Binge read all things wealth building, debt reduction, & lifestyle.

Still Treading Water With Money? Lock This In Before 2026 Arrives!

If you're a medical professional who feels like you're working nonstop but not moving forward financially, you’re not alone. We're already more than halfway through the year—and if 2025 hasn’t brought the money progress you were hoping for, it’s not because you’re lazy. It’s because you don’t have the right systems in place.

Let’s fix that.

This moneycheck-in will help you:

- Understand where you are in your wealth journey

- Identify what’s missing from your strategy

- Take specific action steps to make the second half of this year count

The Wealth Building Continuum (and Where You Fit In)

Everyone’s checklist will look different based on where they are in the wealth-building process. Think of it like a continuum. Most medical professionals go through these stages:

- Clear High-Interest Debt — Credit card debt, personal loans with interest rates >10%. These are urgent and must go first.

- Have a Strategy for Moderate-Interest Debt — Studen...

Will AI Replace Physician Assistants & Nurse Practitioners? Here’s What You Need to Know

You’ve seen the headlines. You’ve heard the stats.

But let’s get real… will AI actually take your job as a PA or NP?

And more importantly: what can you do right now to protect your income, career, and long-term freedom?

Let’s break it all down without the fearmongering.

🚨 AI Disruption Is Real (But Not the Full Story)

AI is already shaking up industries, with projections estimating 85 million to 800 million jobs displaced by 2030.

In medicine, specialties like radiology and pathology are already seeing massive shifts.

But what about PAs and NPs?

Here’s the good news:

You probably won’t be replaced.

But your job will change—and those who adapt will thrive.

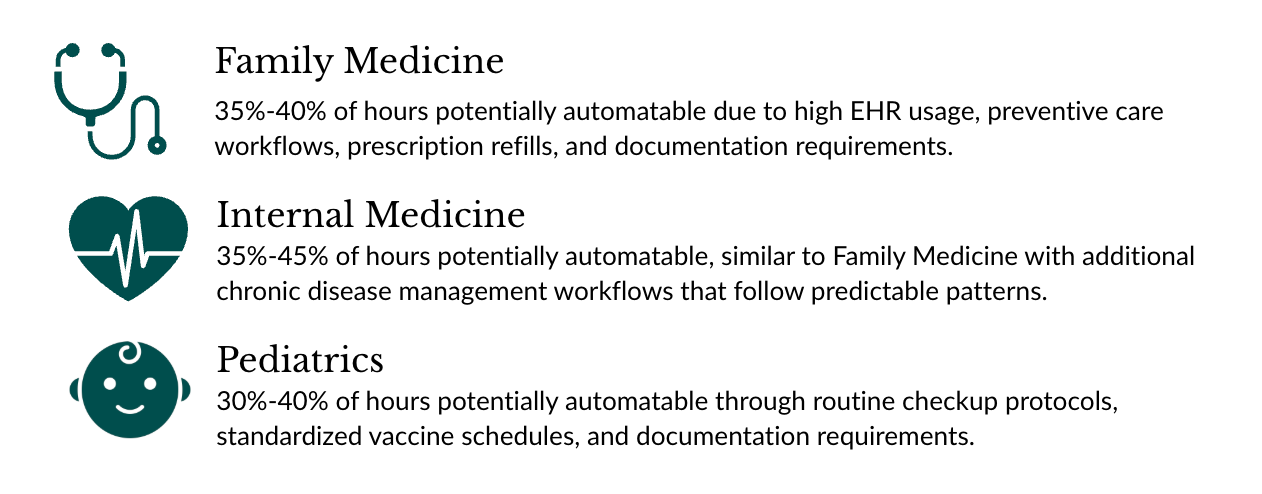

💡 Step 1: Understand Automatable Hours

AI disruption isn’t all-or-nothing. The most important question is:

How much of your job can be automated?

Examples of automatable roles:

- Radiology = high risk

- General medicine = moderate

- Psychiatry = low (empathy can’t be coded)

- Surgery/Pro...

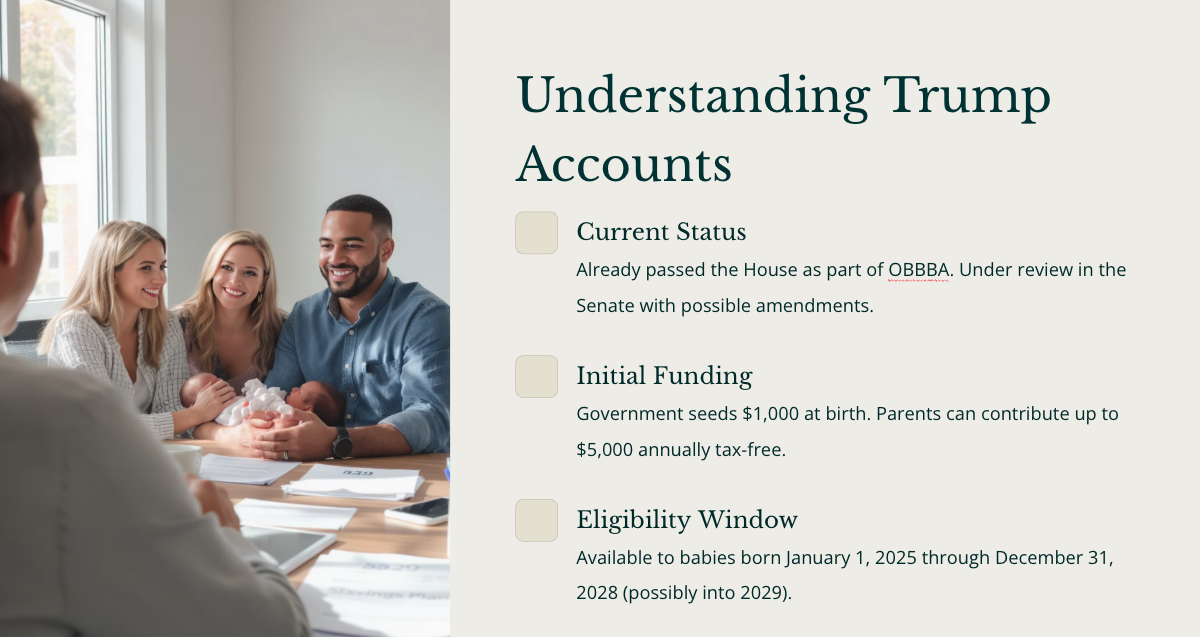

Trump Wants to Give Your Kid $1,000—But Is It Worth It?

You’ve probably heard it already:

“Trump wants to give your kid a thousand bucks.”

And if you’re a medical professional trying to build wealth for your family, you’re probably wondering:

Is this legit? Should I open one of these Trump Accounts?

Let’s break it down... money-first, politics-neutral.

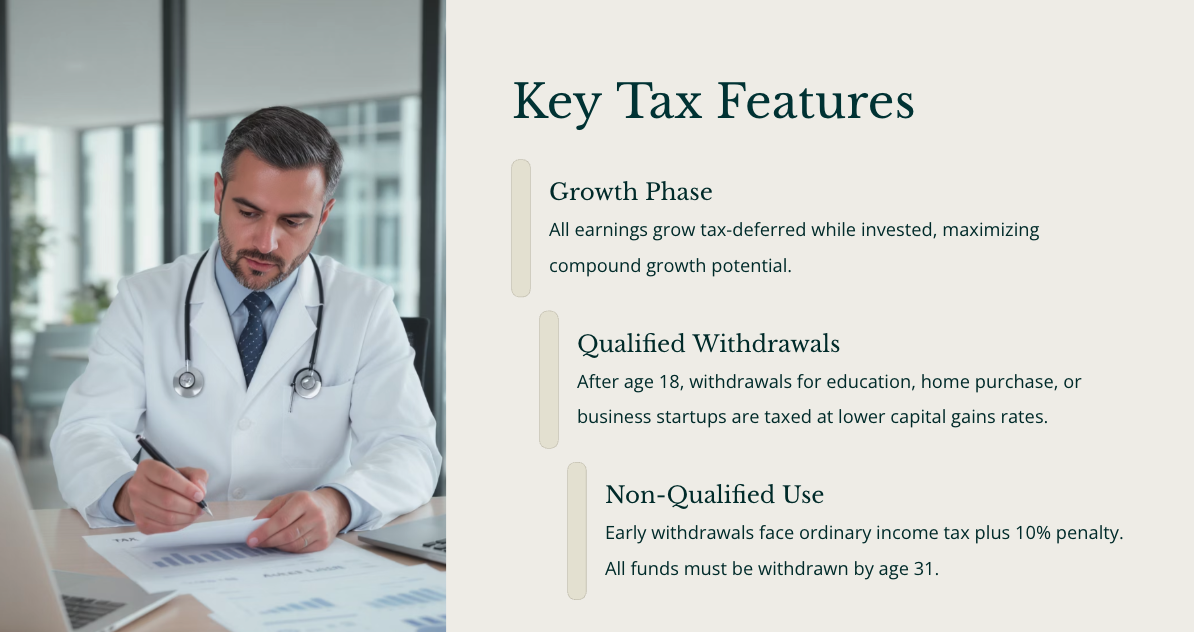

What Is the Trump Account?

This account is part of the One Big Beautiful Bill that’s officially passed and signed into law.

The details are still murky, but here is what the Trump Account for kids plans to offer:

✅ $1,000 in seed money for kids born in a specific time window from the federal government

✅ Up to $5,000/year in parental contributions allowed

✅ Tax-deferred growth

✅ Tax breaks (specifically taxed at capital gains rates rather than ordinary income brackets) if the money is used for:

- Education

- Housing

- Starting a business

But if the money is used for anything else?

Ordinary income tax + a 10% penalty.

Also, all funds must be withdrawn by age 31.

Sounds Good… But How ...

How to Make Your Kid a Millionaire by Age 35 (Yes, Really)

If you're a medical professional and either have kids or want kids someday, you've probably wondered:

How can I give them a financial head start I never had?

Let me show you how we’re doing it.

I’ve set up a system where both of my kids will be millionaires by the time they’re 35—and it doesn’t require hundreds of thousands of dollars.

It just takes intention, a few monthly contributions, and the right accounts.

First—This Is Not All or Nothing

Let me be clear:

You don’t need to hit millionaire status for this to be worth it.

Even if you can only do a fraction of this plan, you're still setting your kid up with a financial launchpad that most of us never had.

Even $100/month over time = six figures by adulthood. That’s still a huge win.

But if you do want to go all in, here’s exactly how we’re making millionaire status happen by age 35:

Step 1: Open a UTMA Account

We start with a UTMA account (Uniform Transfers to Minors Account)—

✅ It’s flexible

✅ It’s taxable

✅ And the mone...

How to Buy a House as a PA, NP, or Pharmacist Without Screwing Up Your Financial Future

The fastest way to wreck your finances as a medical professional?

Buying the wrong house.

I’ve seen it too many times—PAs, NPs, and PharmDs rushing into homeownership, only to end up house-poor, underinvested, and stuck in golden handcuffs for decades.

So if you’re dreaming of buying a home in the next 1, 2, or even 5 years, let’s walk through what really matters when it comes to buying a house without sabotaging your future freedom.

Step 1: Don’t Start With the House

Don’t start by asking what kind of house you want.

Start with: “What can I safely afford each month?”

This is one of the biggest money moves you’ll ever make—especially if you’re not planning to become a real estate investor. You’ve got to get this right.

Step 2: Calculate Your Max Monthly Housing Expense

Here’s the formula I use:

1️⃣ Take your gross annual household income (pre-tax)

2️⃣ Divide by 12 to get monthly income

3️⃣ Multiply by 0.2 (that’s 20%)

That number = your max monthly housing cost

✅ If you’re buying:...

How to Build Wealth When the Economy Feels Like a Dumpster Fire

Spring 2025 came in hot with tariff wars, rising inflation, student loan chaos, and stock market volatility that has a lot of medical professionals wondering...

“Is it even possible to build wealth in a season like this?”

Short answer: yes.

But you need a strategy—and some serious emotional discipline.

Why Personal Economics > Macroeconomics

The truth? You could come out of this economic mess ahead—if you have your personal financial systems dialed in.

✅ No high-interest debt

✅ 3–6 months of cash reserves

✅ Multiple income streams

✅ A student loan plan

✅ A long-term investing system

If you don’t have these in place, this season can wreck you.

If you do? You can use it to build wealth while everyone else panics.

What Investing in a “Down Market” Actually Feels Like

Whether you’re:

- A new investor putting in your first $1,000

- Or a seasoned one watching $70K disappear from your account in a day

It still stings.

But this is where people either panic and pull out...

Or keep go...

What Most New Grad PAs Realize After Their First Paycheck

You graduate. You pass your boards. You land the job.

That six-figure paycheck hits—and then... reality sets in.

If you’re a brand new PA, you know exactly what I’m talking about.

It’s not quite the dream you imagined. Expenses feel overwhelming. Loans are looming. And you’re wondering, “Wait… where did my paycheck go?”

Let’s walk through exactly what you should be doing in your first year of practice to get your money right.

Why Generic Budget Rules Don’t Work for PAs

You’ve probably heard of those 50/30/20 budgeting rules:

- 50% to needs

- 30% to wants

- 20% to savings/investing

I hate those.

They’re made for the masses—not for people like us.

If I followed that rule? I wouldn’t be a millionaire by 31. I needed a lot more than 20% going toward debt and wealth-building.

What you really need is a cash flow system that helps you grow your net worth—not just track your spending.

Inside the Millionaires in Medicine Club, I break down exactly how to do this with a free tracker you c...

How I’m Making My Kids Millionaires... Without Spoiling Them

Yep, you read that right. It's totally possible to turn your kid into a future millionaire—without needing to throw in hundreds of thousands.

I’m doing it with just a few thousand dollars and a lot of intention. And in this blog, I’ll show you exactly how:

👉 The accounts we use

👉 The money system we teach our 3-year-old

👉 And the mindset shifts that actually matter more than the money

Let’s break it all down.

Our Four-Bucket Money System for Kids

You’ve probably heard of the classic give-save-spend system for teaching kids about money.

I hate it.

Why? Because it completely ignores investing—arguably the most important pillar of long-term wealth.

So instead, we created our own version: Give, Save, Spend, and Invest.

Every Sunday, our 3-year-old gets her allowance in quarters (supervised, of course), and she gets to divide those coins between her four jars.

To make the “invest” jar feel real, we created a visual thermometer tracker for her investing goals, broken into:

- 🎓 Coll...

How PAs, NPs, and Pharmacists Are Building Millions (Even Without High Salaries)

If you’re a PA, NP, or pharmacist and think wealth building is only for people in higher-paying specialties or dual-income households with no debt—this blog is for you.

The truth? It’s 100% possible to become a multi-millionaire with a six-figure income, even if you’re working in primary care, living in a high cost-of-living area, or just starting out. How do we know? Because we’ve helped medical professionals just like you do exactly that.

Below are five real client case studies to show you what’s possible with the right systems, strategy, and support.

CASE 1: Kelly, a Primary Care PA, Married to an RN

Challenge: Lower-paying specialty + early 30s with limited investments

Goals: Reduce hours when they start a family, retire early with flexibility

What We Did:

- Optimized their PSLF strategy to save $600/month on student loan payments

- Reallocated that money into an investing system

- Completely overhauled their account structure and monthly contributions

Result:

Kelly and her sp...

Why I Stopped Paying for Someone To Manage My Investments, and Saved Over $1.5 Million

If you're a PA, NP, or pharmacist and you've ever thought, "Personal finance is just too complicated for me," you're not alone. That’s exactly what most of us are conditioned to believe.

But here's the truth: learning to manage your own money could save you more than $1.5 million in your lifetime. I know this because I’ve lived it.

My Story: From Student Debt to Seven Figures

When I graduated as a critical care PA, I had $161,000 in student loans and zero assets. Like many new grads, I was eager to "do the right thing", so I hired a financial advisor and opened a Roth IRA through Edward Jones.

It felt like I was checking all the right boxes. But years later, I realized I had paid thousands in fees without even realizing it: fees that were quietly dragging down my returns.

Once I learned to manage my portfolio myself, everything changed. Less than a decade later, I hit $1 million in net worth at age 31.

The Cost of Not Learning Personal Finance

Most medical professionals fall int...