myself, everything changed. Less than a decade later, I hit $1 million in net worth at age 31.

The Cost of Not Learning Personal Finance

Most medical professionals fall int...

Can You Really Become a Multi-Millionaire as a PA, NP, or Pharmacist?

When I first became a PA, I thought hitting $1 million in net worth would mean I “made it.”

But now that I’ve actually crossed that milestone, and helped hundreds of medical professionals do the same. I can tell you this:

A million dollars isn’t enough.

If you want to retire comfortably (or early), reduce your clinical hours, or stop working when your health is still good, you’ll probably need $3–4 million or more.

Let’s break down why that number matters, and how I built wealth faster than most people thought possible.

Why $1M Won’t Cut It Anymore

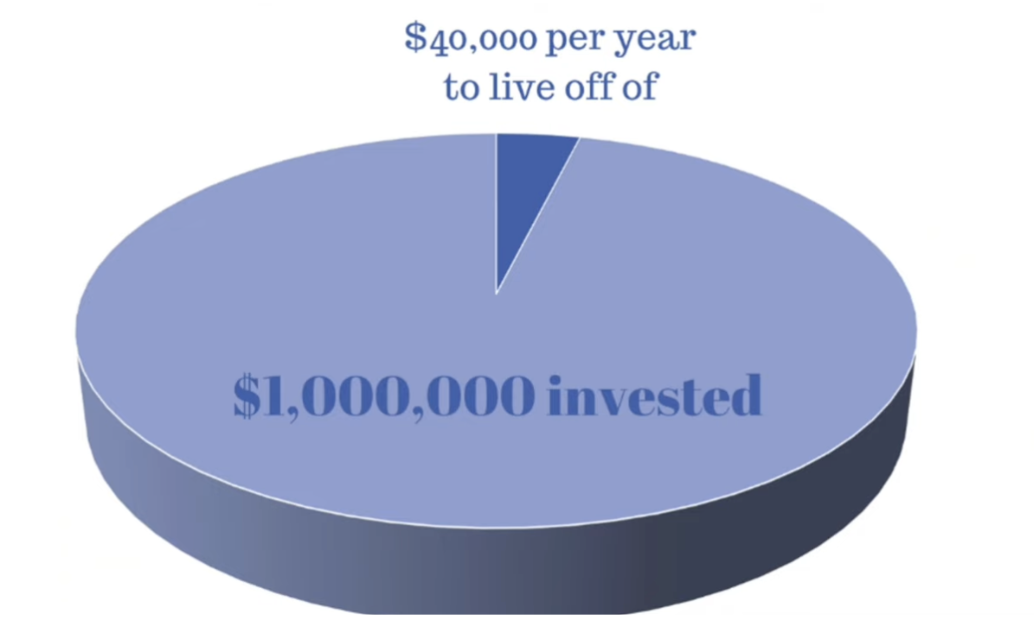

Here’s what most people don’t realize:

If you retire with $1 million, and use the standard 4% withdrawal rule, that gives you just $40,000/year to live on. Not exactly luxurious.

Now add inflation into the mix.

What feels like enough today won’t go nearly as far by the time we’re 65.

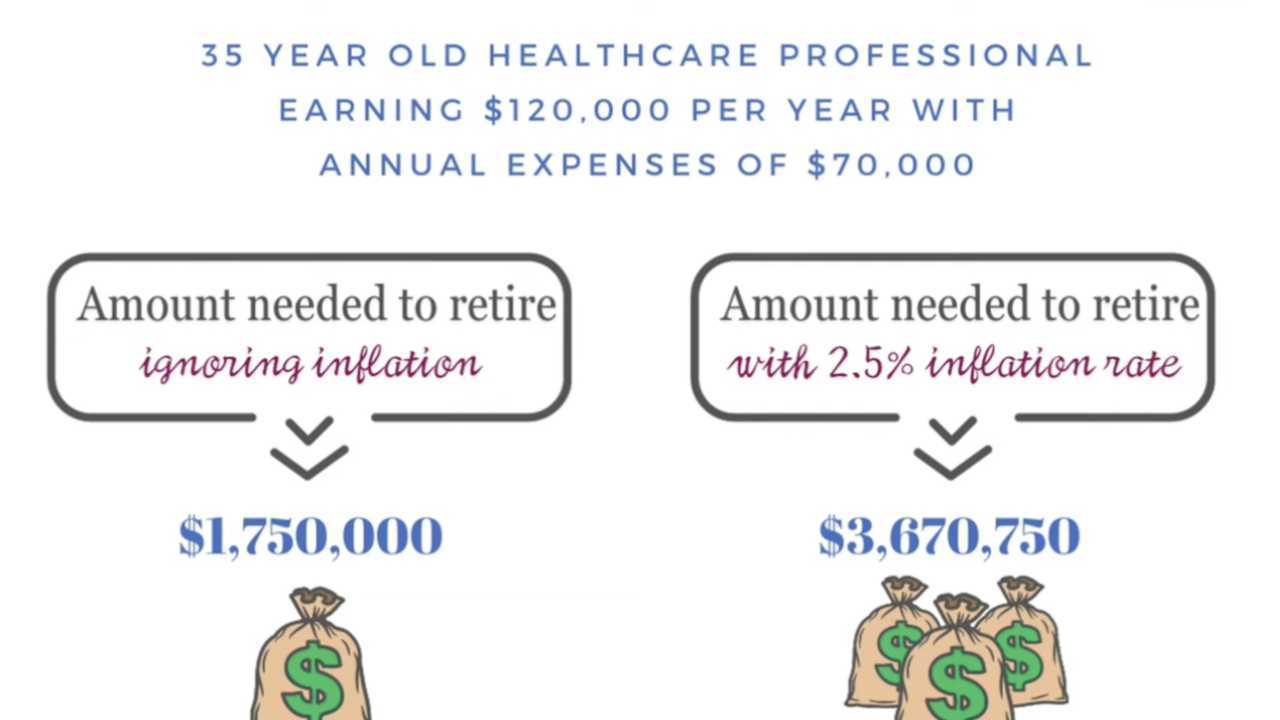

Example:

At 35 years old, if I spend about $70K/year, I’d need $3.7M by age 65 to maintain that lifestyle.

At 35 years old, if I spend about $70K/year, I’d need $3.7M by age 65 to maintain that lifestyle.

(That’s the inflation-adjusted cost.)

So no…...

How Medical Professionals Can Earn $10K+ a Year in Passive Income (Without Working More)

How Medical Professionals Can Earn $10K+ a Year in Passive Income (Without Working More)

What if your money could work harder, so you don’t have to?

Whether your goal is an extra $10K, $20K, or $50K/year, building passive income as a PA, NP, pharmacist, or physician is 100% possible. But not all passive income streams are created equal.

In this post, we’re breaking down the top 3 cash-flowing investment strategies that medical professionals are using in 2025 to earn more: without picking up extra shifts.

1. Dividends from the Stock Market – True Passive Income

Barrier to entry: Low

Truly passive: ✅

Tax advantages: ✅ (qualified dividends = long-term capital gains rate)

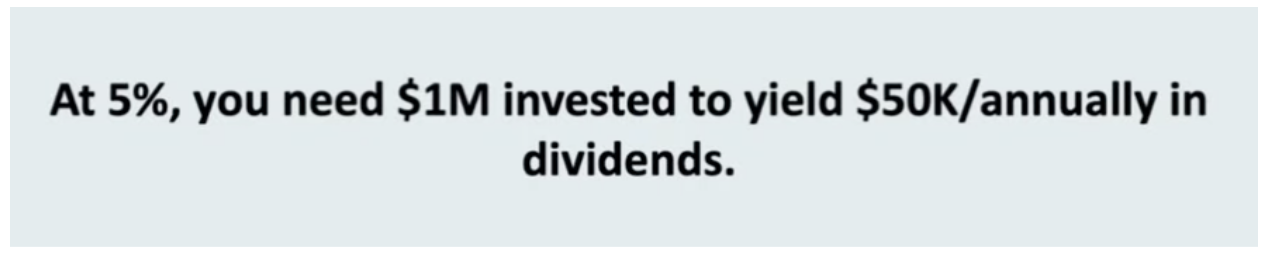

But here’s the catch:

To earn $50K/year from dividends, you’d need to invest $1 million at a 5% dividend yield. Most people can’t do that in the early wealth-building years.

This is the easiest place to start. Open a brokerage through Fidelity, Vanguard, or Schwab and invest in ETFs and index funds that pay divi...

How to Plan a Money Date: Build Wealth and a Stronger Relationship

As a PA-C and money expert,, I’ve worked with thousands of medical professionals who are trying to juggle busy lives, growing careers, and massive student loans. But there’s one thing my husband and I started doing years ago that changed everything in our relationship and our finances:

We started having quarterly money dates.

It’s not just about budgets. It’s about alignment, goal setting, and long-term wealth building…. together.

What Is a Money Date (And Why Every Couple Needs One)?

A money date is a structured yet relaxed time to check in with your partner about money without distractions or stress. It’s a chance to:

- Celebrate financial wins

- Review spending & progress

- Set clear, intentional goals

- Avoid miscommunication about money

- Stay on the same page (and build real wealth)

And when done right? It turns “you and me” into a financially unstoppable we.

How Often Should You Do It?

Quarterly is ideal. Once every 90 days keeps things on track without being overwhelmin...

The One Student Loan Metric Every New Grad PA-C & Medical Professional Needs to Know

If you’re a new grad PA, NP, PharmD, or medical professional trying to figure out how the heck you’re supposed to manage your student loans… there’s one number that changes everything:

Your Debt-to-Income Ratio.

This simple calculation determines:

✅ Whether PSLF is worth it

✅ If private practice is even an option

✅ How painful your monthly payments will be

✅ And how much flexibility you’ll actually have in your career

Let’s break down why debt-to-income ratio (DTI) matters so much, especially if you're just starting out.

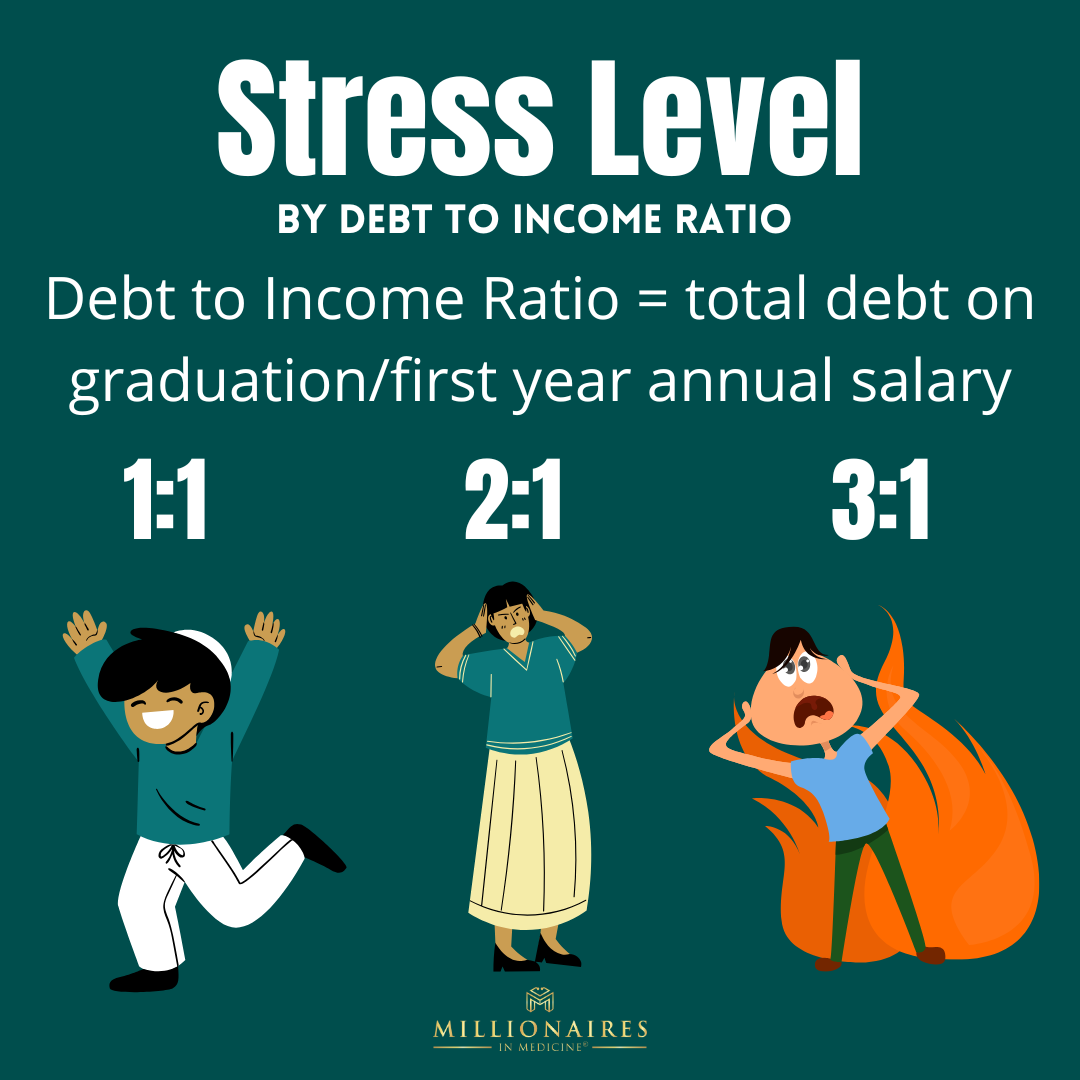

What Is Debt-to-Income Ratio (DTI) for Medical Professionals?

Your debt-to-income ratio is your total student loan debt divided by your anticipated annual income.

Example:

If you graduate with $100K in student loans and expect to earn $100K as a PA, your DTI is 1:1.

If you have $200K in loans, and still earn $100K, your DTI is 2:1.

🎯 Key tip: Use starting salary, not median salary, especially if you’re still in school or early in your career.

The Ideal DTI Rat...

Wealth Building Lessons of 2024

We became millionaires at 31/32 as a PA-C and construction manager.

Our net worth gains in 2024 were much greater than our annual income, because our money was out earning more money for us.

Here are the top 10 lessons I learned in 2024 about building wealth:

(I didn’t even believe #7 was true a few years ago...)

- Results are based on compounded efforts. If we saw gains this year, it wasn’t because of what we did this year. It was the cumulative efforts of the last 6 years of aggressive investing. Basically, the candy came out of the piñata. It wasn’t because we hit the piñata once in 2024. It was because we hit it over and over again every year leading up to this one.

- Mistakes are part of the journey. If you’re not making mistakes, you’re not trying hard enough. The biggest hurdle isn’t actually the objective loss you sustain from any mistake, it’s the potential for falling into a mindset that doesn’t serve you as a result.

- Skills compound like money. Nothing is more valuabl ...

Baby Proof Your Finances

Are you ready, financially speaking, to welcome a baby?

Preparing for a baby can be thrilling yet nerve-wracking, especially when considering the financial implications. My husband and I are currently expecting our second child, which has brought me right back to that headspace of “what do we need to do to get financially ready?” It’s been three years since we last went through this, and a lot has changed.

Buckle up! This is gonna be long but definitely insightful!

👉🏻 Prefer watching instead of reading? Here’s the video version of this blog where I dive into the same strategies: Watch the video

The Backstory: Preparing for Our First Daughter

Three and a half years ago, we found out we were expecting our first daughter. The joy was immense, but so was the responsibility. We knew that preparing financially was not just for us but primarily for her. Through diligent planning and investing, we’ve positioned her to potentially be worth over $4 million by the time she reac...

Who Needs A CPA?

As a medical professional wrapping up the year, you’re probably wondering: “How do I get my taxes right this time? Should you try filing yourself? Rely on TurboTax? Or is it time to bring in a CPA? These aren’t just checkboxes; they’re choices that could save—or cost—you thousands.

👉🏻 Looking for expert guidance? We’ve partnered with Bryan Martin, CPA at Taxstra, to provide tailored tax strategies for medical professionals.

Let’s break down the situations where a CPA is truly worth the investment, and where they can help with more than just filing, especially for those navigating complex strategies like public service loan forgiveness, real estate, or self-employment.

When Should You Bring in a CPA?

1. Married and Pursuing Public Service Loan Forgiveness (PSLF)

For couples where one partner has substantial federal student loans, choosing the right tax filing status can have a huge impact on loan repayment costs. A CPA experienced with PSLF can help you decide betwe...